Aequus Pharmaceuticals (AQS.V) is a growing specialty pharmaceutical company focused on developing and commercializing high quality, differentiated products. Aequus has grown its sales and marketing efforts to include several commercial products in ophthalmology and transplant. Aequus plans to build on its Canadian commercial platform through the launch of additional products that are either created internally or brought in through an acquisition or license; remaining focused on highly specialized therapeutic areas.

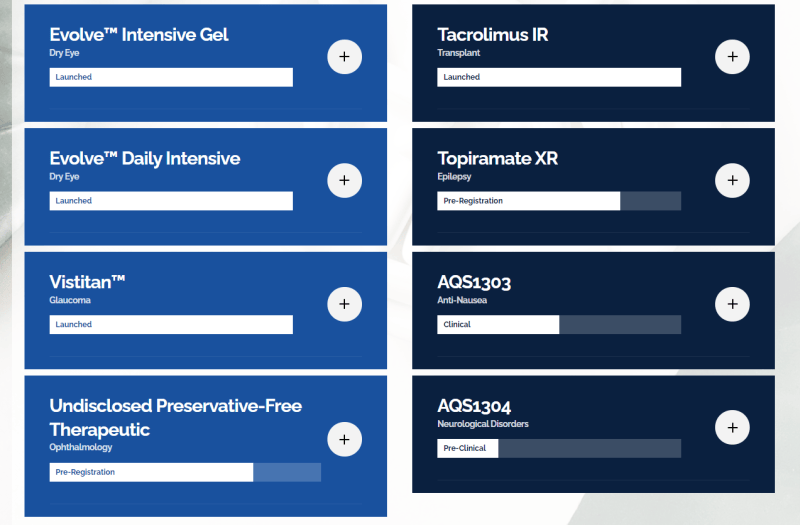

Here is the Aequus pipeline. There are some products that are launched. Meaning cashflow for the company.

A lot of focus is on Aequus’ evolve product for eye care. You can find more information on these products here.

For a breakdown on the companies financials, I recommend reading TK’s breakdown of the financial statements. If you checked out our Investor Roundtable on Aequus, TK allocated his full cash in hand to play the stock. He likes the upturn in cash flows.

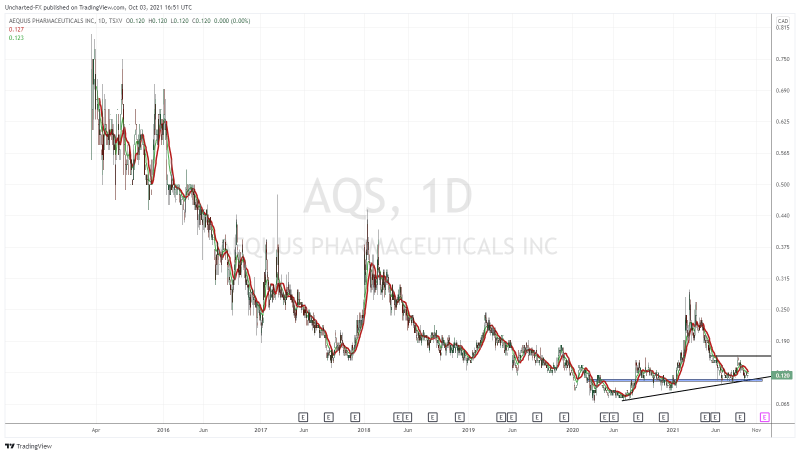

The same can be said about the chart. It appears as if a turn is occurring. A shift from a downtrend to an uptrend with a great entry opportunity for investors.

Before we delve into the charts, just two quick points I want to make. Firstly to management, I think it would be great to have an investor presentation available. It would make Aequus more investor friendly. Secondly, Marc Lustig is on the board of directors and is making direct equity investment into the company. A very strong signal of support.

A broader perspective before making a case for a turn around. The chart hasn’t been a great sight for long time shareholders. The stock has had a clear downtrend. Just recently, we have begun to make some sort of basing. And as you can all see from my trendline, we have our first uptrend line. You cannot draw an uptrend slope line anywhere else. This is the first time a technical analyst can.

If I zoom in, you all can see that this is setting up to be a big week for Aequus stock. Not only are we retesting the trendline, but also testing a major support zone of $0.10. A lot of positive confluences, providing us a great opportunity for entry.

I should note the big pop earlier this year. The stock popped to $0.30 before selling off. February 12th was the Marc Lustig announcement, which fits nicely within the uptrend move. Big news and a big response. Lustig got in at $0.15, so investors can actually enter at a better price point currently.

You can see I have a horizontal line at around the $0.16 zone. The resistance zone I want to see break for further upside. A way to play this stock is to enter at this support, and then add to your position on the break of $0.16. Sure, you may miss out on some of the move, but the probability that the stock continues higher increases. Whereas currently, the stock may just continue to range, or even break below our support and uptrend line. Thinking in terms of opportunity cost for our well earned money.

In summary, Aequus provides an opportunity for investors to enter at a lower price point than Marc Lustig. Friday’s volume was low with only 584 shares traded. However, looking at historical data, we do have much more volume per day. Friday seems to have been an outlier. The company has a pipeline which includes products for sale, and the chart is showing signs of recovery and a new uptrend. A lot of positives here.