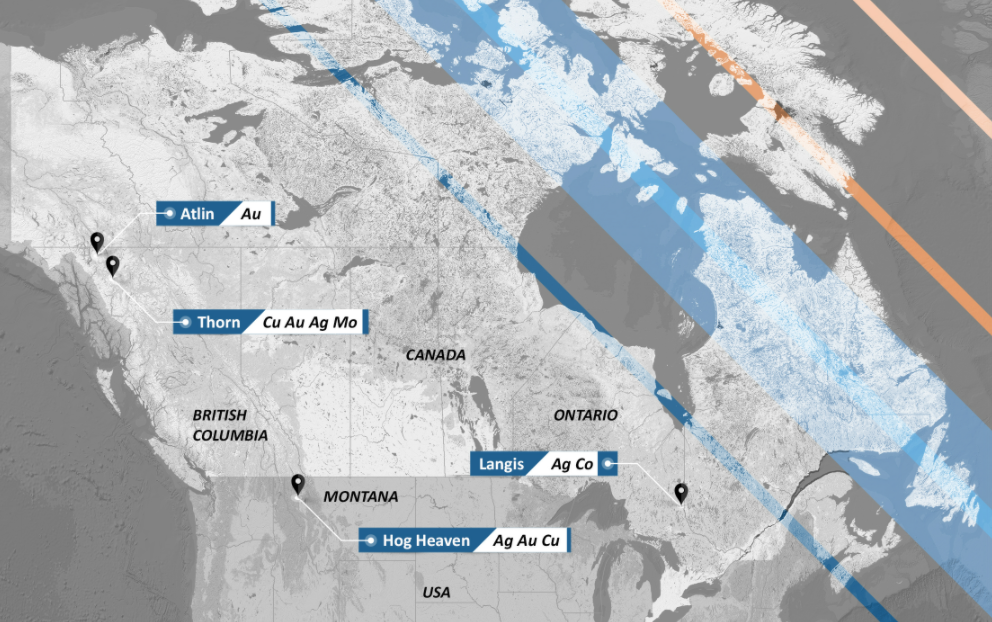

Brixton metals is an exploration company that acquires, explores, and develops mineral properties in Canada and the United States. They have four primary assets dealing with Gold, Silver, Copper and also Cobalt.

Readers know that we are bullish commodities here at Equity Guru. Sure, there could be pullback on commodities with a stronger US Dollar as the Federal Reserve turns hawkish. However, the inflation trade, and the central bank confidence crisis bet still is in play. Hard assets, especially commodities, are what you want to be holding. And we are putting our money where our mouths are. The Fed did implement the largest rate hike since 1994, but needs to thread carefully because if we get a negative GDP report for Q2, the US is in a recession. The Fed would have to reverse or pause hawkish monetary policy… unless inflation remains elevated.

The price of gold has been ranging between $1805 as support and $1870 resistance. A bottoming pattern perhaps? If so, this will be a good time to pick up great gold mining juniors, explorers, miners, royalties etc that are on sale. A break and close above $1870 would get gold going.

Copper and cobalt provide supply and demand factors and other fundamental bullish reasons. The move to green/clean energy is already beginning, and both of these metals will do well. Copper is touted as the green metal as a lot of it will be needed to electrify the green infrastructure grid. In fact, I just wrote a “Copper investing for millennials” article a few weeks back outlining the bullish case for Dr. Copper.

Cobalt is used in lithium batteries for electric vehicles, and are perhaps the most instrumental commodity for said batteries. The problem is that a lot of it comes the Congo, where sourcing ethical cobalt (not from child labor etc) does not bode well with the ESG investing crowd and today’s consumers. Cobalt exploration and assets in North America are due for an interesting (and bullish!) few years.

I really do believe Brixton Metals is one of the best junior metals mining play right now. I say this for three reasons:

- Assets in good jurisdictions and locations

- Cashed up with JV’s and BIG names as shareholders

- The technicals are hinting at a major reversal

Let’s break these down.

Not much needs to be said about jurisdiction. For mining, this is very important when it comes to the legal process of obtaining permits etc, and of course, you don’t want the government to just walk in and claim your resource/mine. Marin Katusa has a simple method of determining good jurisdiction: don’t invest in AK-47 countries. Canada and the US do not fall into this category.

