As the markets drop and investors feel the pinch in their portfolios, one of our major picks in the recent months is ticking to the upside and looking to break above a major technical area. NioCorp Developments (NB.TO) is a company that is developing the next niobium mine in the US.

With China relations deteriorating and the US needing more domestic supply of rare earth minerals, NioCorp provides an opportunity to play this macro/geopolitical trade.

NioCorp’s Elk Creek Critical Mineral Project is the second largest rare earth resource in the United States.

The company has had consistent press releases from tax incentives, to their demonstration plant now processing ore samples.

The most recent major news was NioCorp acquiring SPAC GXII in order to be listed on the US Nasdaq exchange. The acquisition close is expected in Q1 2023, and can give NioCorp access to as much as $285 million. Money that can go a long way as they continue to advance their Elk Creek Project.

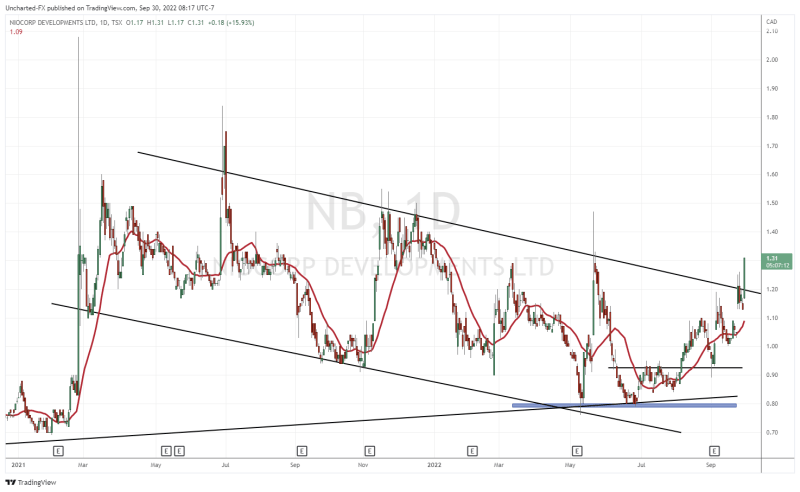

The stock has been on a tear.

I want to remind readers that we called the breakout trigger on the stock way back on August 8th 2022. That was the trigger to enter, and readers have done well if they have rode the uptrend.

We have already had multiple higher lows in this uptrend and price momentum is showing signs of a major technical breakout.

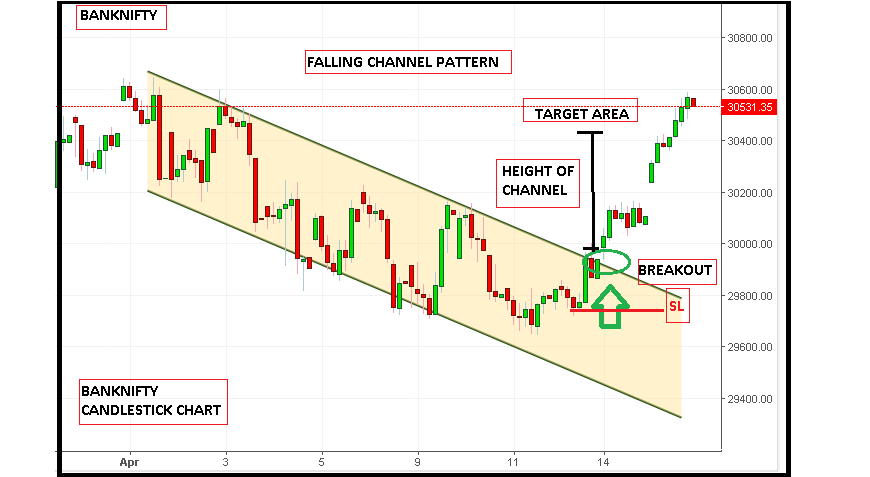

I have drawn out what is known as a channel. Not just any channel, but a falling channel. This is how they tend to play out:

The missing element? The breakout. But that could be changing with today’s price action.

The stock is currently up over 17% with volume of over 377,000 shares traded. The news is that CEO Mark Smith will appear on Fox Business News’ “The Claman Countdown” on Monday October 3rd 2022. The recent NioCorp SPAC news will be covered. It will bring many more American eyes to the stock in anticipation for its US Nasdaq listing in Q1 2023.

If we can close above the trendline, or over $1.25, then we have the trigger confirmation.

What price levels would I target next? There is some major resistance at the $1.50 zone (which is also a psychological important resistance zone). With major interest likely to build up for the stock, I can see it eventually taking this resistance out and then aiming for previous all time record highs.