With the recent stock market drop, it is time to consider picking up some good deals. In this technical breakdown, I will take a look at some solar plays. But before we begin, I want to say that we are not out of the woodwork for stocks just yet. There is a big event risk on Wednesday. Yes, the Fed rate decision. Markets can still flip flop leading up to and after that event. I am still on the sidelines as I am waiting for one level to be taken out on the S&P 500.

For the stocks that we look at today, I will be mentioning the breakout trigger levels. In a market environment like this, I think it is prudent to await that breakout trigger, however, those with a higher risk profile may enter right at support. Just accept the high event risk.

The last time I looked at some Solar plays was back in November 2021. You can read my thoughts and chart setups here. My macro thoughts really have not changed. We are heading towards green and clean energy, but the big question is if solar power can deal with base load power. Storage is the key. Some of the Uranium bulls might be hoping for solar to fail.

Government’s are set to unleash green spending. In fact, I believe our next ‘new deal’ will be the government spending money on green projects and infrastructure. My preferred way to play this is still through commodities such as Silver and Copper. However, I do like the residential component of solar panels. That is what I am really bullish on. Individuals setting up solar panels and then selling the extra power back to the grid for profit. I am sure in the future, governments will even give you a cash incentive to do this, just like they do (did in some countries) with electric vehicles.

Three of these companies are what I would consider utility plays. Energy stocks that pay a dividend. Utility plays are great safety plays because their business is consistent. Solar plays a role, but some of these companies include wind, hydroelectricity, natural gas and more. Well diversified. Canadian Solar is the pure solar play.

Innergex Renewables (INE.TO)

Innergex Renewable Energy Inc. operates as an independent renewable power producer in Canada, the United States, France, and Chile. It acquires, owns, develops, and operates hydroelectric facilities, and wind and solar farms, as well as energy storage facilities. The company operates through three segments: Hydroelectric Generation, Wind Power Generation, and Solar Power Generation. As of February 25, 2021, it owned and operated 75 facilities with a net installed capacity of 2,742 megawatts, which included 37 hydroelectric facilities, 32 wind farms, and six solar farms; and had interests in 10 projects under development, as well as prospective projects at various stages of development.

Disclaimer: I own the stock. It is my utility play. I like the constant dividends, and from someone coming from the mining sector, I was surprised a few years ago. This renewable energy company was paying out dividends, so they were profitable (I thought these companies wouldn’t become profitable for years), and they pulled a large acquisition. Back in 2018, Innergex bought out Alterra power corp for $1.1 Billion. A very big deal back then, which indicated to me that moves were being made in the renewable energy space.

We broke our support at $19.00 back in December 2021. We then pulled back for a retest, and sellers piled in. Typical break and retest pattern. My readers are very familiar with this. It is our bread and butter.

We then began basing at support at $17.00. What you should notice is that while markets were dropping last week, Innergex was moving up. Multiple green days. This is what you want to see on a utility play, and why I think you should have one in your portfolio.

A very interesting close yesterday. We have closed above a trendline, which could be hinting at a trend reversal. However, I would love to see a break and close above $19.00. We would then be above the previous lower high, and reclaim support which has become resistance. Very bullish.

Boralex (BLX.TO)

Boralex Inc engages in the development, construction, and operation of renewable energy power facilities primarily in Canada, France, the United Kingdom, and the United States. As of December 31, 2020, the company had interests in 88 wind power stations with an installed capacity of 2,002 megawatts (MW); 16 hydroelectric power stations with a capacity of 181 MW; two thermal power stations with an installed capacity of 47 MW; and 10 solar power stations with an installed capacity of 225 MW. It also operates two hydroelectric power stations on behalf of R.S.P. Ãnergie Inc.

They have a hydroelectric, thermal and energy storage element too. Great for diversifying if you think the world starts to head towards say nuclear or other sources. Hydroelectricity is pretty solid, but maybe I am biased because I live in BC.

You see a similarity? A lot of the chart setups will be looking similar. Our support broke back in December, the retest was sold off, and now we begin to base and retest resistance once again. Another similar trendline breakout incoming. However, I really recommend getting above the lower high at $35.40.

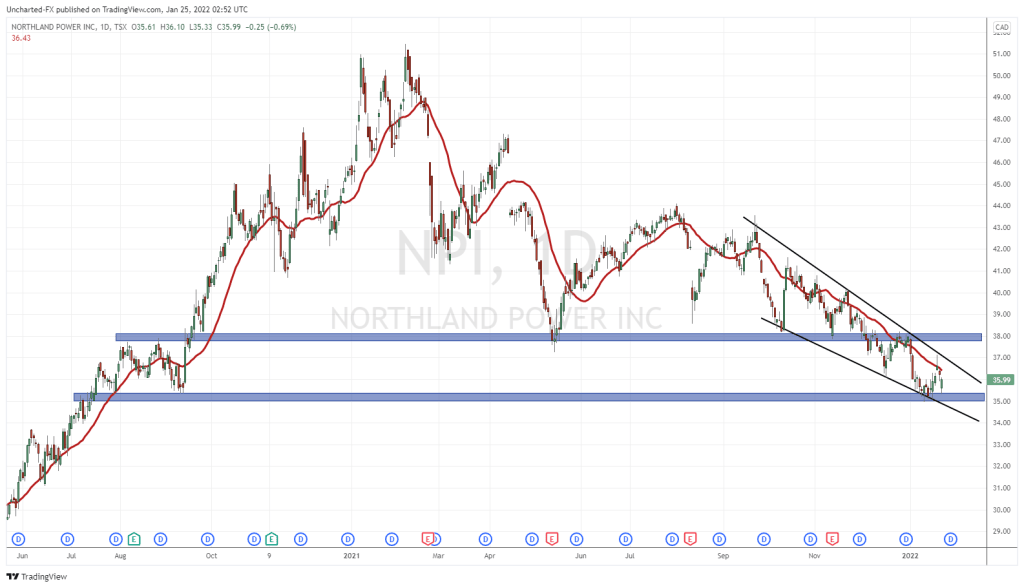

Northland Power (NPI.TO)

