Most of our analysis for months on this weekly Agriculture sector roundup, and my Market Moment technical pieces, are coming true. Food prices for 2022 are increasing, and I believe we are just in the beginning stages. Expect inflationary pressures on all things, but food is what will hit the middle class the most for obvious reasons. In previous posts, I have outlined how Russia and Ukraine are major players in Agriculture.

Here is my article on the Eastern European agricultural superpowers before the conflict began back in late January 2022. While many were watching energy, I was watching agriculture because of Ukraine being the bread basket of Europe, and knowing that agriculture is one of Russia’s largest exports. Then in late February, I did a follow up on wheat prices rocketing up because of the Russian invasion. Last week, more traders and investors began paying attention to Agriculture as wheat prices hit limit up on multiple days.

Not really bragging, but I gave myself a pat on the back. Thanks to the readers who messaged me on Twitter and social media too. I hope my work provides value and can benefit your trading/investing. I really do believe that technicals can foretell what is coming, and if we know what to watch, we can profit immensely.

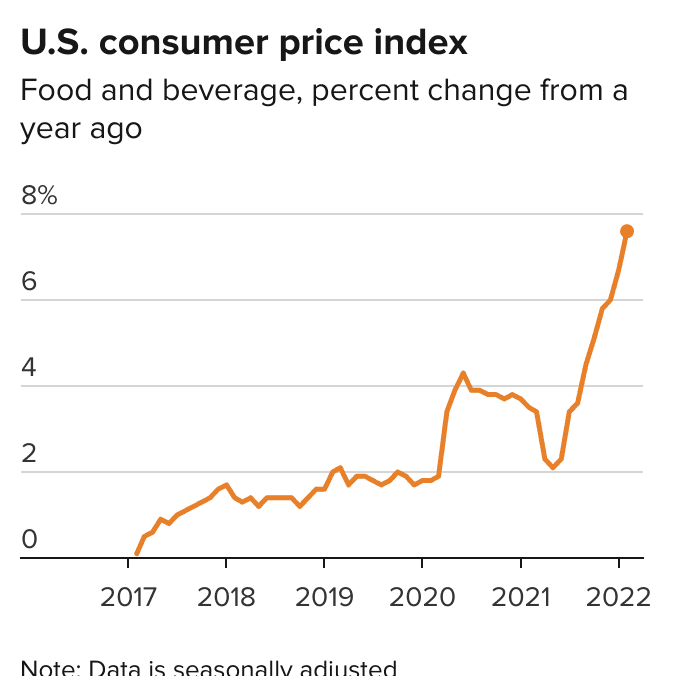

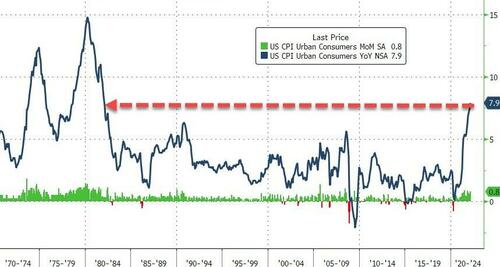

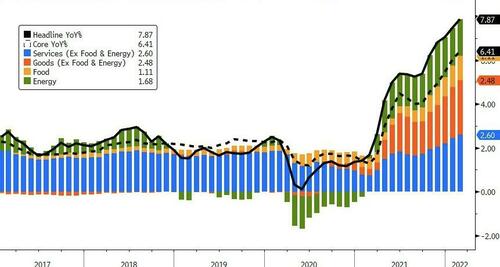

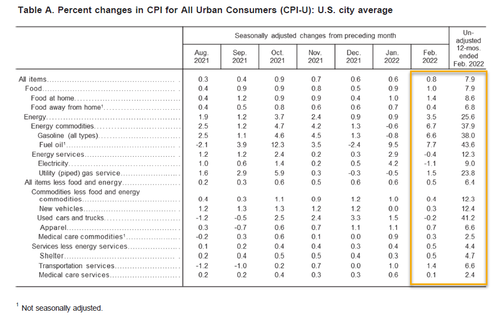

Food prices are going to continue to increase. Many people are talking about February’s US CPI (inflation) data which was released yesterday. Keep in mind, this CPI reading does not account for the brunt of the recent move in oil and agricultural commodities. The CPI for March 2022, which will be released next month is setting up to break even more records.

Speaking about records, CPI for February came in at 7.9% from a year ago. The highest level since 1982. Gas, groceries and shelter were the largest contributors to the CPI gain, but excluding food and energy, core inflation still rose 6.4%. Again, wait till the CPI data for March taking into account current price action on energy and agriculture.

