E-Sports and the Publishers

Last week we talked about the esports sector in general from the perspective of someone who’s looking to gain exposure through the stock market. Just as a precursor and a reminder for the upcoming topic in today’s piece the three main avenues of exposure we found were through

- exchange-traded funds or equity indexes

- purchasing large scale publishers

- filtering through the many esports firms

It’s obvious that the most appealing of these three for many investors would be looking at all the E-sports firms that are available. For that reason, we shall talk about this another time and will go directly to purchasing large-scale publishers as this is usually not the first avenue for most.

I feel the reason for this is because these dinosaurs of industry are looked at as the old dogs that you can’t teach new tricks. In industries like semiconductor manufacturing where Intel Corp is experiencing some rapid pressure from companies like AMD and NVIDIA, this might be true, but not always be the case for other sectors. On the contrary, these old dogs might have learned a few tricks back in their day that helped them stay competitive. ( I’m looking at you IBM how are you still here)

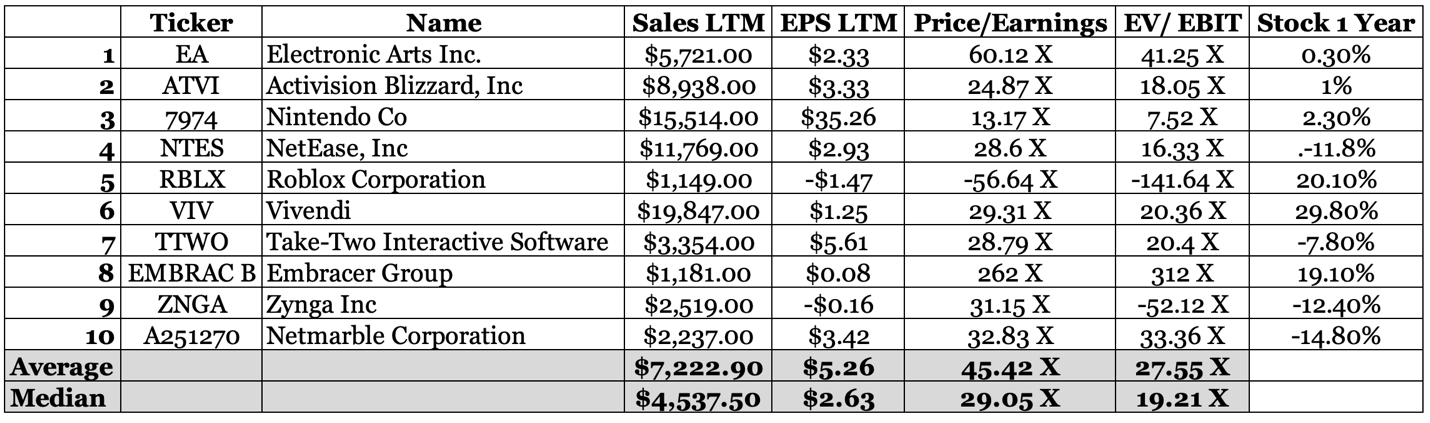

Just as a reference the list below are all the companies from the previous article that we identified as publishers.

On average this group is largely contributing almost $7 billion in sales in the last 12 months, but the companies do trade at a high price to earnings multiples and enterprise value to EBIT multiples as well. Pound for pound means you are using more of your investable dollars to purchase one dollar for each of these companies’ earnings. But don’t let the price to earnings be your guiding grace in valuation but we need to look at what the business is doing and how it is gaining exposure into the Esports market.

The easiest to do this analysis would probably be Electronic Arts (EA. NASDAQ) and because of my lazy nature, this is the one I’m going to analyze from the perspective of an individual who wants to gain exposure to Esports through a publisher.

EA Sports It’s In The Game

If you are reading this, I don’t really need to go deep into the history of who EA is as a business. you’re probably fully aware of what they do and who they are, and at the same time, we hate them for constantly releasing the same game repeatedly. Man, I am getting tired of playing the same FIFA game repeatedly. Having said that I can’t wait to buy the FIFA 23 use Lionel Messi at PSG. I digress!

EA is an American video game company headquartered in Redwood City, California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization. The firm was founded and incorporated on May 27, 1982, by an Apple (AAPL) employee Trip Hawkins. The company was a pioneer of the early home computer game industry and promoted the designers and programmers responsible for its games as “software artists.” Since then, they have developed and published games of established franchises like

- The aforenoted FIFA games

- Battlefield

- Need for Speed

- The Sims

- Medal of Honor

- Command & Conquer

What a collection!

