CubicFarm Systems (CUB.T), a Canadian-based agricultural technology company focused on developing and distributing indoor modular growing systems, announced financial results from its Q2 2022.

According to the release, the company reported a net loss of $9.1 million CAD during the quarter and $17.9 million net loss for the six-month period beginning in Q1 compared to $6.5 million loss and $10.1 million loss in the prior period.

The increased loss was attributed to growth expenditures related to building staff for both operations and research and development.

Revenues for Q2 2022 totalled $2.9 million, a 19% increase of $400,000 from the prior period.

Research and development expenses more than doubled from the previous period total $3.2 million for the quarter and $5.8 million for the six-month period.

The quarter was active operationally for the Cubicfarm as the company announced in April that it had added another member to its HydroGreen certified dealer network.

In May, the company announced that its HydroGreen division had entered into an agreement with Deloitte LLP to develop a carbon commercialization program to provide high-quality carbon credits to an emergent marketplace.

An agreement with Cnossen Dairy was announced in the middle of June which called for the sale of 10 HydroGreen AVPs. The AVPs are slated to be installed in Hereford, West Texas.

Cubicfarm also entered into agreements with NTE Discovery Park as announced on June 28, 2022, for the sale of 26 Cubicfarm System modules at a sale price of $4.4 million as well as future manufacturing of major components for contracts in North America.

The initial 26 modules are scheduled to be installed at Discovery Park in Campbell River, BC, Canada, with the intention to expand with the sale and manufacturing of an additional 100 modules in the near future.

Carlos Yam, Cubicfarm CFO, commented on the company’s performance, “In the second quarter, we continued our focus on project execution, including installations underway of our commercial indoor growing Cubicfarm Systems and HydroGreen Automated Vertical Pastures™ (“AVPs”) solutions, while further building our sales pipeline. We will review our operating performance on an ongoing basis and implement measures, including expense management, to ensure financial alignment within our operations.”

Equity.Guru’s own Maddy Grace spoke with Cubicfarm CEO, Dave Dinesen, in a recent episode of Five Easy Questions:

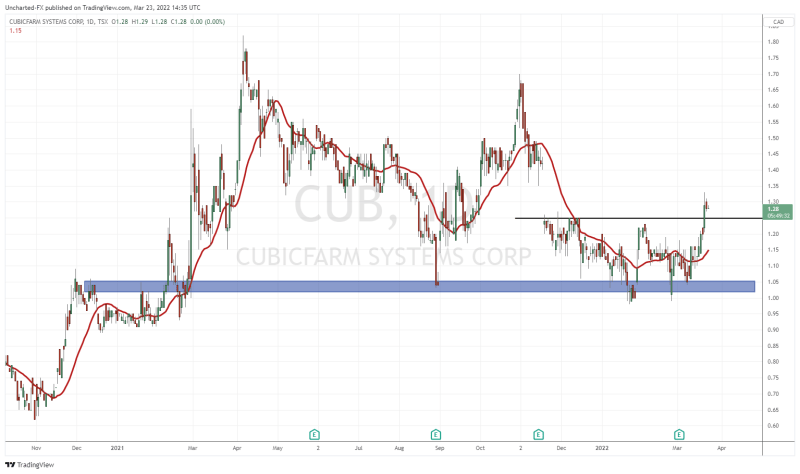

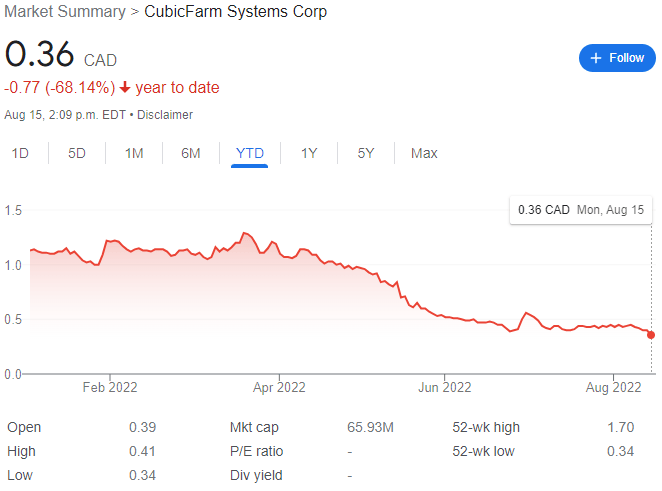

Currently Cubicfarm Systems trades at $0.36 per share for a market cap of $65.93 million.

–Gaalen Engen