All the signs were there: A long awaited move to production, a long period of silence broken with news, a financing near the 52-week low that the largest shareholder was buying most of… Ceylon Graphite (CYL.V) wasn’t exactly making a secret of the fact that the rubber was hitting the road for them over the last month. And neither were we.

And those who were listening have managed a quick triple in the time since.

The cannabis sector would be putting up statues if a licensed producer managed that kind of month on the public markets at this moment in time. That Ceylon Graphite has had this kind of a move while pulling graphite out of the ground, after several years of the entire graphite sector being ignored like a Democrat subpoena, is noteworthy.

We’ve seen a few resource sectors go from negative to wildly positive lately; Defense Metals (DEFN.C) pulled off a triple in three months in the long bewildering rare earth sector. Great Bear Resources (GBR.V) has had some luck for the last year in the gold business, including their own 30% rise in the last few months. Our old friends at First Cobalt (FCC.V) jumped 50% in two months despite cobalt being seen by many as Mining AIDS for much of the last few years by retail investors.

Mining in general is having a long overdue moment, with excited CEOs at the recent Cambridge House investor conference in Vancouver all but lifting their shirts for beads. That was a nice change after the last few years of shows included a discount on bulk purchases of nooses and razor blades.

While the bulk of retail money continues its efforts to wish cannabis back into the green, mining stocks are providing a happy alternative, and the young money is starting to notice.

Which is how a graphite company in Sri Lanka can suddenly be interesting, and rocket its stock after two years of mostly quiet prep work.

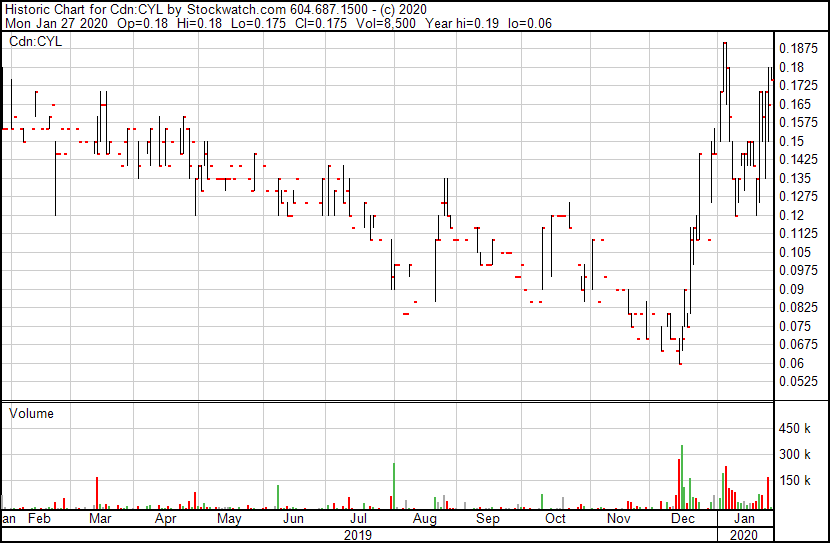

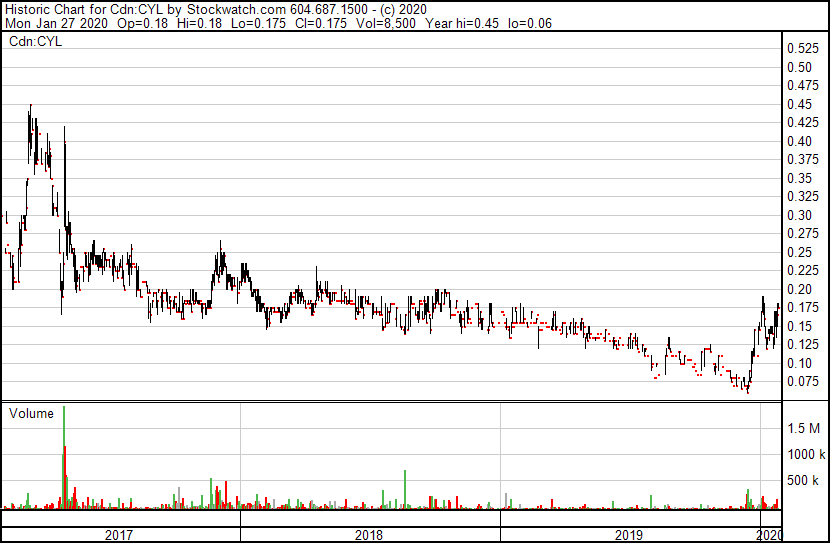

It takes years to be an overnight success. Here’s what that’s looked like for CYL:

Three years to get to the starting line. But if that seems to you like a long way to travel to get to go-time, you don’t know the mining business.

