AMPD Ventures (AMPD.C) closes first tranche of PP and ups offering

AMPD Ventures (AMPD.C), a Canadian company focused on providing high performance computing solutions for low-latency applications, announced today that it had closed the first tranche of its previously announced non-brokered private placement.

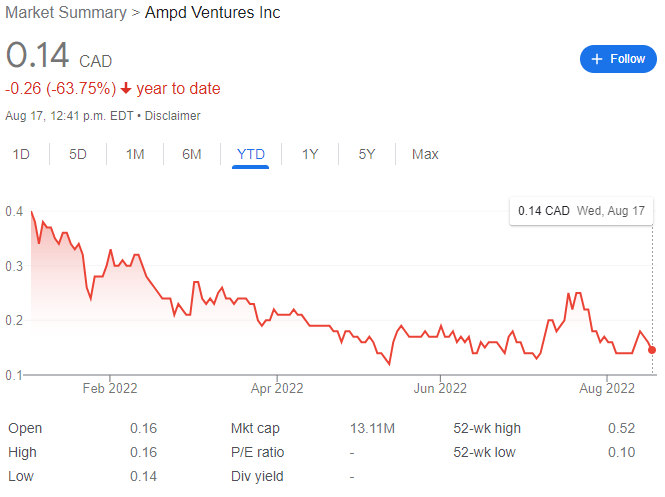

The first tranche included the issuance of 4.60 million units at $0.14 CAD per unit for gross proceeds of $643,800.

Each unit contained one common share and one common share purchase warrant. Each warrant entitles the holder to purchase one common share in AMPD at an exercise price of $0.20 per warrant share for 18 months after the date of closing of the private placement.

All shares issued under the private placement are subject to a four-month and one-day holding period from closing. The private placement is still subject to regulatory approvals.

AMPD is increasing the size of the offering to $1.8 million due to high demand and expects to close the final tranche on or before August 24, 2022.

Anthony Brown, company CEO, commented, “We are pleased to see such strong support from our shareholders and the investment community. As we focus on revenue generation now that several of our platforms are commercially ready, having this additional capital positions us strongly to execute over the coming months.”

The company intends to use the proceeds from this transaction to deploy AMPD infrastructure, increase headcount and for general working capital.

In other news, AMPD announced at the beginning of August that it its subsidiary, Departure Lounge’s Metastage Volumetric Capture Stage had received its certification to operate from Microsoft Mixed Reality Capture Studios and the facility had launched full commercial operations.

AMPD reported $4.18 million in cash as of February 28, 2022, and $1.67 million in revenues for $481,772 of gross profit for the quarter. Net loss for the period was $1.63 million.

Equity Guru’s own Chris Parry took three minutes earlier this month to sum up the company’s value proposition and what it could mean for investors:

AMPD currently trades at $0.14 per share for a market cap of $13.11 million.

–Gaalen Engen