Northland Power is a power producer dedicated to developing, building, owning and operating clean and green global power infrastructure assets in Asia, Europe, Latin America, North America and other selected global jurisdictions. Their facilities produce electricity from clean-burning natural gas and renewable resources such as wind, solar and efficient natural gas, and have a long track record of 33 years in business.

Northland owns or has an economic interest in 3.2 GW (net 2.8 GW) of operating generating capacity and a significant inventory of early to mid-stage development opportunities encompassing approximately 4 to 5 GW of potential capacity.

We have a different looking set up here. One that is basing at a major support zone. We have a few technical confluences here. Support is huge, and we shall see if the stock can build a breakout from here. I would love to see a close and breakout above $38.00, however, this current wedge pattern is looking very nice. A close of the uptrend line can get us excited for a break and close above resistance.

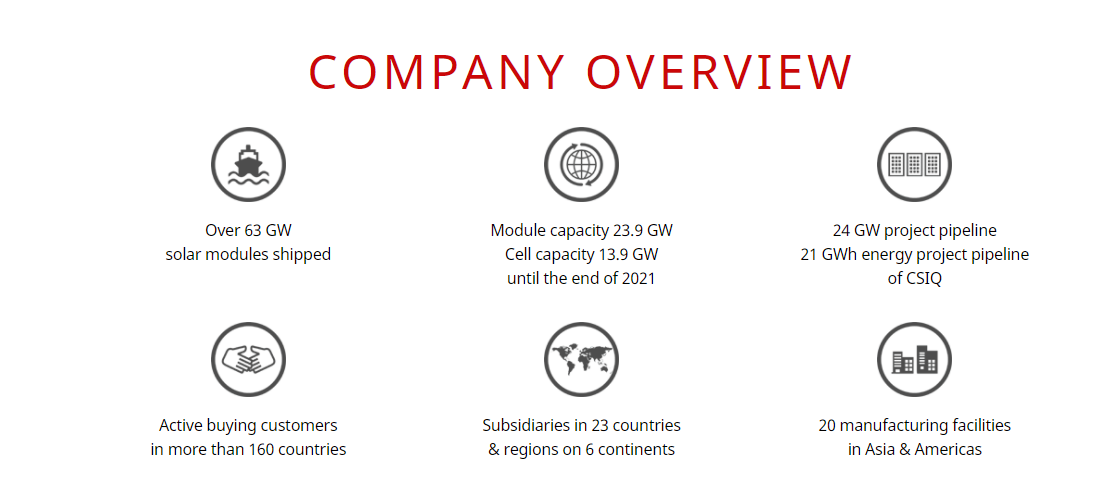

Canadian Solar (CSIQ.Q)

This is the pure solar play. And one I am keeping on the radar given the residential component they have.

Canadian Solar was founded in 2001 in Canada and is one of the world’s largest solar technology and renewable energy companies. It is a leading manufacturer of solar photovoltaic modules, provider of solar energy and battery storage solutions, and developer of utility-scale solar power and battery storage projects with a geographically diversified pipeline in various stages of development.

Over the past 20 years, Canadian Solar has successfully delivered over 63 GW of premium-quality, solar photovoltaic modules to customers across the world. Likewise, since entering the project development business in 2010, Canadian Solar has developed, built and connected over 6.2 GWp in over 20 countries across the world. Currently, the Company has around 430 MWp of solar projects in operation, nearly 7 GWp of projects under construction or in backlog (late-stage), and an additional 17 GWp of projects in pipeline (mid- to early- stage).

The stock looks different from the other solar plays. It looks very similar to the solar ETF TAN. Support at $31.50 did not hold. We broke below and what was once support became resistance. It seemed as if we were going to retake support because there was no follow through movement on stocks. We eventually broke down and I am thinking overall stock market weakness had a large part to play.

Now what? Well we have hit a major support zone at $22.50. If I shorted this solar stock, this is the zone where I would be closing my position and taking profits. We are looking to bottom here. But would I buy right now? Not quite. I would like to see some signs of a range. If we don’t get this and the stock rips higher, then I would be looking for the break back above $31.50. Not only would we take out resistance, but also the lower high which maintains the current downtrend.

In summary, Solar is definitely a future investment opportunity. I really like the residential side of things. In terms of base load power, I would watch the improvement of storage technology. My play for that would be silver and copper. I just don’t know if nuclear power comes out on top. It seems like the best clean CO2 energy right now, and even Bill Gates backs nuclear. I think it is prudent to have a utilities play in your portfolio, preferably one with a solar and green energy element to it like the companies listed above. For those looking to enter in the short term, I would wait for those breakouts and keep an eye on what the stock markets do overall.