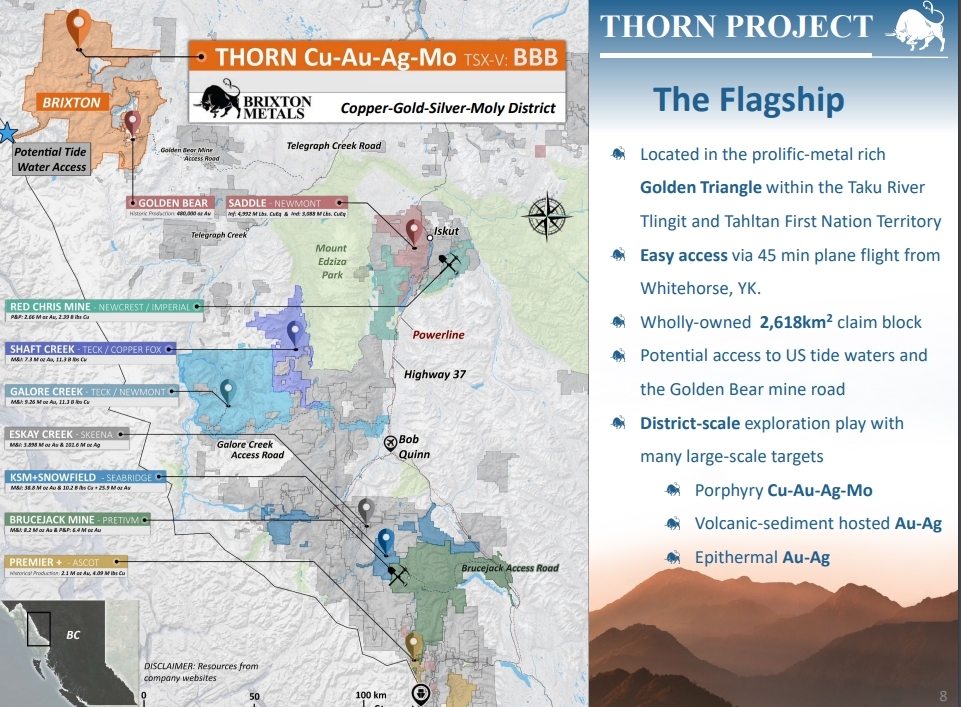

When it comes to the projects, Brixton is focusing on the Thorn project in BC and Hog Heaven in Montana.

The flagship project has investors excited. In January 2022, Brixton provided highlights of the results of its 2021 exploration activities, and outlined 2022 exploration plans and drilling plans. Brixton raised $12.2 Million and is fully funded for exploration at the Thorn project for 2022. They have the funds to initiate a catalyst for shareholders in 2022 with drilling already under way.

Brixton entered a letter of intent with Pacific Bay Minerals where Pacific Bay has the Option to acquire 100% interest in the Atlin Goldfields Project located within the traditional territory of Taku River Tlingit First Nations, Atlin, British Columbia, Canada. Check out the press release for details and monetary amounts.

Chairman and CEO Gary R. Thompson Stated, “We are excited to have Pacific Bay take on the Atlin Goldfields Project. This deal would mark Brixton’s second Option Agreement, having optioned the Hog Heaven Project to Ivanhoe Electric in recent years. It provides value add for Brixton shareholders while the Company focuses on the flagship Thorn Project.”

The most recent news has Brixton beginning a geophysical survey at the Langis Project in Ontario, and acquiring more mineral claims at the Thorn Project. Some of the highlights from these claims include results yielding up to 26.88 g/t Au, 48 g/t Ag and 0.52% Zn from rock grab samples.