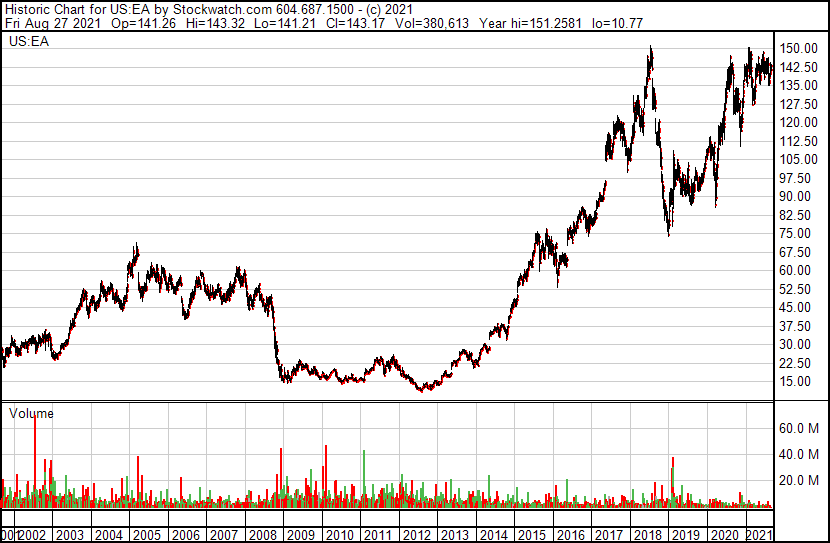

It goes without saying that this collection of brands has generated billions of dollars for them over time and made their shareholders extremely wealthy.

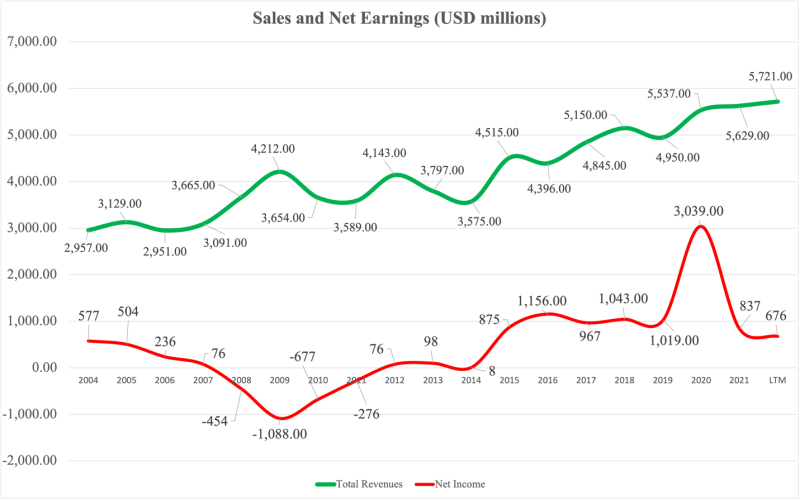

Not only are shareholders feeling wealthy the business has also generated massive sales over time.

But it’s obvious from the chart that its ability to generate great franchises has reflected well on their ability to generate sales, but earnings are a totally different situation. For them to stay competitive the business must spend almost a billion dollars a year just on the team of people they use for https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative purposes at the HQ.

On top of those billion dollars, they also need another billion dollars just to fund the research and development, which you can think of as the capital expenditures before paying taxes to maintain their current economic model and expanded it. These two large bills are fundamental to the growth of the business in the future. Although they might fluctuate the firm has to continuously reinvest in new projects as the industry’s growth consolidates as new players (Activision Blizzard, Roblox) come into the market.

This is where an expansion into the esports market is detrimental to their longevity as a competitive firm.

Some of their other brands are more predictable like FIFA is obviously very compatible with the E-sports sector, but the firm has also developed other franchises outside of the sports ones to facilitate for gamers under competitive skill. One such example is The Sims franchise. the firm has launched The Sims™ Spark’d competition we please create characters and pretend to be gods for a few seconds in a virtual reality TV show.

Like everyone else in the industry, EA has been forced to pivot to digital events because of the coronavirus which accelerated the trajectory of the esports sector.

While esports companies have had to withdraw from traditional esports, EA and others have shifted their efforts to online-only events in the near term. With the likes of pro baseball and basketball canceled, esports had a chance to gain some more attention as sports fans search for new ways to get their sports fixes.

A few years back the company CEO also discussed cloud-based gaming and other avenues to gain exposure to the market and for those who are really interested in this, I’ll attach the video below.

When it’s all said and done it’s obvious that these large behemoths of the publishing industry are starting to get their feet wet in the E-sports market. In my mind, over time these firms have the chance to utilize their scale this might create a mobility barrier for a lot of these smaller E-sports firms. Not only are these companies the publishes of the games they will also have some of the distribution rights and royalties for the new market as well, but that’s just my opinion.

So, what does this all mean for me who has $15,000 burning a hole in my pocket? As usual, to answer this I’m always going to go straight to the numbers, I’m sorry.

