First, on behalf of Equity.Guru:

Legalization day was a fire sale.

Some provinces sold more than others. Alberta made $730,000 worth of sales on their first day. Nunavut’s sales numbers on day 1 were $660,000, which is impressive, considering they make up just a quarter of the Alberta population.

That, however, is just the Canadian sector. News is picking up in the states fast. People are missing out on it because Canada’s volatility is, at this point, simply a made-for-media distraction that everyone loves to watch.

US based weed companies are liquefying their assets as fast as they can, racing to build the biggest war chest. The name of the game right now is capital, and a war is being fought over acquisitions and retail/dispensary locations in the US.

Smaller companies are either excited to be bought out or terrified, but either way, there’s a target on their heads.

With this in mind, we’re watching C21 Investments (CXXI.C) closely while all of this plays out. C21 is of the sharpest and most business-minded cannabis companies we know of, and they have an impressive list of achievements they’ve collected this year, reported by Equity Guru’s Lukas Kane.

There’s a reason they’re well positioned. However, they’re not the only ones playing the game. If this is in fact an arms race, they weren’t even the ones who started it.

Over these last two weeks, US cannabis companies panicked after witnessing two back to back $650M+ acquisitions by their competitors, and a play by Tilray to liquefy mass amounts of capital.

In the largest cannabis company acquisition in US history, MedMen (MMEN.C) acquired PharmaCann for US$682M, just a couple of weeks after acquiring Seven Oaks (Chicago) and several other smaller dispensaries in San Jose, Scottsdale, and San Francisco.

MedMen is raising capital as fast as they can, as well, taking out 2 separate loans, for US$86.5M and $99.5M respectively.

IAnthus (IAN.C) similarly acquired MPX for approximately US$640M, and is also raising capital. With similar acquisitions, capital goals, and target markets (US dispensaries), it’s safe to say that iAnthus and MedMen are two companies both fighting over the same slice of pie, and are currently neck and neck.

Tilray (TLRY.Q) raised $450M in capital essentially overnight through a convertible-note offering. $450M is a scary number for your average Mom and Pot shop, but what’s really terrifying these smaller companies is that that is just 5 percent of the company’s valuation as shown by their market cap.

Led by iAnthus, MedMen and Tilray, the rest of the cannabis world has already begun building up their war chests, just in case.

Think about it this way. You never want to be the kid in the snowball fight who didn’t build the reserve snowballs, right? You never want to spend early game in League of Legends doing ANYTHING other than farming, either.

When little guys see big guys building snowballs, they don’t attack. Why would they? They just start building snowballs as fast as they can and hope it’s enough to save their sorry asses.

Our big 3 have started a bit of a baby-kissing frenzy, with everyone trying to suck up and stock up on cash.

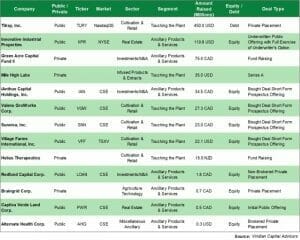

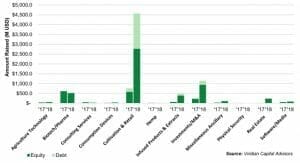

Here’s a look at capital that was raised in the cannabis world JUST LAST WEEK

(Oct 12. – Oct. 18):

Like I said. War chests.

Legalization-Week was no different. The Green Organic Dutchman (TGOD.T) successfully raised $76M through bought deal financing, Supreme-Cannabis (FIRE.C) closed a $100M bought deal financing. Even Aurora Cannabis (ACB.T) sold 5 million of The Green Organic Dutchman shares they own, netting themselves an extra $32.86M.

This is definitely a race to the dispensary line. Seeing this play out in dollar amounts raised by sector is interesting, as well. There’s a clear winner. Can you see it?

Retail. Technically “Retail and Cultivation,” but, they need to hurry up and separate those categories because they’re two completely different worlds, for now and probably forever.

If you listen, you can hear the market is sending a clear signal. However, it’s not easy to hear, because the fireworks are still playing over English Bay, and we’re all still abuzz about “Cannada” when market value has already started moving elsewhere.

US dispensaries are the next big wave in the cannabis industry; and the race to own them has already begun.

Whoever has the best acquisition strategy is ultimately going to win, and we want to be on that side’s team when they do. For myself, I don’t care about gross revenue, (although my current favorite, C21, has a trailing twelve month revenue of $37.5M that puts them near the top of the US sales figures.)

What I really care about is percentage increases over time. I care about stock price.

Which is where C21 is going to shine. They’ve been doing everything that I’ve listed above, at an exponentially better price point, actually looking for good deals because they only have so much capital to work with. Like Equity Guru’s Chris Parry wrote about extensively,

“They (C21) have plans to go wherever others haven’t yet taken over, and small states that they can lock up without too much competition, that’s a nice move for the future.”

– Chris Parry, Equity Guru.

These guys are playing the long game.

It can be pretty boring playing the long game sometimes, but it pays off.

They’re acquiring companies at an excellent rate, with 3 closed for under US$30M these past 4 months. And the acquisitions that they’re making are smart.

One of their best acquisitions is a company that’s primarily focused on edibles and CBD, which legalization day proved is in higher demand than anybody realizes. Another, Phantom Farms, won the 2018 “Best CBD Flower” Dope Cup award in 2016 and 2018, and this might be an even bigger win because like we said, CBD is king in this market.

They’ve made $75M worth of pending and closed acquisitions in the US cannabis market, and the fact that their market cap is only set at $55M in spite of that shows just how out of touch the market currently is.

Full Disclosure: C21 Investments, iAnthus, Supreme Cannabis and The Green Organic Dutchman are Equity Guru marketing clients.