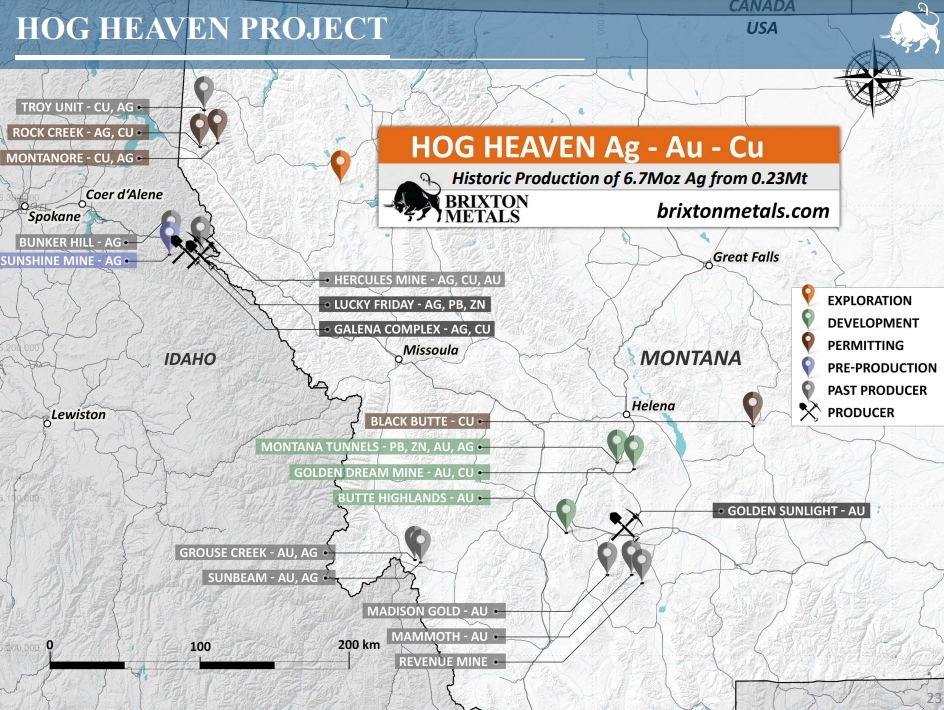

Advancement at the Hog Heaven project is also a catalyst for investors to expect in 2022. Brixton recently announced that it received the second payment of USD $500,000 from Ivanhoe Electric, who have a joint venture (JV) with Brixton Metals. Ivanhoe Electric holds the option to acquire up to 75% interest through a USD$44.5 million spend.

Some of you mining folks might recognize the name Ivanhoe. Yes folks, Ivanhoe Electric is owned by the same man who owns Ivanhoe Mines, Canadian billionaire and Mining magnate Robert Friedland, who is also bullish on Copper and its role in the electrification of the new green infrastructure.

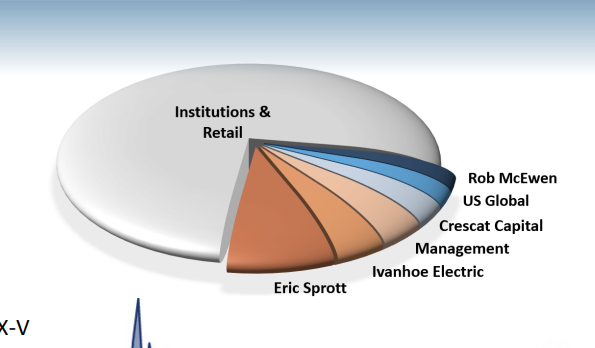

But it isn’t just Robert Friedland and Ivanhoe Electric who are shareholders of the company:

Eric Sprott and Rob McEwen, two other legends in the mining space, own shares in Brixton Metals. Drill results can be a gamble for some of us. I mean I am not that well versed in Geology, and you never know what is under the ground. But I rest more easily knowing that big money has done their due diligence (especially when it comes to Geology!). If they see potential and like the probabilities of good drill results, so much so that they have skin in the game, then I feel comfortable investing with them.

Readers know I love my technicals.

Around early March of 2022, Brixton Metals looked like it was about to print a quintessential reversal pattern: the cup and handle. Unfortunately, this did not pan out. Another reason why it is important to wait for candle closes to confirm breakouts and momentum.

Instead, the stock dropped lower as we saw the return of the risk off move. Money was heading into the US Dollar for safety. People were selling everything. I mean you probably know this if you have been following the stock markets recently. There is a possibility that markets could be bottoming after restored confidence in the Fed. We would see money return back to risk on assets like stocks. The more interesting scenario is money running into gold with all this uncertainty. Perhaps the inflation trade once again.

In terms of what comes next, we do have a major support at $0.13. It was major support back in Fall of 2021. However, we did break below it just recently. It got me worried, I am not going to lie because that would have confirmed a breakdown. But pay attention to the candle printed on June 16th 2022. A large engulfing candle. A 20% green day with volume of 1.2 million shares traded. Importantly, it got us back over the $0.13 zone.

Now, we need to see Brixton sustain momentum and hold above reclaimed support. For a move higher, I see a downtrend line that is acting as near term resistance. If price action can close above this trendline, this downtrend would be over, and it would go a long way to confirm a bottom here at $0.13. And with that, a run back up to $0.20 just on technicals. A catalyst from drilling would get us popping nicely over this.

So there we have it, Brixton Metals is one of the best junior miner plays on the market right now. They have the assets, they have the cash and big money backing/investors, and the technicals are hinting at a reversal. The icing on the cake is the real potential of a roaring Gold market in the long term, as inflationary pressures and geopolitical uncertainty continue.

Brixton Metals (BBB.V) releases first drill hole results from Camp Creek