I built my career on cannabis investing. At one point, a full third of the cannabis public companies in Canada were doing business with me. I spotted the first cannabis pubco in the wild in 2013 and duly built my reputation on filtering through which (few) opportunities were real and which (many many more) were bullshit, over half a decade.

So the fact that I all but stopped investing in, and talking about, cannabis companies in early 2019 and stopped taking money from them because I thought they were indefensible, let alone unprofitable, is worth noting.

Also worth noting? I was right.

Like, right to within four days. I announced it on stage in front of a thousand people at a Cambridge House investor conference that folks needed to get out of everything cannabis related, without exception, and four days later the whole industry crashed and never came back.

At its high point, based on today’s shares outs6tanding, Canopy Growth Corp (CGC.T) was worth around $40 billion.

Today it’s less than $1 billion, and that’s half what it was two months ago. Still, true believers keep funneling their money into it, thinking that ‘this must be the bottom.’

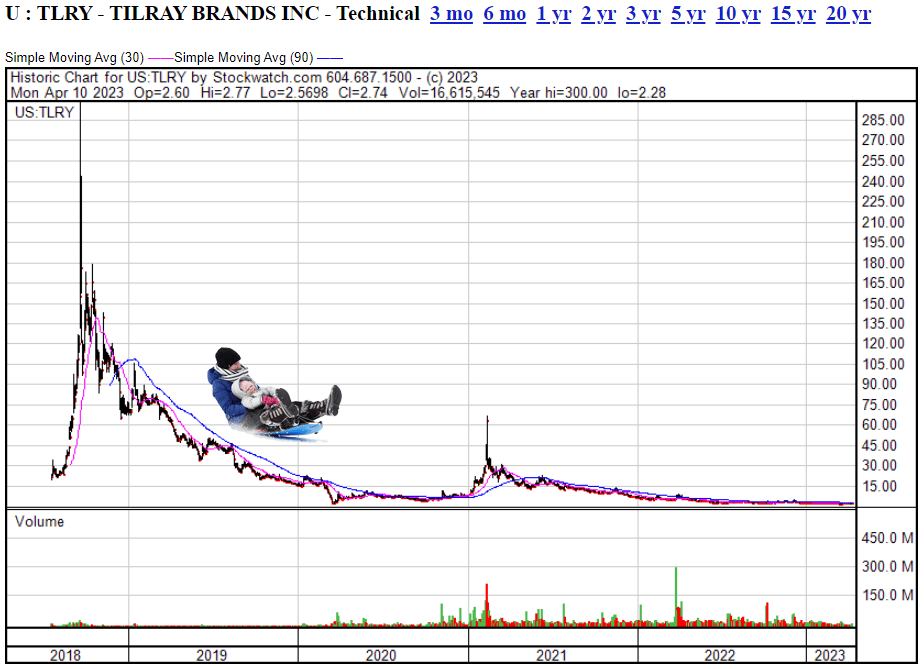

Tilray (TLRY.Q) was another giant, worth (at one point) around $300 billion, with its CEO earning the honour of ‘highest paid CEO in North America.’

Today? Tilray is worth just $1.4 billion and slipping by the month.

Tilray just announced its going to buy Hexo (HEXO.T) which, at its highest, was worth 40x more than it is at the time of writing.

Hexo has never made money but Tilray is buying it because market share is apparently super important in a market where nobody seems to know how to make money, and they’re doing this while having to buy out HEXO’s fat loans. Way to earn that juicy CEO cash, boys..

It’s not that I haven’t seen some okay weed deals out there in the wild in the years since, even some that I like a little, and that are run by people I know are really trying to do the right thing. Avant Brands (AVNT.T) as an example, has been toiling – GRINDING – for several years, fighting for every dollar of revenue, sweating on quality and brand building, and spending no money along the way for anything (trust me, I’ve been working them for years, to no luck). Even still, despite prudent business operations, anemic spending, and growing sales, they’re down by half from their annual high.

Because the cannabis business suuuucks.

So can anyone make money investing in Canadian cannabis?

Yeah. But you have to be built the right way.

- You have to come to market at a reasonable price, not from a fat IPO where the dealmakers fill their pockets with sub-penny paper and start blowing it out immediately.

- You have to have people at the helm who understand the Canadian weed landscape – not just enthusiasts, but actual market guys who’ve been through the wars and learned.

- You have to not be getting crushed by debts and bad deals that, years later, have come due.

- You need a business model that focuses on the place where one can actually make money.

That last bit is an imperative.

