I have a bit of a sweet tooth. When I was little, my dad used to buy me those massive 64-ounce Jelly Belly containers from Costco. Even that wasn’t enough to satiate my craving for sugar seeing as I would finish the entire thing in just a few days. Eventually, I grew out of my jelly bean phase and moved into the hard stuff like energy drinks, alcohol, and frozen meals, the three hallmarks of a struggling university student. It wasn’t until recently that I began to consider diabetes as a serious risk. When I was still working overnights as a merchandiser, I wouldn’t eat all day before going to work. Being a physically demanding job, I would get lightheaded and almost pass out every night. With this in mind, energy drinks were like an elixir that turned me into a menace on the work floor. The difference was night and day, which raised some concerns for me. Eventually, I went to get my blood tested and was told I was pre-diabetic. Needless to say, I have cut my sugar content down significantly and haven’t had any dizzy spells since. Great, right?

However, compared to most, I am at a higher risk of developing diabetes as it runs in my family. Keep in mind, diabetes is closely associated with diabetic retinopathy, a condition that can develop in anyone who has type 1 or type 2 diabetes. Diabetic retinopathy occurs as a result of the high blood sugar levels caused by diabetes. Over time, high sugar levels in the blood can damage blood vessels throughout the body, including the retina. Some of the symptoms of diabetic retinopathy include blurred vision, eye floaters, and potentially a sudden loss of vision. To make matters worse, diabetic retinopathy can eventually lead to the development of glaucoma, an eye condition that can cause damage to the optic nerve. Damage to this nerve can result in permanent vision loss and, in some cases, blindness. Furthermore, a study published by the International Journal of Ophthalmology revealed that diabetes may raise one’s risk of open-angle glaucoma by approximately 36%. In particular, diabetic retinopathy, which causes the blood vessels in the retina to weaken, can eventually lead to glaucoma. Lucky for me, glaucoma also runs in my family!

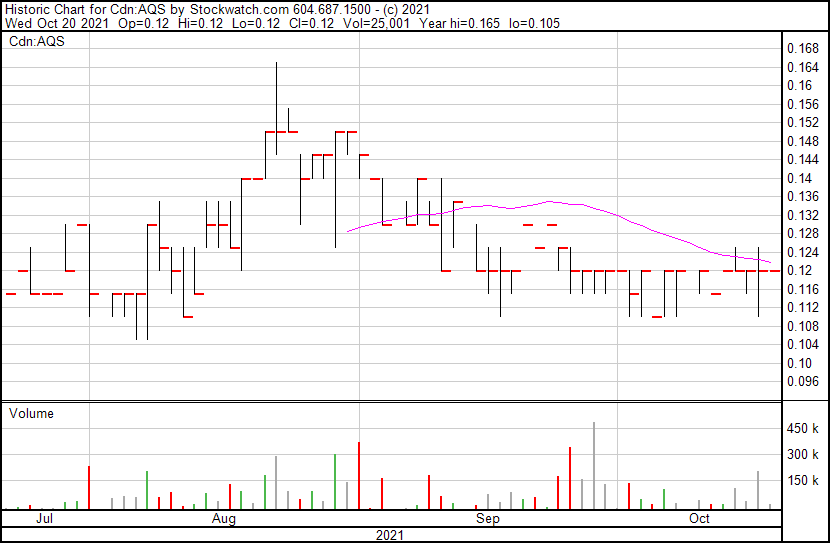

Aequus Pharmaceuticals (AQS.V)

Although glaucoma can’t be reversed, there are various treatments available to help slow or prevent vision loss. With this in mind, Aequus Pharmaceuticals (AQS.V) is a specialty pharmaceutical company focused on developing and commercializing differentiated products for therapeutic areas including neurology, ophthalmology, and transplant. With regards to ophthalmology, the Company has three eye care products that have been approved for launch and are currently marketed in Canada. Of these products, Aequus’ Vistitan™ is the most efficacious topical treatment presently available for glaucoma and ocular hypertension in terms of intraocular pressure (IOP). In a study evaluating the comparative efficacy of latanoprostene bunod, an ophthalmic drug used to treat open-angle glaucoma, to other treatments for intraocular pressure reduction at three months, Vistitan™ was the most successful in decreasing intraocular pressure, and therefore reducing glaucoma risk.

“In treating a disease where every millimetre of ocular pressure control is important, the data continues to support the use of Vistitan over the competition due to its effective bimatoprost 0.03% formulation…This study adds to a growing body of evidence that Vistitan, the only bimatoprost 0.03% formulation currently marketed in Canada, is the most effective product available for treating glaucoma and is the cornerstone of our rapidly expanding ophthalmology franchise in Canada,” said Ian Ball, former CCO of Aequus.

