Aequus Pharmaceuticals (AQS.V) and reVision Therapeutics today announced a collaboration on the development of a therapy for Stargardt disease. The agreement will provide the Company with the option to acquire North American commercial rights to REV-0100, reVision’s proprietary Stargardt disease program.

“We are very excited to be working with the reVision team to advance this much needed potential therapy. The REV-0100 mechanism of action suggests the possibility of slowing disease progression as a first line therapy…Besides representing a meaningful market opportunity, there are a number of advantages ranging from orphan market exclusivity, potential for accelerated regulatory review and the opportunity to be eligible for a Priority Review Voucher,” said Doug Janzen, Aequus Chairman and CEO.

Aequus is a specialty pharmaceutical company focused on developing and commercializing differentiated products, including several commercial products in ophthalmology and transplant. Similarly, reVision is a biopharmaceutical company focused on the development and commercialization of therapies for ocular and rare diseases. With this in mind, Aequus and reVision are like two peas in a pod, collaborating in an attempt to develop a therapy for Stargardt disease. What is Stargardt disease? Stargardt disease is a genetic eye disorder that affects central vision in children and adults, often leading to vision loss. Furthermore, it is the most common form of juvenile macular degeneration, with a prevalence ranging from 1 in 8,000 to 1 in 10,000. To make matters worse, there are currently no approved treatment options for Stargardt disease.

With this in mind, reVision’s REV-0100 has been shown to reduce elevated levels of lipofuscin in pre-clinical trials. For context, lipofuscin refers to one of the aging pigments found in the liver, kidney, heart muscle, retina, adrenals, nerve cells, and ganglion cells. The accumulation of lipofuscin in the eye is a major risk factor associated with macular degeneration and Stargardt disease. Having demonstrated efficacy in reducing levels of lipofuscin, REV-0100 was granted designation as an Orphan Drug and Pediatric Disease Drug for the treatment of Stargardt in October 2020. These designations support accelerated development of REV-0100, expediting review and evaluation among other benefits, including market exclusivity upon successful program completion. Moreover, REV-0100 has an established safety profile and is manufactured to GMP standards, potentially reducing safety risk and shortening the development timeline.

“We are excited to partner with Aequus, an established commercial ophthalmics company, to continue developing REV-0100 for Stargardt disease…We believe that the existing efficacy data in animal models of Stargardt disease and established safety profile of the REV-0100 drug substance provide real hope for Stargardt disease patients who presently have no approved therapeutic options,” said Paul Fehlner, reVision’s co-founder and President.

As part of the option terms, Aequus will make an initial USD$140,000 equity investment in reVision with the option to fully fund the development program in return for the North American commercial rights to REV-0100. Aequus initial investment is intended to cover the costs of a pre-clinical toxicology study for REV-0100, which is planned for the near term. Additionally, clinical trials with Stargardt patients are expected to begin in late 2021 or early 2022. If Aequus decides to fully fund the development program, the Company would receive exclusive commercial rights to REV-0100, a treatment with Orphan Drug and Pediatric Disease Drug designations, in North America. Keep in mind, the North American vision care market reached an impressive valuation of USD$25.1 billion in 2021, and is expected to exhibit steady growth between 2021 and 2026. With this in mind, REV-0100 could become a potential boon for Aequus depending on how the Company chooses to proceed.

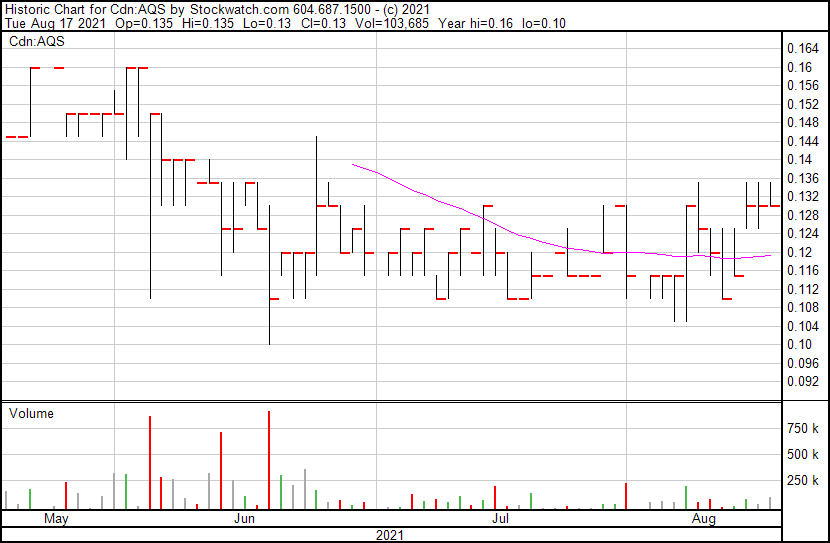

Aequus’ share price opened at $0.135, up from a previous close of $0.13. The Company’s shares were trading at $0.13 as of 11:42AM ET.

Full Disclosure: Aequus is a marketing client of Equity Guru.