You will not make money in cannabis by any of the following businesses:

- Dispensaries – rent is high and taxes are high and wages are high and the amount of products you can sell is limited and you can’t market anything to do with your products, and price compression is real. Too many dogs in this fight and all of them are three-legged mutts that mostly do government work.

- Growing – you can’t make money in farming unless you own a shit-ton of land in a country where your costs are next to zero. Canada is a wintery country, so outdoor grows are meh unless you’re in BC, and indoor grows aren’t profitable with the insane costs associated. Take my word for it, switch out to saffron while you still can.

- Medical weed – Let’s be honest, everyone told a nice story about ‘being there for the patients’ early on, because medical weed was the only game in town, but as soon as recreational was an option, who the hell is going to their doctor to get a prescription? Just get down to Crazy Mike’s Ganja Hut on the offramp, and load up on the purple head crush kush and staple your ass to the couch for season 24 of 90-Day Fiancée. Your neck ache will be fine.

- Processing oils – there was a time this was promising as a business, but pretty quickly every idiot at an LP got themselves a super-squeezy machine and used it to process their shittiest weed into the shittiest products that nobody really buys anymore. Nice work. Thumbs up. Great job.

So where can one make money in the dystopian hellscape that is Canadian weed, be it government regulated, government taxed, and then government distributed and sold?

Brands, baby. Brands.

I said this first in 2015 and have been saying it since. I said it to Marc Lustig in the months before he started Cannaroyalty on a shoestring, which became Origin House once it owned a stake in 25 brands, which was then consumed by Cresco Labs (CL.C) for a cool billion.

Lustig’s formula was simple:

- Do the due diligence on every single brand out there

- Find the top 2 in every SKU, in every state

- Buy in, loan them money, take a royalty, whatever you need to own a piece of a brand that people know and loved

- License that brand into other states, effectively creating the closest thing to a ‘national brand’ while such things were still all but prohibited

The model was genius. Go to California and buy a stake in the best grower and the best beverage company. Go to Arizona and buy a stake in a grower and another in the best oils brand, then have the California grower debut the oil and the Arizona guy can do the beverages. Then go to Michigan and find the best edibles chocolate maker, and roll that brand into Arizona and Cali and so on and so on.

It’s also a strategy that rarely lost money. By not being the guy having to go out and build a chocolate kitchen, you sit back while someone else does the work and wait for either your loan to be repaid (great job, need more?), or you take over the kitchen when it doesn’t get paid off, right size it, and either run it or sell it on for a profit (worst case scenario, albeit still a pretty good outcome).

Lustig was the perfect guy for this routine, because, and I say this with the utmost knowledge of the weed finance sector – he’s the rare guy in that business who is not a raging pustulant cockface. That is, there are plenty of guys who’ll loan money to anyone desperate enough to ask, and they’ll set their deals up to eventually fail so they can pick up the asset cheap and, likely, sell it off for parts and a profit.

Lustig isn’t going to give you money for free, but he ultimately doesn’t want to take over your business and run it. He’d much rather you do that, and pay him sizable but fair interest rates and royalties as you grow. I’ll help you stay alive, but I want you to wash my car on Sundays, you know?

Oddly enough, in the cannabis world, this is about as holy an interaction as you can have with a guy who has access to money. If you HAVE to drop your pants for someone, at least choose the guy who uses lube.

When everyone else was messing their bed back in 2018-2019, Cannaroyalty was the only one rising.

So where does that leave us today?

You’re going to have to wait a minute because I’m not done yet on the ‘guys who built the weed industry and didn’t suck unholy ass juice’ nostalgia tour. There was another guy back then who was moving and shaking when all you could legally do was move and shake and he too has never screwed anyone over.

Back in 2013, every broker and deal guy became a weed guy in the space of about four months. From Satori Resources changing its ticker symbol to BUD.V, and jumping by a triple inside a day as yours truly pointed out they owned a mine shaft in Flin Flon that the government once used to grow weed in, to a single quarter later when there were 100 ‘psst we’re getting into weed’ deals on the market, a lot of people showed their whole ass by acting in a shady manner often and early. And as far as early weed investors were concerned, the shadier the better.

So you owned a silver resource exploration company that had been at half a cent per share for four years? No you don’t; now you own ‘the next big weed play’, and all you had to do to justify that was tell the public ‘when the government figures out licensing we’ll ask for one.’

