Cannabis in Canada is, in the eyes of Chris Parry, nothing less than a “dog orgy”. In his recent analysis of the industry, Parry paints a grim picture of the country’s cannabis market, laying the blame predominantly on the government’s regulations and what he sees as their misguided handling of the industry. Here’s a closer look at his argument and what he sees as potential investment opportunities in the currently strained sector.

Parry starts by outlining the state of the Canadian cannabis market, which he colorfully describes as a “dumpster fire.” He notes that several high-profile companies, such as Fire and Flower and Choom, have taken significant hits, being sold for a fraction of their value or undergoing bankruptcy protection. Others, such as Isracann and Khiron Life Sciences, have all but vanished from the industry.

According to Parry, the primary culprits for this chaotic state of affairs are governmental regulations and missteps. The Canadian government, he contends, should have capitalized on the legalization of cannabis by promoting the country as a global leader in the production of “professional, medical, clean, efficient weed”. Instead, he believes they burdened the industry with excessively high taxation and over-regulation, discouraging innovation and limiting market expansion.

The rules, he says, prevent companies from effectively marketing themselves, reaching new demographics, and creating enticing products. In his view, the industry is currently stuck in a futile struggle to cater only to established cannabis users while neglecting potential newcomers. He even goes as far as to suggest that the production of cannabis should be outsourced to cheaper locations, such as Africa, rather than being cultivated locally in expensive, security-heavy warehouses.

But the issues don’t end with production. The post-production process is fraught with bureaucratic hurdles, from distribution to retail. For instance, Parry criticizes the government’s control over the retail experience, which, he argues, confuses first-time buyers and inhibits them from becoming repeat customers.

The sales of cannabis in Canada, Parry notes, have seen a recent decrease. This, he attributes partially to the seasonal nature of the market and the increasing popularity of substances like shrooms, LSD, and ketamine. Parry believes the over-regulation of cannabis, juxtaposed with the decriminalization and less restricted sale of these substances, is driving potential consumers away from cannabis.

Despite the seemingly bleak outlook, Parry suggests two potential investment opportunities. The first is in large cannabis companies that aren’t afraid to challenge the status quo and “break every fucking rule,” as he puts it. These companies, he believes, could potentially force the government to revise its policies if they were to openly defy the regulations and take the resulting legal battles to court.

On the other end of the spectrum, he recommends keeping an eye on smaller, self-sustaining companies like Avant Brands (AVNT.T) and BC Bud Co. (BCBC.C). The former, he notes, recently had a near break-even quarter despite acquiring the assets of Flowr for $4 million. The latter, a client of Parry’s, is patiently waiting for the right distressed assets to buy up while prices are low. Both these businesses have managed to grow, even in the face of a struggling cannabis market, without amassing significant debt. Avant is actively growing and acquiring other businesses, while BC Bud is capitalizing on the desperation of companies eager to sell, providing high-quality products in the process.

Unlike many of their larger counterparts, these companies are not burdened by excessive operational costs. They don’t need to continually raise millions to keep their doors open. Rather, when they raise funds, it’s because they’ve identified a specific target or opportunity. It’s this efficient operational model that Parry believes offers significant potential for growth and a successful investment.

However, this does not mean that investing in these companies comes without challenges. Parry emphasizes the importance of due diligence. Potential investors should analyze the small-cap market thoroughly, discarding the companies that don’t offer a functional business model, and concentrating on the ones that do. Avant Brands and BC Bud Co., in his view, pass this test.

To conclude, Parry’s take on the Canadian cannabis industry is undoubtedly critical and unforgiving. However, despite the struggles and challenges faced by the cannabis industry, there is a potential for growth, and it may be found within the smaller, more agile companies like Avant Brands and BC Bud Co. Investors seeking to navigate this volatile market might find these picks of the crop a worthy consideration. Do your due diligence!

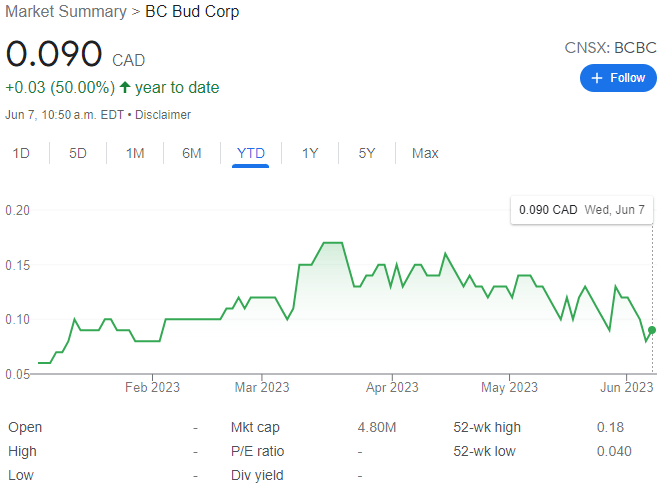

BC Bud Co currently trades at $0.09 CAD per share for a market cap of $4.80 million.

BC Bud Co (BCBC.C) ringing in cannabis 2.0