On October 28-29, 2018 Equity Guru’s CEO Daria Grave will be in San Francisco.

We’d like you to join us.

Not because “fog is better than rain.”

Not to take the “Haight-Ashbury Flower Power Walking Tour”.

Not to visit Alcatraz.

But because Equity Guru will be attending the 2018 Silver and Gold Summit – a wealth-generating opportunity to engage with “precious metals trends, geopolitical risk and investment opportunities within the natural resource economy.”

Typically, conference attendees have over $100,000 invested in junior mining stocks, 20% of those with over $500k invested.

At the summit, there is mind-boggling line-up of speakers including:

Rick Rule – CEO of Sprott US Holdings, involved with equity and debt instruments, across the entire spectrum of the natural resource industry.

Rob McEwen – Chief Owner of McEwen Mining and former CEO of GoldCorp – stewarded a $50 million – $8 billion market cap growth.

And…Timothy Sykes – author of An American Hedge Fund – who turned $12,415 in bar mitzvah gift money into $100,000 – while still in high-school.

Being a gold-bug in October, 2018 – brings back a memory.

One muggy summer, years ago, all my friends fell in love with Radiohead’s ethereal song, Paranoid Android. (“Ambition makes you look pretty ugly/kicking squealing Gucci little piggy”).

I had a dirty secret.

I was in love with ZZ Top’s Pearl Necklace (“She was gettin’ bombed/I was gettin’ blown away).

In 2018, believing in precious metals carries the same vapour of un-hipness, dumbness, shame.

Of course, we gold-bugs have data to bolster our beliefs.

The Fitch Ratings Report on Trump’s Tax Cuts and Jobs Act, projects an additional $1.5 trillion added to the federal deficit over a decade.

Surely all those duffle bags of $100 bills fluttering like confetti from helicopters will devalue fiat currency and cause a stampede to gold equities!

Every US tax payer now owes about $140,000. Something’s gotta give. Do you have the balls to make a contrarian bet?

The Price-to-Earnings ratio of the S&P 500 is double historical levels – and headed exactly where it always goes before a stock market crash.

Despite this background of gloom, gold bugs are confronted with a daily onslaught of bullish macro-economic data!

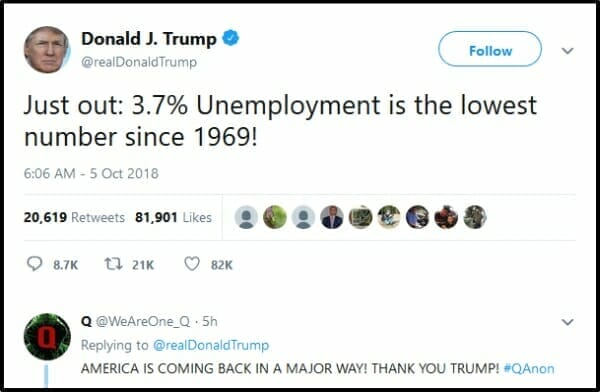

According to an October 5, 2018 CNBC article, “The U.S. unemployment rate fell two-tenths of a percentage point to 3.7 percent, the lowest level since December 1969 and one-tenth of a percentage point below expectations.

The key question is: are we burning the furniture?

Is winter coming?

When winter comes – will gold to the moon?

“Gold has been oscillating between two converging trend-lines over the past three-weeks, forming a symmetrical triangle on 4-hourly chart,” opined one analyst on October 5, 2018.

“The commodity’s inability to register any meaningful recovery from multi-month lows and acceptance below the very important 200-day SMA qualifies the contracting wedge as a bearish continuation pattern.

The negative bias would only be confirmed after a decisive break below the pattern support, currently near the $1293 region, albeit a move beyond 200-day SMA would invalidate the bearish outlook.”

The exhibitors at the San Francisco summit are worth billions.

They include Aben Resources (ABN.V) that has three gold projects located in The Yukon, Saskatchewan and BC’s “Golden Triangle”, and Blue Sky Uranium (BSK.V) developing the newly delineated Amarillo Grande Project in Argentina; hint: they have vanadium too.

“Gathering the top thought leaders, CEO’s, investment professionals and retail investors from around the world, the 2018 Silver and Gold Summit provides an unmatched opportunity for investors to get a behind the scenes.”

Get off the sidelines and stay informed – speak to the experts, meet with the companies, make valuable decisions. Take control of your wealth.

Equity Guru has Codes for discounted registration, and the summit provides discounted hotel accommodation.

Come join Daria in San Francisco.

Put ribbons in your hair.

The time is now.

Full Disclosure: Equity Guru is exhibiting at the Gold and Silver Summit, ABN and BSK are marketing clients, and we own stock in both companies.