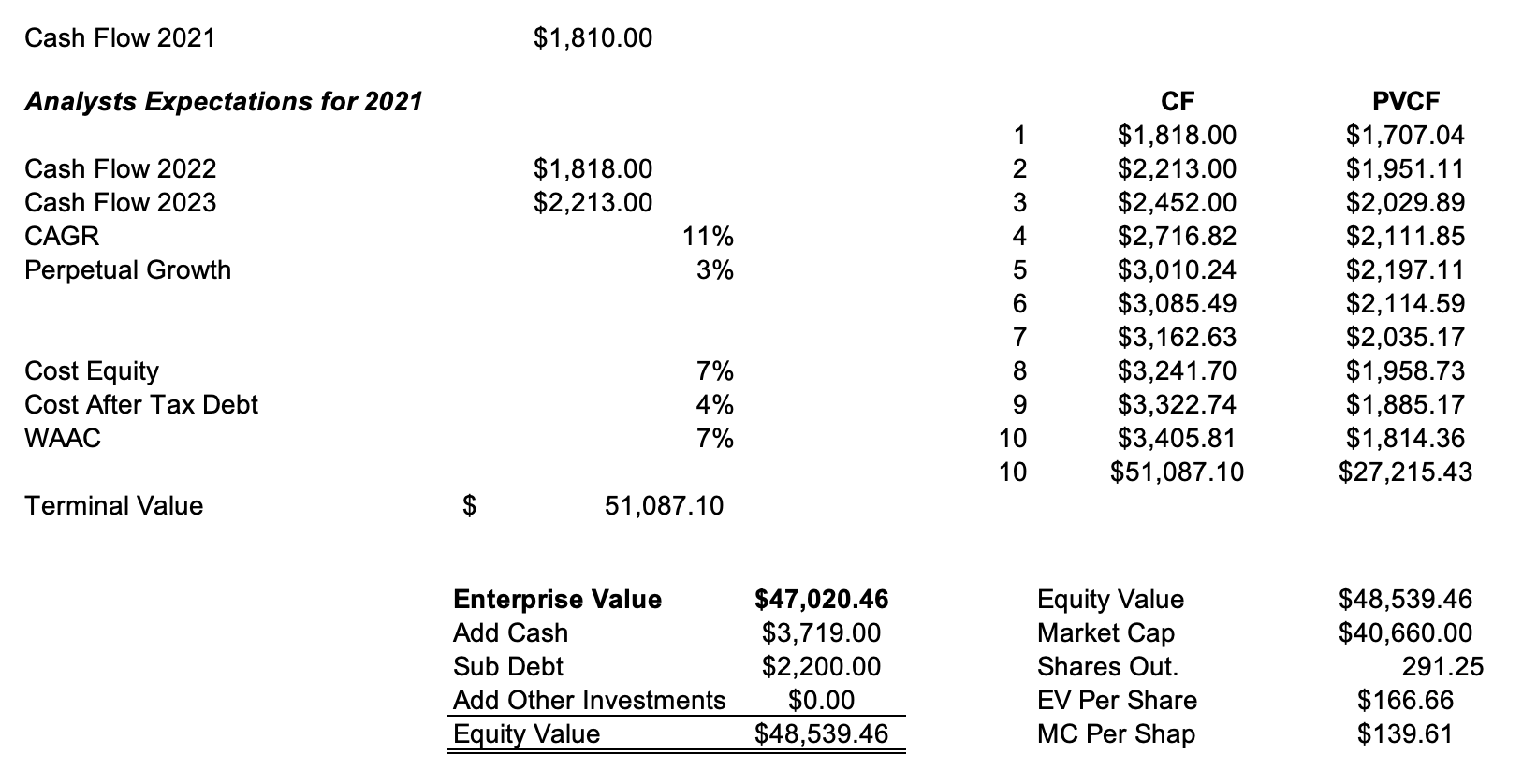

- The free cash that EA generated in 2021 was $1.8 billion. This free cash is money that can potentially be used to pay down debt, repurchase shares, pay dividends and make strategic investments without interrupting the operations of the business

- The analysts expect the cash flows to grow at 10.8% in the first stage and then to grow perpetually at 2.5% after that

- They use an average discount rate of 7% to bring back the cash flows to today’s present values

- Once we add up these cash flows, we get an enterprise value that we need to subtract net debt and add other invests and get an equity value of $48.5 million compared to their current price of $40.7 million

There seems to be reason from this short analysis to say that the stock is either fully priced or mildly undervalued. Of course, more research needs to be done to make sure the analysts’ numbers are correct. But this might be an old dog that is trying to learn new tricks.

What do you think?

Next week we will cover the individual companies directly exposed to the Esports market and see if they pose great profit-making potential.