My gig was to try to keep all the pieces on the board in some semblance of reality. The fake breathalayzer deals, the dispensary deals five years before dispensaries would be allowed, the ‘tired and emotional’ LP CEO who’d fire off drunken emails at 3AM, the uranium CEO who was going to grow weed in New Guinea, the guy who loaned his stock to a financier so they could short the company they were financing and then took off for Switzerland, the guy who took six years to grow strawberries, the shell used by a Uruguay-based grower who wasn’t allowed to re-enter Canada and which was eventually used to buy the music catalogue of a garage band owned by an investor for $400k on the promise he’d use the money to buy stock on the open market (those last two were the same dude)..

Oh, the salad days.

But there was one man who stayed straight, and helped a lot of companies not only find good assets and good people, but helped them avoid shitty assets and shitty people. That dude is Brayden Sutton.

Sutton built a reputation out of Chilliwack BC by knowing who the real weed guys were, knowing how to present them to the money guys, and ensuring that those real guys understood the river of pissewasser they were about to go swim in if they were going public.

Sutton, at one point, knew every deal, every player inside those deals, and every crack in their shiny veneer.

There were times I had negative opinions of a company and he’d call and tell me why I was wrong and, you know, he was on point with his info more often than not. It wasn’t that he wouldn’t find himself attached to the occasionally shitty group, but that was mainly because he was in the vortex of just about every deal going, in some way, either at the beginning of something good, or at the end of some sort of lifesaving measure to try to salvage something bad.

If Sutton was at your door, more often than not he was fighting the good fight against the forces of shitty.

Sutton was in the room when Lustig put together Cannaroyalty. He was in the room when Supreme Pharma got its license and was soon growing the best weed in the country by a country mile. He was there when that company, then renamed 7 Acres, sold to Canopy for $400m. And he was in the room for countless other deals, when I’d show up looking for answers, only to find him already in there reading the riot act to a CEO who’d fumbled badly.

On the money side, Marc Lustig is the fuckin’ man.

On the operations side, Brayden Sutton is the fuckin’ man.

So imagine if those two, with $1.4 billion in weed company exits behind them, got together on a new weed deal.

Yeah. Holy shit, right?

Behold: The BC Bud Corp (BCBC.C).

30 products across five provinces, across multiple SKUs, all from ingredients grown by small batch artisans.

Realistically, they’ve built what everyone claimed they were going to build, back before the whole schmoz became a race to see who could build the biggest greenhouse.

THE QUANDARY:

Brand building is hard in Canada. Dispensary product lists are like the Yellow Pages nowadays, even to the point where some companies use numbers and hyphens at the beginning of their brand name to get first spot in alphabetical ordered cannabis product menus.

Really, bro? -NESS?

The cold hard fact of the matter is, nobody gives a shit about brand names, because there’s just too many of them and none of them mean anything. So we look for something – anything – that might make a product stand out from the 300 others.

- NAMES: Big Bag O’ Buds, Broken Coast, Doja, Ghost Drops, Good Supply.. what do any of these tell you off a menu? They’re just a word salad.

- EFFECTS: We do give a shit about what a given weed will do to us, but the government doesn’t really allow that, so effects are barely useful in the sales process.

- THC COUNT: If we’re being honest, if two products are of the same strain and one is a 180mg/g THC and another is 140, we’re taking the 180.

- PRICE: The big one, the thing most consumers focus on, and why most Canadian corporate weed growers can’t make money.

As mentioned above, Tilray spent $250m buying Hexo, even as Hexo’s revenues implode every quarter, just so they could brag that they have bigger market share when the deal is done. Because that’s LITERALLY THE ONLY THING THEY HAVE TO LEAN ON as a success metric.

But imagine if you could create a brand that resonated with consumers from the outset. Like, before they even tried it. A brand that made them stop scanning the menu and settle in.

Right off the bat, BC Bud Corp has the brand building not just started but NAILED.

Who you going to try, sight unseen?

- Pistol and Paris or BC Bud?

- Hiway or BC Bud?

- Sundial or BC Bud?

- Strain Rec or BC Bud?