I feel like I sound like a broken record, but yes folks, food prices in 2022 will continue to rise. It is pretty obvious that Europe will feel the pinch. North America will not be exempt. But Africa and the Middle East might feel the largest impact as war will cut Ukraine and Russia wheat exports by 12%.

USDA analysts said that exports from the two countries would fall to a combined 52 million tonnes this marketing year, down by 7 million tonnes from their estimate before the invasion. The reduction would be partially offset by Australia and India, which have ample supplies to sell (Save us Australia!). Abundant rainfall throughout the growing season boosted the Australian wheat harvest to a record 36.3 million tonnes. Aided by competitive prices, the bumper crop will allow Australia to export 27.5 million tonnes of wheat, its highest total ever.

The Economist put out a great piece regarding how hunger in the Middle East and Africa will spread given the current situation in Ukraine. Countries that will feel the impact include Turkey, Egypt, Afghanistan, Algeria, Kenya, Pakistan, Tanzania, Yemen, and members of the EU.

Food prices in Africa are set for another rise. Across sub-Saharan Africa food makes up roughly 40% of the consumer-price basket. Food inflation, which had been running at about 9% a year in 2019-20, started ticking up a year ago to reach 11% in October because of rising transport, oil and fertilizer prices and disruptions to farming from the pandemic. The first to be hit by higher wheat prices will be the likes of Ghana and Kenya, where it accounts for about a third of cereal consumption, or Nigeria, where poorer urban families slurp a lot of instant noodles.

Rising food prices in 2022 will lead to something far worse. Civil unrest. I hate to say it, but I do expect we will be seeing an increase in protests not just in Africa but even in North America and especially in Europe. This could mean rationing and a bigger/authoritarian government.

For us ag bulls, 2022 will be a great year for our investments. I know the Ukraine situation is impacting supply chains, but there are other things such as a potash/fertilizer shortage, and climate related catalysts that will continue to put pressure on food supplies. I don’t want to sound too preppy, but I do believe it is important to prepare for a potential food shortage.

In terms of our agriculture companies, let’s take a look at some news and charts.

Followers know that it is important to have a long term portfolio. Loblaws (L.TO) is my preferred long term holding. Pays a dividend, and all I do is buy shares on a monthly basis. The idea is to turn this into a Dividend Reinvestment Program (DRIP). It was a Agriculture roundup way back in the day where I spoke about the $75 breakout. We are now at $115. Have a stock like this in your portfolio. Regardless of what happens to financial markets or to the real economy, people will always need to buy food.

Look at Costco, WalMart, and others.

On the US side, a stock like Sprouts Farmers Market seems like a no brainer right now. I spoke about this when we took out the resistance and trendline back when price was under $24. Nice breakout and continuation. These are going to be smart plays both on fundamentals and the fact these companies have good and essential businesses.

Evogene (EVGN)

Evogene has a REALLY nice technical set up. I am licking my lips. But first, the fundamentals.

Evogene released Q4 and full year 2021 financials results. Here are highlights:

- Evogene (EVGN) came out with a quarterly loss of $0.18 per share. This compares to a loss of $0.25 per share a year ago.

- This quarterly report represents an earnings surprise of 10%. A quarter ago, it was expected that this agricultural company would post a loss of $0.17 per share when it actually produced a loss of $0.19, delivering a surprise of -11.76%.

- Biomedical and Genetics industry, posted revenues of $0.31 million for the quarter ended December 2021, compared to year-ago revenues of $0.35 million. The company has topped consensus revenue estimates two times over the last four quarters.

Inverse head and shoulders reversal pattern. Nuff said. No but seriously, the structure here is absolutely amazing. Yes, the stock has been in a LONG downtrend, but things look ready to reverse. And as we know, nothing moves in a downtrend forever. Things move in cycles, and a new uptrend cycle could be in the works. As always, I do not suggest entering a position just like that. We need the trigger.

A breakout and daily candle close above $1.50 is our trigger. Love the structure and the bullish confluences. Keeping this on the top of my watchlist.

AppHarvest (APPH)

AppHarvest here is looking for a nice run up to $7.00. The company develops and operates indoor farms to grow non-GMO produce free of chemical pesticide residues.

This is a stock that we can say is one step ahead of Evogene on the technical side. Where we are waiting for the breakout on the aforementioned, AppHarvest has a breakout and is succeeding in the retest. Whenever we take out resistance to trigger our trade, price pulls back to retest the breakout zone allowing buyers to jump in again. Nice green day yesterday indicating buyers jumping in. A higher low is the technical term, and it appears as if we are heading up to $7.00.

