AMPD Ventures (AMPD.C), a Canadian company providing cutting-edge performance computing solutions for video game development, esports, film and entertainment, AI, and big data, announced yesterday that it planned to offer a non-brokered private placement of up to 14.29 million units at a priced of $0.14 CAD per unit for aggregate gross proceeds of up to $2.0 million.

Each unit consists of one common share in AMPD and one common share purchase warrant, with each warrant entitling the holder to purchase one common share in the company at an exercise price of $0.20 per warrant share for up to 24 months after the date of closing.

AMPD intends to use the proceeds from this raise for the deployment of AMPD infrastructure in additional geographic locations, to increase head count and for general working capital purposes.

All securities issued in this placement are subject to a customary four-month hold period from the date of closing.

This latest private placement announcement follows the September 1st closing of a previous private placement announced on August 4, 2022, which garnered the company aggregate gross proceeds of $1.18 million.

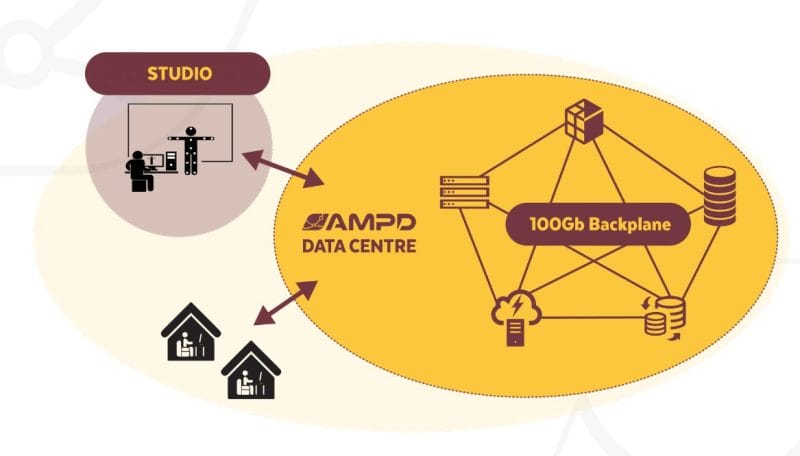

At the beginning of October, the company announced that its Virtual Studio solution had been selected by Tippett Studio, led by Hollywood VFX legend Phil Tippett for Tippett’s expansion plans in North America. Tippett Studio provides VFX for such well-known productions as the Mandalorian, The Book of Boba Fett and The Falcon and the Winter Soldier.

AMPD’s Virtual Studio solution is a studio in the cloud with a suite of solutions designed to build a infrastructure-less studio by moving the majority of computing off site in purpose-built secure and enterprise grade AMPD hosting environments connected by fibre.

AMPD followed up that transformative deal announcement with even better news as it moved to solidify its Vancouver-based subsidiary, Departure Lounge’s, market position as a provider of digital twinning, AR, and artificial intelligence solutions for built environments like real estate development with the appointment of industry expert, Monica Morgan, as Vice President of Real Estate and Projects.

The Departure Lounge provides an integrated set of tools and technologies to allow for the transfer of humans and objects into and out of the metaverse. Departure Lounge boasts the world’s largest volumetric capture stage and an expert team of creative professionals who are developing cutting-edge mixed reality content both in-house and for outside clients.

James Hursthouse, CEO and founder of Departure Lounge, is 20-year industry veteran pioneering creative technology and digital media, contributing to industry standards and leading such companies as Roadhouse Interactive, Cooper’s New Reality Garage and PlayChannel Inc.

AMPD has a busy year ahead and if it continues adding to its deal book as it expands its computing locations, this ground-breaking company could be at the centre of the Metaverse and new world of high-performance edge computing solutions.

Equity Guru founder Chris Parry digs into AMPD, its offerings and what growth opportunities are available for investors wishing to get behind the industry-leading performance computing company in a recent Three Minute Hits segment:

The company currently trades at $0.14 per share for a market cap of $12.4 million.

–Gaalen Engen