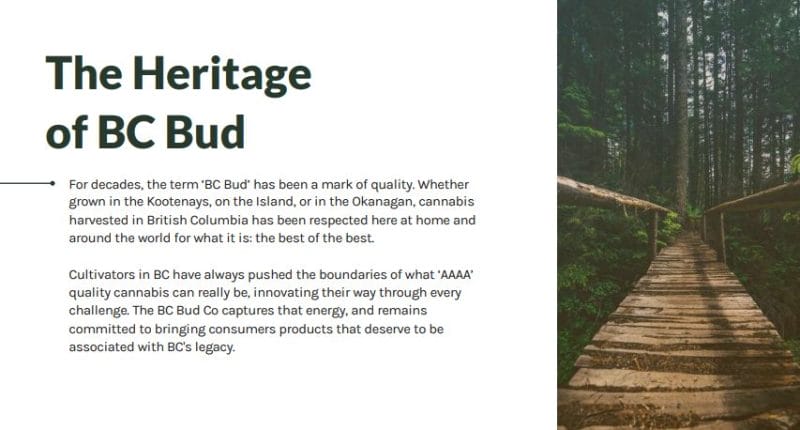

For decades, weed smokers up and down North America’s west coast clamoured for BC Bud. Anything from Chilliwack ditchweed to Kelowna wine country gourmet shit was ‘BC Bud’ to the rest of the world because it was just superior to just about everything.

Don’t come at me with your dried out Hells Angels closet-grown skunk, or your Kentucky backwoods trash, or your New Jersey ‘driven up fresh from Tijuana’ special, or your ‘two years old, floated over from Afghanistan in a sweaty shipping container’ kush.

I’m friends with a Canadian border guard, and she tells stories of people who’d get busted bringing in a small amount of weed when they flew into Vancouver and she’d say, “I’m not even angry, I’m just disappointed. Did you do no research before you came here? Did you want to make sure you had a good supply of that top shelf Korean shit? The biggest punishment I could give you is to let you enter the country with your dogshit weed and watch you smoke it.”

Like, they’d barely even look for weed coming in because, why would you even? Stake out a spot at the end of an East Van Dennys lunch counter and wait five minutes and you’d be offered weed four times before you were finished your Grand Slam. Go to a concert and put your hand out to the right and whoever was next to you would just pass you a joint without thinking. Cheech and Chong started out in Vancouver, true fact. People would put themselves through police training in BC selling chronic out of the back of their cruiser. If someone got busted with weed on them in this town, it would usually be because they were wanted for something else the cops couldn’t get evidence on. Guys in prison, when they told their bunkmate they were in jail for weed, would hear, “No, but what for really?”

BC is a weed province. Has always been. Will always be. And BC Bud was the unofficial catch-all brand for years, like an underground tourism campaign that ran for half a century.

So when you’re building a weed brand from scratch, and you’re not allowed to do celebrity endorsements or make lifestyle claims or talk about medical benefits, you can create one out of nothing like ‘Spinach’ or ‘Hexo’ or ‘Jonny Chronic’..

..or you can use the catch-all term that lingers in the minds of everyone who has bought weed in the last 50 years.

BC BUD.

THE BUSINESS PLAN

BC Bud Corp is set up to do business in a very simple manner. They get others to do business for them.

Sure, it’s a bit more complex than that, but not really though. They get to choose from all the artisan grown small grower weed out there, and whoever offers them the best deal with the best quality for what they’re looking for, they get the deal.

BC Bud grows nothing. It simply takes the best deal from the copious amount of quality BC weed out there, guarantees that grower a deal that keeps them in business, labels it how they want and sells it forward.

No massive capex. No massive writedowns. No massive staff rosters. No nickel and diming.

The farmer that’s best does what they do, without worrying about processing, delivering, and selling. And the dispensary receives an AAAA+ product for a decent price, that people will buy.

The middle ground in that deal is where the profit is, and it’s also right where BC Bud Corp positions itself. Maximum return, minimum outlay, minimal risk.

THE QUALITY THING

So Lustig and Sutton are off to a great head start with BC Bud Corp branding and the sleek business model, but that early boost would mean nothing if the first time someone tried their products, they had a bad time.

They know this, and so they’ve cultivated the best of the best.

“That first interaction with the product, that’s everything,” says Sutton. “If people love it, they’ll buy more until they can’t, so you need to know you have a guaranteed supply, a high level of quality, and no corporate bullshit.”

It’s early days, but BCBC’s offerings are making an impression.

