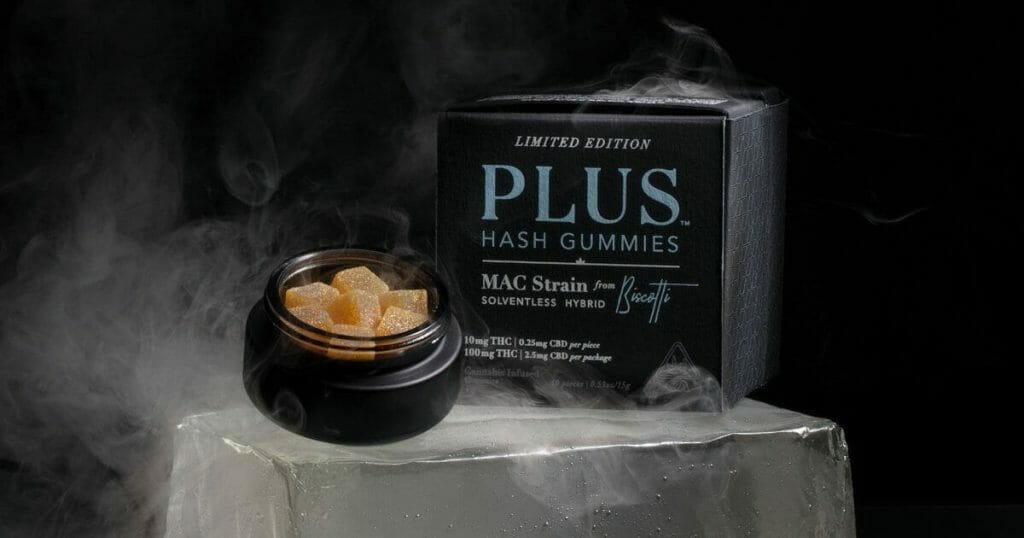

Plus Products (PLUS.C) has launched its Plus Hash Gummies in cooperation with Biscotti Brands, a premium hash brand. Products will be available for purchase in California for a limited time.

“Our PLUS Hash Gummies are formulated to bring consumers as close to the plant as possible, providing the characteristics that make hash unique, in the form of an edible…We’re thrilled to partner with Biscotti, whose proprietary process delicately separates trichomes to preserve a richer, fuller experience. We knew they were the right partner to bring this product to life,” said Jake Heimark, co-founder and CEO of PLUS.

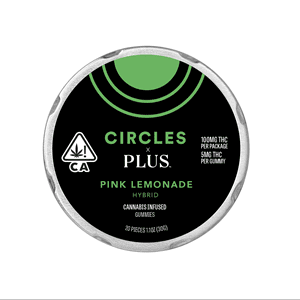

PLUS’ orange blossom-flavored PLUS Hash Gummies are infused with cold water hash extracted from Miracle Alien Cookie flower which is known for its relaxing and uplifting effects. Each gummy contains 10mg of THC and is naturally flavored. To celebrate the launch, the Company will be hosting a virtual launch event on April 18, 2021. PLUS’ latest Hash Gummies come’s shortly after the release of the Company’s CIRCLES X PLUS cannabis gummies created in partnership with Eaze delivery platform.

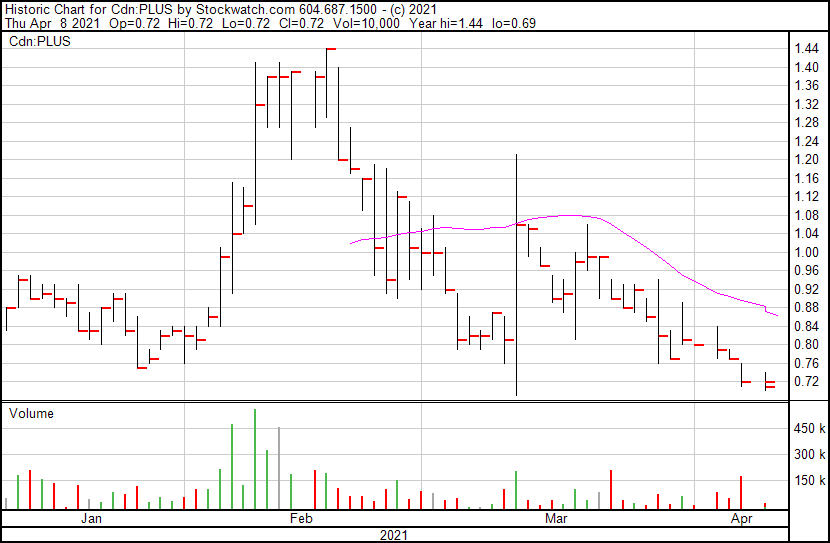

With this in mind, PLUS has been making every attempt to expand its portfolio with a variety of products like PLUS CBDRelief, PLUS SLEEP, CIRCLES X PLUS, and now Plus Hash Gummies. However, the Company’s stock performance has remained stagnant despite a flurry of new SKUs. According to PLUS’ 2020 year-end financial results, the Company’s net revenues were lower than expected at $3.1 million in Q4 2020. PLUS attributes this to its transition to a self-service distribution partner which resulted in the return of inventory initially sold to a prior distribution partner in Q4 2020. Additionally, the Company claims promotional costs were higher than anticipated.

In addition to switching to a self-service distribution partner, in January 2020, PLUS began restructuring to improve costs. This included reducing its non-production workforce by 20% and cutting executive salaries from 20% up to 50%. Ouch. Those are some pretty serious cuts, but the Company saw more than an 85% reduction of cash consumption from 2019 to 2020 as a result. Subsequently, more recently in February 2021, PLUS expanded its internal workforce by more than 50%, eliminating the need for external account management and sales.

Although PLUS saw general improvements with regards to operating profits, revenues, and gross profits in 2020, the Company’s growth in 2021 has remained quite dormant since February. PLUS’ stock performance could be compared to Ionic Brands, a cannabis holdings company also trading on the CSE. However, Ionic is much smaller than PLUS, with a market cap of $5.18 million compared to PLUS’ market cap of 30.72 million. Additionally, Ionic Brand’s stock price currently sits at $0.16 while PLUS’ stock price is $0.71. Furthermore, Ionic Brands sees a significantly higher volume of trading daily.

Overall, PLUS still has plenty of room to grow, however, determining if and when the Company will see a significant growth spurt remains difficult. PLUS will likely need to solidify its presence as a self-service cannabis distributor in 2021 before it sees any major change in its stock performance.

PLUS’ stock price currently sits at $0.71 following a close of $0.71 on April 8, 2021.