Aequus is led by its Chairman and Chief Executive Officer, Doug Janzen, who has 19 years of experience in the Life Sciences industry. In addition to Aequus, Doug is the Founder and President of Northview Ventures, an organization that invests in and provides strategic advisory services to a number of technology companies. Doug also served as the President and CEO of Cardiome Pharma, a NASDAQ-listed drug development company that raised over $300 million from investors. Moreover, Doug oversaw the completion of over $1 billion in licensing deals during his tenure. Aequus appears to be in good hands, but how are the Company’s financials?

According to Aequus’ Q2 2021 Financial Results, the Company achieved its second highest revenue quarter to date, with $651,516 in promotional services and product sales revenue during Q2 2021 compared to revenue of $542,992 year-over-year. Moreover, during the six months ended June 30, 2021, Aequus’ achieved $1,143,337 in revenues compared to $1,122,442 year-over-year, indicating a 2% increase. On the other hand, the Company’s expenses and net loss increased substantially in the same period. In particular, Aequus’ sales and marketing costs for Q2 2021 were $523,929 compared to $270,296, representing an increase of 94% year-over-year. Similarly, the Company’s net losses increased by 114% in the same period. With this in mind, Aequus attributes these increases to investments in R&D as well as sales and marketing activities related to the launch of the Company’s Evolve™ eye drops. Keep in mind, according to the Company’s Q1 2021 Financial Results, Aequus was able to increase its cash position significantly from CAD$1,718,869 on December 31, 2020, to CAD$3,337,427 as of March 31, 2021.

Eye Can See Clearly Now

So, what’s in sight for Aequus? Recently, on August 25, 2021, Aequus announced that Dr. Robert K. Koenekoop had joined the Company as a medical and clinical consultant on inherited retinal diseases. More specifically, Dr. Koenekoop joined Aequus to support the Company’s collaboration with reVision Therapeutics, for the product REV-0100, a potential therapy for Stargardt disease. Don’t worry, I don’t know anything about Stargardt disease either, but here’s my attempt at explaining what it is. Stargardt disease, also known as Stargardt macular dystrophy, juvenile macular degeneration, and fundus flavimaculatus, causes progressive damage to the center of the retina, which is responsible for sharp, straight-ahead vision.

“We are very excited to be working with the reVision team to advance this much needed potential therapy. The REV-0100 mechanism of action suggests the possibility of slowing disease progression as a first line therapy…Besides representing a meaningful market opportunity, there are a number of advantages ranging from orphan market exclusivity, potential for accelerated regulatory review and the opportunity to be eligible for a Priority Review Voucher,” said Doug Janzen, Aequus Chairman and CEO.

Earlier last month, on August 17, 2021, Aequus announced that it would be collaborating with reVision to develop a therapy for Stargardt disease. In October 2020, reVision’s REV-0100 was granted designation as an Orphan Drug and Pediatric Disease Drug for the treatment of Stargardt disease. As part of Aequus’ collaboration with reVision, the Company will make an initial USD$140,000 equity investment in reVision with the option to fully fund the development program in return for the North American commercial rights to REV-0100. For more details related to this collaboration, check out this article. It is worth mentioning that REV-0100 is being considered for multiple uses and has demonstrated potential effectiveness as a first-line monotherapy adjuvant treatment in combination with other oral therapies. With this in mind, paired with Aequus’ extensive portfolio of commercialized products, REV-0100 could strengthen the Company’s North American presence. Let’s not forget that the North American Vision Care Market was valued at USD$25.1 billion in 2021, and is expected to grow at a steady CAGR between 2021 and 2026.

Unfortunately for me, I didn’t win the genetic lottery. With a history of glaucoma and diabetes in my family, the likelihood that I will have to rely on a treatment like Vistitan™ or REV-0100 in the future is glaringly obvious. It doesn’t help that I stare at my computer for almost the entire day and refuse to wear the dorky glasses I was prescribed when I was sixteen. Sure, I’m not doing myself any favors, however, there is some comfort in knowing that there are already treatments out there that will help me when I am old and decrepit.

If you’re looking for a more technical analysis for Aequus, feel free to check out Vishal’s Chart Attack article here and TK’s analysis here. On the other hand, if you’re an auditory learner, check out our “To Invest or Not” episode for the Company here.

Aequus’ share price opened at $0.115 today (October 20, 2021). The Company’s shares closed at $0.12.