Some of you know that I am a big fan of agriculture. Last year in Summer, I wrote my initial piece on why I am going big on agriculture. In that piece, I detailed the 4 reasons I am bullish on the space. For those who haven’t read it, go check it out. One of the 4 reasons was supply chains. There are plenty of other issues that haven’t even begun affecting agriculture.

A few months after that piece, and many agriculture weekly sector rounds afterwards, my readers are sitting in good positions. Much of my analysis is coming true, and we have spotted some big movers in the Canadian and American agriculture space. One of those companies is CubicFarms (CUB.TO), who in fact, were the company I highlighted in my inaugural agriculture piece.

CubicFarm Systems Corp. develops, manufactures, and sells cubic farming systems for farmers worldwide. The company offers CubicFarm System and CubicFarms’ HydroGreen System. Its systems help farmers to produce lettuce, basil, microgreens, nutraceutical ingredients, and animal feed.

It has been a busy past 4 months for the company. CubicFarms has raised $20 million in a bought deal public offering. Cashed up and ready to utilize said cash for growth and catalysts.

CubicFarms also announced a bunch of sales. At the beginning of this year the sale of 9 Hydrogreen Grow System modules was announced. The equipment sales valued at approximately $1.26 million CAD.

In the first week of March 2022, CubicFarms announced the sale of 27 CubicFarm System modules at a price of $5.13 million CAD.

We have been warning of a fertilizer crisis coming this Spring planting season, and a potential food crisis. In fact, readers were warned about this starting around November of last year. Much of this is now coming true. Just this week, we have seen fertilizer prices hit their highest ever, and the media is now running headlines of food shortages which has begun to spook stock markets.

Many of the large cap agriculture stocks (Deere, Agrium etc) are already performing well. Trust me, more money will flow into this sector. We are just in the first inning. For people who think I am doom and gloom, I just want to say that we will overcome this. There has been so much innovation in the agriculture space. I am betting on indoor and vertical integrated farming. We might go through a period of crisis, but there is light at the end of the tunnel. As an investor, this should get you excited as there are many great companies listed on both the Canadian and American exchanges. CubicFarms is one of them.

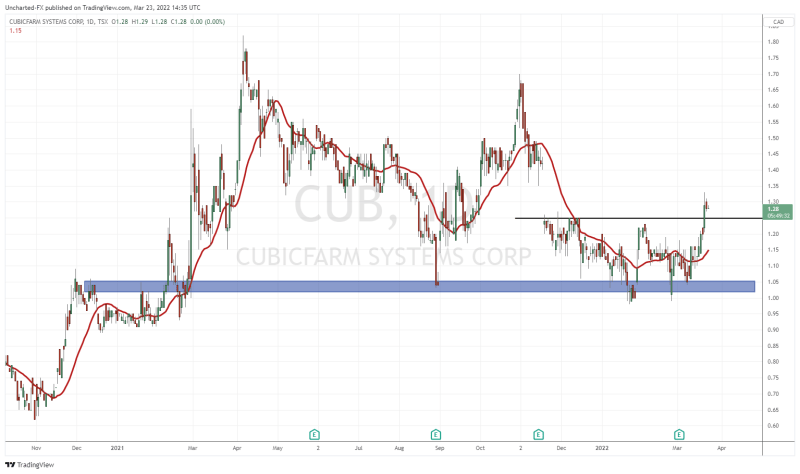

CubicFarms has appeared regularly on my weekly agriculture roundup. I notified my readers when the stock approached and hit $1.00. This is a very important psychological support level.

We have witnessed a battle there. For two months, the stock ranged between $1.00 and $1.25. I am happy and excited to say that we have finally gotten the breakout. On March 21st 2022, CubicFarms took out resistance with a strong green candle and big volume. 295,954 shares traded. These details are very important when it comes to acting on good breakouts.

The breakout came with no news. It seems like food shortage headlines are driving money into this space. And as I said…we are still in the early stages.

So what happens to the stock now? We remain bullish above the lows of the breakout candle which comes in at $1.20. Price can pullback to retest the $1.25 zone, allowing buyers to enter. Completely normal. We expect to see retests whenever there is a breakout. The retest will determine whether the new uptrend remains intact and we continue to make higher lows and higher highs, or if this was a false breakout. The latter would see a red candle close below $1.20. You never want to see the breakout candle be taken out.

When it comes to the bullish momentum, we do need to mind the gap. As you can see, the price gapped down on November 18th 2021. This was when the bought deal financing was announced. Gaps tend to act as resistance, which means we could see selling pressure here. The big bullish indicator would be a gap fill. If CubicFarms closes above $1.40, the gap has been filled. I cannot stress enough how bullish this would be.

Personally, I am expecting the gap to be filled. I like the technical set up, I like the fundamentals and the agriculture headlines, and I think agriculture and food prices will be talked about more in the near future. The risk vs reward looks great for an initial entry, or adding to your position.

Disclaimer: I am a shareholder of CubicFarms