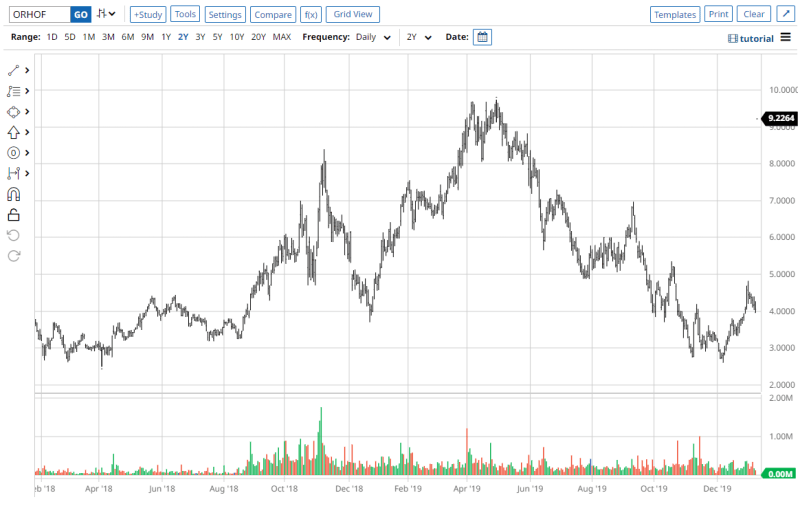

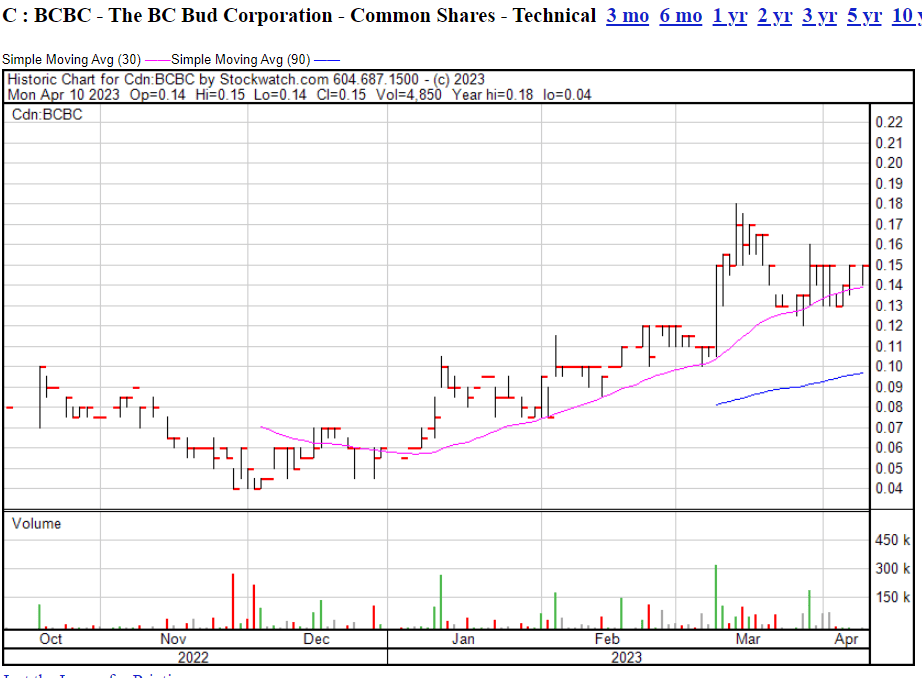

THE CHART

Up top you’ve seen a lot of charts from the big boys over the years. The guys who lost billions in asset value trying to be the biggest grower, without concerning themselves as to whether they could do that sustainably. Patting themselves on the back for raising $300m and building a company that loses half a billion per quarter is a special kind of stupidity. There’s just no sense in what 90% of the cannabis market has been doing since it was created, but that’s the public markets for you.

But BCBC, that chart is a little interesting.

We started telling you about this deal in December, and it’s been pretty good timing on our part. If you got in at $0.04, well lucky dawg. The $0.15 today represents a nice upward shift, not to mention the exact opposite of what the rest of the cannabis industry is getting.

That’s a nice steady ascent, fueled by growing buying every day. No hard bottoms or tops, no psychological barriers to get through, just an increasing trust and understanding that this business model isn’t a hard one to show results with. Low costs, growing organic revenue growth, minimal risk.

Shoot it directly into my veins, brothers.

Obviously this business model is not exactly reinventing the wheel, but because most of BC Bud Corp’s competitors got off to such a shitty start, and had to absorb years of losses and rough financings and downward stock moves, righting their ship isn’t easy. BC Bud Corp’s advantage is, it launched its ship after rough weather had beat up the rest of the fleet.

Sure, they haven’t gone out and raised $50m in dilutionary financings, but that’s a GOOD thing.

Only 53 million shares out.

Only an $8m market cap.

This means, if you’re in and the next financials show a net profit (and they’re not far off as things stand), you’re likely to see some real price action, while CGC has half a billion shares out and requires some astronomical turning circles to get back to serious multiples on the share price.

Unconvinced?

PS: I’m back.

— Chris Parry

FULL DISCLOSURE: BC Bud Corp is an Equity.Guru marketing client, and we’re buying at the time of writing.