AgriFORCE (AGRI)

AgriFORCE Growing Systems, Ltd., an agriculture-focused technology company, focuses on the development and acquisition of crop production know-how and intellectual property augmented by advanced AgTech facilities and solutions in North America, Europe, and Asia.

What a day for the stock yesterday. A nice 102.37% day:

This week AgriFORCE announced a planned convertible debt facility of up to $20 million with an accredited institutional investor. The Notes would be convertible at $2.75 per share. Under the agreement, the Company would receive an initial amount of $10 million and would have the right to receive an additional $10 million at the Company’s discretion, in one or multiple tranches, subject to certain conditions.

The big news yesterday, causing a rip in the stock, was a binding LOI to acquire Deroose Plants NV, one of the largest tissue culture propagation companies in the world!

Founded in 1980, Deroose has multi-national operations in Europe, North America, and Asia, over 2.11 million square feet of laboratory and greenhouse facilities, and over 800 employees. Deroose’s unaudited 2021 revenues were US$40.5 million with EBITDA of approximately US$4.2 million.

The net purchase price by AgriFORCE is expected to be approximately US$69 million. The purchase price represents approximately $46.4 million for the Deroose business on a cash and debt free basis and $22.6 million for the IP portfolio.

I have to say, the stock has closed above major resistance levels. Above $2.50 and above $3.00. $2.50 is key for me because look at how prices reacted here in the past. We closed above this resistance last year in November 2021 with a super spike. The following days on the retest, we had a fakeout confirmed. Let’s see if this breakout and acquisition news gets investors excited!

Agrify (AGFY)

Just a quick one on Agrify.

We have a nice potential reversal pattern setting up. Yup, the double bottom pattern. We still have some work to do in order to confirm it though. I wanted to bring this stock to your attention because we saw some big volume on the 10th of March 2022. 1,375,430 shares traded. Maybe some big news is upcoming…or investors like this area near previous record lows. Nonetheless, we have something to work with here.

Deveron Corp (FARM.V)

Deveron, an agriculture technology company, announced the closing of a private placement this week. A non-brokered private placement through the issuance of 857,143 units in the capital of the Company at a price of $0.70 per Unit, for gross proceeds of $600,000.10. Each Warrant entitles the holder thereof to acquire one Common Share at a price of $0.90 per Common Share until the date that is twenty-four months from the date of issuance.

My triangle is still drawn out. We did breakout above it, but failed on the retest. We are now below the triangle, and broke down further. There is a nice support here at $0.55 which saw buyers. Take a look at the large wick candle we had this week. A positive sign.

From here, I would watch for a bounce back to $0.70. If we break below $0.55, the next support I have would be $0.45.

EarthRenew (ERTH.CN)

We need to talk about the epic-ness that is EarthRenew. I have been telling readers that this is the best set up in the Agriculture space. Literally was the title of my article. Since that article, I had 2 other article follow ups detailing the breakout. This is a stock that is expected to do well given the fertilizer shortage in North America. Maybe investors are frontrunning this…or perhaps major news is coming.

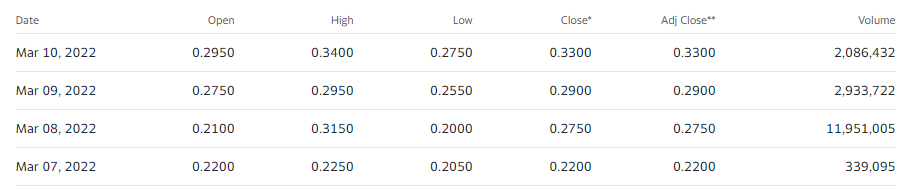

We have had big volume this week. No news out but take a look at this:

Yup, you read that right, 11 million plus shares traded on March 8th. We have big volume in the 7 figures coming in!

All the levels I have detailed before remain on my chart. We have the breakout, we got the retest, and we now have the first higher low swing. As long as prices remain above $0.20 (our confirmed higher low now) the new uptrend remains. I do see some resistance around $0.35 and $0.40 ahead. It could be a good profit taking opportunity to lock in some gains. Then ride the rest. I love the company long term. I think the macro fundamentals are setting up very nicely, and the technicals remain great. Our readers and members on Discord have had the opportunity to enter this stock on the breakout above $0.20, and we are just a few cents away from doubling our money.

Some very nice set ups for the week ahead! I hope I have provided some way for you to play rising food prices 2022. If you are a new reader, be sure to check my Market Moment and weekly Agriculture Sector Roundups (released every Friday) here at Equity Guru!