Producing electricity from solar panels in the 70s cost about $20 per watt and had approximately 14% efficiency. Even though people could envision a solar-powered future, it was too impractical to use on anything more than satellites. A lot has happened since then, as technology improved enough to minimize costs and increase efficiency where the International Energy Agency declared solar power as the “cheapest…electricity in history” in its World Energy Outlook in 2020.

Today, high efficiency solar panels exceed 22% efficiency with experimental versions reaching as high as 40%. Consumer solar panels now cost $0.70 to $1.50 USD per watt on average but can run from $0.30 to $2.20 per watt. The price of solar PV panels has decreased 99% since 1977 and in 2019, solar power generation surpassed consumption in the US for the first time since 1957.

With panels experiencing 25–30-year life spans, solar power generation now makes up 55% of the globe’s renewable energy output. It has been projected that the entire planet could exclusively run on solar and renewable energy by 2050 with China intending to be the first country to collect solar energy from space and beam it directly to earth.

That said, over the last decade, the solar power sector took a beating as fossil fuel industry influence and technology revealed the inevitable reality trough, but recent advancements and stronger environmental legislation have created another opportunity for players within the solar power sector.

Some of the biggest opportunities in the solar market come from forward-thinking utility companies offering blue-chip dividend paying options for investors.

![]() Boralex (BLX.T) is a Quebec, Canada-based utility focused on renewable energy offering solutions for wind, solar, hydroelectricity, storage and thermal.

Boralex (BLX.T) is a Quebec, Canada-based utility focused on renewable energy offering solutions for wind, solar, hydroelectricity, storage and thermal.

With projects in Canada, France, U.S., and the U.K., Boralex adheres to strict ESG guidelines and boasted 2,462 MW of highly diversified production capacity as of November 12, 2021.

The company continues to move, noting an annual compound growth rate of 17% of installed capacity, 21% in EBITDA and 37% in market cap.

Boralex pays out a quarterly dividend of $0.165 CAD per share with a project portfolio capacity of 3,144 MW of energy production and 193 MW of storage capacity.

As a utility company, investors benefit from long-term contracts resulting from community-based partnerships.

The company reinvests 50-70% of discretionary cash flows toward growth and through increasing its share of solar power provision and storage both in the U.S. and abroad, it intends to up installed capacity to 4.4 GW in 2025 and further to 12 GW by 2030.

Boralex’s combined revenue for Fiscal 2021 was $140.0 million with a net loss of $22.0 million attributed to growth.

With 99% of its contracts possessing an average remaining length of 13 years and US states like New York aiming for a zero-emission electrical grid by 2040 and California looking to the same goal by 2045, Boralex has room to move.

Currently the company trades at $33.01 per share for a market cap of $3.39 billion.

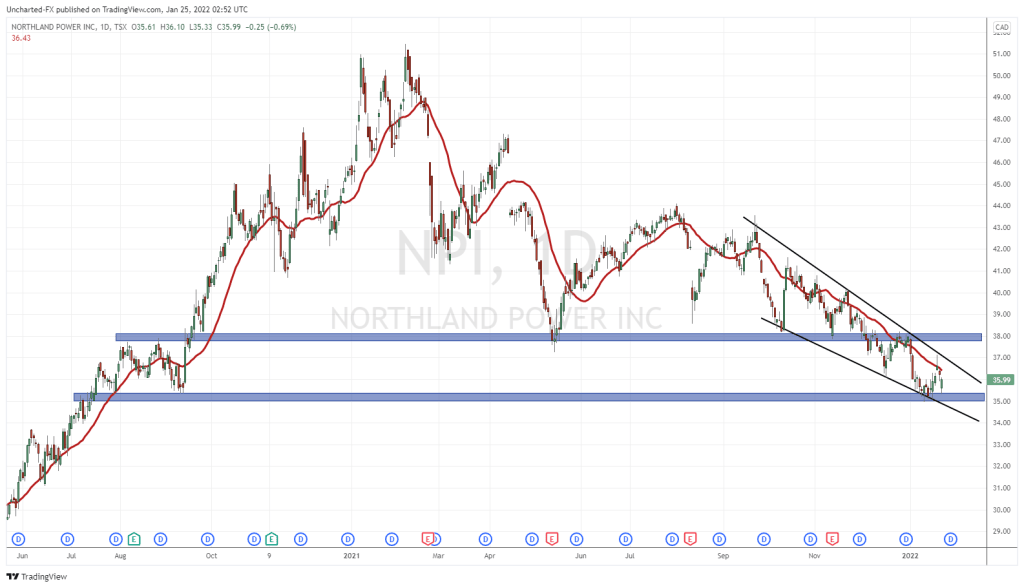

![]() Northland Power (NPI.T) is a Toronto, Ontario-based power producer focused on developing, building, owning, and operating clean and green global power infrastructure assets. The company has three production segments:

Northland Power (NPI.T) is a Toronto, Ontario-based power producer focused on developing, building, owning, and operating clean and green global power infrastructure assets. The company has three production segments:

- Natural gas

- Wind

- Solar

Northland currently has assets in Canada, Columbia, Germany as well as a solar project in Mexico which is under construction. The Mexican La Lucha project is expected to have 130 MW of generating capacity upon completion.