Usually, three years in, companies are just starting to figure out if it had been worth drilling their ground or not. At Ceylon, they’re producing graphite.

Part of the reason why is, Sri Lanka. The country’s government wants this graphite mined, it has a bunch of it sitting underground that’s mostly been picked away at by individuals over decades, and it knows that its graphite is high quality, which is what end users (read: large battery companies) need. And, Sri Lanka being a developing country, it’s staggeringly cheap to drill and mine there. Ceylon Graphite has 121 grids of lands under their control thus far, which is a lot of future growth potential. They say they’ve discovered over 20 veins so far.

But to discover those 20 veins, they’ve had to spend insanely little money. Drilling is so cheap in Sri Lanka that they just bought their own drill.

So rather than put together long, time consuming drill programs to figure out exactly how much graphite might be underground, and spending years working towards doing massive raises to finance a juggernaut operation that would take a decade to stand up, CYL opted to just start digging in to where they can see ore, selling it to end users, and using the cash to dig and drill for more.

Because it’s so cheap to drill and operate, they can just follow the veins to where they end up, and not radically damage their operations if one stops early.

When we started pointing out that this play was in play a few months back, the market cap was $4 million. It’s now $11 million.

THAT’S STILL CHEAP.

Why? Because they’re PRODUCING GRAPHITE FOR SALE.

Not container ships full of it, at least not yet. But enough to shift from the ranks of high risk, high reward exploration junior to lower risk, high reward producer.

Put frankly, if someone comes with a barrow full of cash for CYL to put to use, they have a ton more targets they can start working. And if that money isn’t brought to them, they have current targets they’re actively working that will pay for slower growth.

At 8c per share, the company announced it was going to raise money, and just six folks jumped on that raise, including major stakeholder Jacob Securities, led by cannabis pubco pioneer, Sasha Jacob. He took 6 million shares in that raise according to documentation.

You may recall Jacob having been one of the bigger financiers of early stage cannabis companies back in 2013-2015, having helped put together many of the companies that went on to become the biggest in the business during the wild west early days. That’s an acclaim that also led regulators, who were not exactly enamored with the public market players front running changes to cannabis laws, to hounding him out of the brokerage business.

Now a merchant banker, and long an enthusiast on the renewable energy pace, Jacob set Ceylon in play with a view to doing exactly what the company is doing today: Producing early, albeit small, amounts of high quality graphite for sale to the end user market, at ultra low cost and with minimal capex needs.

Others in the resource sector have played in the graphite space for a while, mostly talking up the need for the US to lock down its own supply, but rarely going to the lengths needed to move to operation. I’ve heard from Graphite One (GPH.V) a handful of times over the last few years about how ‘now is the time’ and it’s still not actually the time. They too are having a bit of a run, but only after a 10:1 rollback early in 2019. It’s not that they’re not trying, but getting a mine stood up in the USA is a lot harder than it is in Sri Lanka, which is why so few have done so recently.

While Ceylon Graphite isn’t going to ‘send it to the Gigafactory by taxi’ as many in the lithium space argued they’d one day do when they were carpetbagging the Clayton Valley a few years back, or ‘pile it on a train to Nevada’ as other graphite plays in Alaska or Quebec thought they’d be doing by now, Ceylon figures there’s as much need in Asia for good quality graphite as there will ever be in the USA, and a whole load of battery manufacturers who see Sri Lanka as a local supplier.

They are not wrong.

The downside? Production numbers will be small for now.

But the company is following veins and making cash money, bringing on new execs with graphite in their blood, and looking to expand this thing in a way that minimizes risk and capex outlay.

I can jive with that, for now. One of the things that keeps a lot of younger investors out of the resource space is the long, arduous, document heavy, bureaucratic process of getting a full mine into production can take years, require a lot of reading between the lines, and a decent amount of not just math, but outsized risk. Macro- and micro-economic factors can screw a good deal before it gets a chance to fly, and financing difficulties can hamper even quality projects from moving forward, while stock dilution can hamper investors even when projects move ahead.

That’s the traditional track. This one is less traditional, and more suited for those who don’t want to bet on bureaucracy, but on revenues being generated.

Respect to CYL.

— Chris Parry

FULL DISCLOSURE: Ceylon Graphite is a long term Equity.Guru marketing client, and we have purchased shares in the open market.