Established in 1987, the company owns or has interest in 3.2 GW of generating capacity and runs offices out of eight countries.

The green energy producer has in-house development, initial plant design, financing and operational capabilities all led by an executive team with a combined industry experience of over 200 years.

An international leader in offshore wind generation, Northland has identified 4-5 GW of generation capacity as well as $15-$20+ billion of potential capital investment over the next five years.

Northland produced 5,929 GWh from Q1 to Q3 2021 with a monthly common share dividend of $0.10 per share.

During that same period, the company brought in $1,453,165 in revenue and $140,351 in net income.

The company reported its 2021 financial guidance in November noting $1.1 – $1.2 billion in adjusted EBITDA which it intends to grow to approximately $2.5 billion with the development of currently identified projects.

Currently, Northland trades at $35.99 per share for a market cap of $8.16 billion.

![]() Innergex Energy (INE.T) is an independent power producer providing solutions for the following segments:

Innergex Energy (INE.T) is an independent power producer providing solutions for the following segments:

- Hydroelectric

- Solar

- Wind

Innergex develops, acquires, owns and operates 79 different power generation sites in Canada, U.S., France and Chile totalling 3,801 MW. These assets include 40 hydroelectric facilities, 32 wind farms and seven solar farms.

The company also holds interest in nine projects under development and several prospective projects at different stages of development.

Founded in 1990, Innergex works with governments and communities to generate high-quality and long-lasting assets within hydro, wind, and solar sectors.

Committed to the highest ESG standards, the company is proud to proclaim it has paid out $48.6 million in wages and benefits in 2020 with 33% women in management positions and 31% women filling staff positions.

In 2020, Innergex supplied the equivalent of 1,007,462 households with clean, renewable energy, paid out $2.7 million in sponsorships and donations, and brought on Hydro-Quebec as a main shareholder with 19.9% of the share float after a private placement at the beginning of February that year.

The company’s PPA remaining terms have an average 14.2-year life, resulting in $7.24 billion in assets and $4.85 billion in debt.

Innergex produced 2,290,086 MW in Q3 2021, bringing in $184,564 in revenue with a net loss of $23.464.

Shareholders received a quarterly dividend of $0.18 per share in 2021.

Currently the company trades at $18.18 per share for a market cap of $3.51 billion.

The next solar power contender is a pure solar play and offers a strong choice to dividend stock investment within the sector.

![]() Canadian Solar (CSIQ.Q) is a Canadian-based global solar power manufacturer focused on solar plants, solar panels (commercial and residential), installation, and power storage.

Canadian Solar (CSIQ.Q) is a Canadian-based global solar power manufacturer focused on solar plants, solar panels (commercial and residential), installation, and power storage.

Canadian Solar acts as a module supplier and/or project developer for a range of international projects in a list of countries as long as my arm spanning five continents.

The company was ranked number one Top Bankable Manufacturer by Bloomberg New Energy Finance in 2020 as well as a Tier 1 solar company by Bloomberg New Energy 2017-2020.

With research centres on cells, modules, and solar systems, 595 research scientists at Canadian Solar create an IP play with 2,250 authorized patents worldwide until the end of 2021.

Canadian Solar is an industry leader, supplying the world’s first 600W high power solar modules based on 210 mm mono PERC cells in May 2021.

Led and founded by president and CEO, Dr. Shawn Qu in 2001, the company has more than 14,000 employees and has cumulatively delivered over 63 GW of solar modules to thousands of customers in more than 160 countries.

The company currently has approximately 24 GW of solar projects and 21 GWh of energy storage projects in its pipeline.

With $260 million in capital from a carve-out IPO and a completed $230 million convertible debenture issuance in 2020, Canadian Solar has the financial fuel necessary to grow its business to 22 GW of shipments and 1.5 GWh of battery storage shipments in 2022.

Canadian Solar brought in $1.23 billion USD in Q3 2021 with a net income of $35.0 million and delivered 3.9 GW of solar modules during that same period.

The company currently trades on the NASDAQ at $25.61 per share for a market cap of $1.54 billion.

Despite the continued growth of these companies, there continues to be a disconnect between investors’ perceptions and the actual performance/potential of successful companies (NOT Solar City) operating within the solar space.

Investment into these entities is a long-term haul, ridiculously huge and unjustifiable market values are gone. We are down to the business of solar, so don’t expect your stocks to be buoyed by memes or the beaver-toothed fraud at Tesla. That said, solar is important and coupled with proper storage technology and base power options like breeder reactors, it will bring about a cleaner world for all of us.

Please, do your due diligence and don’t make any investment decisions without speaking to an investment professional. After that, make your picks and help create a greener future. Good luck to all!

–Gaalen Engen