There’s a buzz in the air. It’s coming from the gold exploration arena. All of a sudden too. The market may finally be waking up to the possibility that we have reached the peak of discovery… the possibility that ALL of the juiciest gold deposits on our planet – those boasting both grade and scale – have already been found. The idea is as unsettling as it is intriguing. Though it’s only a theory, it’s one shared by a number of people whose insights into the subject hold a great deal of validity.

‘We’re right at peak gold’: All major deposits have been discovered, declares Goldcorp chairman

So what does this mean to the average investor? I’ll tell you what it means: if you’re fortunate enough to have staked an early position in a junior gold exploration company that just happens to make a significant new discovery… it’s akin to hitting the lottery.

There’s always a chance.

I’ll tell you what else it means: those wanting a piece of the action AFTER a significant new discovery is made… well, they’re going to have to step up and pay up… pay up dearly, depending on the scale of the deposit, the grade, jurisdiction, etc.

Right now, it’s BC’s Golden Triangle that has been generating most of the noise – price and volume action has been off the charts. There has also been a potentially significant new discovery made in the Red Lake camp of Ontario, as well as on the East Coast of Canada.

Undiscovered discovery potential…

There’s one mining friendly corner of the planet that isn’t currently on investors radar. It should be…

Though previous discoveries have been made in the region, with gold resources already defined, this area is ripe for new finds.

The Tapajós region of northern Brazil…

The Tapajos district is the largest placer province in Brazil and the 3rd largest in the world. This was also the scene of THE largest gold rush on the planet between the mid-1970’s and the mid-1990’s.

The district is estimated to have produced somewhere between 20 and 30 million ounces of gold (that’s somewhere between 600 and 900 metric tonnes of the shiny stuff).

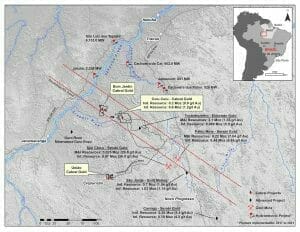

Those in the loop know that Cabral Gold (CBR.V) holds a substantial and strategic land position in the Tapajos district. The company’s Cuiu Cuiu project – the largest of the historical alluvial gold camps in the Tapajós region having surrendered an estimated 2 million ounces of gold – has been the subject of much discussion and speculation here at Equity Guru. And for good reason.

A fairly comprehensive review of Cabral’s Cuiu Cuiu project and future prospects can be found here…

And also here…

Cabral Gold (CBR.V): MORE high-grade gold in a prolific placer belt

If I had to summarize Cuiu Cuiu’s gold potential in one word, I’d have to say… ubiquitous.

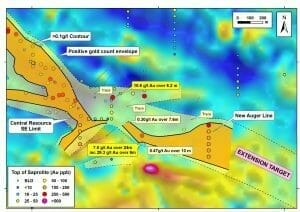

It seems every press release brings fresh news of a new mineralized zone. The map below gives you a sense of the serious tonnage potential at Cuiu Cuiu (don’t forget Cabral is already sitting on a 1 million ounce gold resource in the indicated and inferred category).

The August 27th news…

Cabral Identifies Strong Gold-in-Saprolite Anomaly SE of Central Deposit at Cuiú Cuiú Project, Brazil

The company has been busy scouring the surface at Cuiu Cuiu with a program which includes rock chip and channel sampling, as well as shallow auger drilling.

Curiously, the company coexists with a small group of artisanal workers who continue mining the areas palaeo-valley placer deposits. There is harmony in this arrangement. There’s utility too.

The information the company receives from these miners, particularly where high-grade saprolite mineralization is concerned, is furthering Cabral’s understanding of the underlying geological controls at Cuiu Cuiu. It’s a great working relationship the company has struck with these locals, one built out of a spirit of fairness.

Highlights from this recent news…

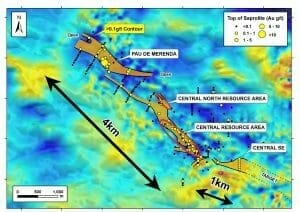

- Auger drilling to the southeast of the Central deposit which contains 485,000oz (Indicated resources of 5.9MMt @ 0.9 g/t Au + Inferred resources of 8.7MMt @ 1.1 g/t Au) has identified a broad gold-in-saprolite anomaly of +100ppb Au, extending 250m across strike in a north-south direction.

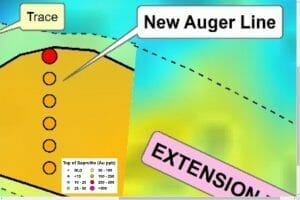

- The anomaly is located 1km SE of the Central deposit and 550m ESE of drill hole CC138-11 which intersected 6.9 g/t Au over 27m. It is well outside the current resource at Central and is open in all directions.

- The auger line is located east of the limit of previous exploratory drilling and extends the Pau de Merenda – Central mineralized corridor by at least 1km. The position represents a priority target to test for extensions to the Central deposit.

The takeaway from this release is that Cuiu Cuiu’s mineralized footprint continues to expand.

This new zone – Central SE – is located on the bottom right of the above map. According to the release, 4 historical diamond drill holes tested the potential mineralized extension of this corridor, the best result was a chunky 6.9 g/t gold over 27 meters in drill hole CC138-11.

The anomaly is open to the north and south and to the east and west and represents a strong target for stockwork-style mineralization associated with the Central trend. Additional auger sampling is planned to define the extent of this anomaly.

The auger drill holes which helped defined this new zone returned positive gold counts – from > 100 ppb (parts per billion) to a maximum of 324 ppb. Note the new auger line on the enhanced map below (thanks for the view Peter Bell)…

This is exactly the kind of progress an investor wants to see in a junior gold exploration company. As the mineralized footprint expands, so does the ultimate tonnage potential for building a significant gold resource.

It’s important to note that the company is currently using an auger drill, which is perfect for testing shallow mineralization in the weathered bedrock. This will lead up to the launch of a full-scale drilling campaign, one scheduled for later in the year. The shallow auger drilling is helping the company fine-tune and prioritize deeper drill targets.

Commenting on the importance of this new discovery, Alan Carter, President & CEO stated:

These auger results from Central SE are some of the highest values we have seen in the 319 auger drill holes completed thus far at Cuiú Cuiú. We believe they are highly significant and suggest that the Central deposit, which contains 485,000oz (Indicated resources of 5.9MMt @ 0.9 g/t Au + Inferred resources of 8.7MMt @ 1.1 g/t Au) may extend to the south-east. Further lines of auger drill holes will test for extensions to the trend, particularly in the undrilled 3km corridor converging towards the MG resource. The current exploration program continues to identify compelling step-out targets in our key resource corridors, and we are confident the program will continue to lead us to additional source areas for the extensive alluvial workings extending through the project area.

Final Thoughts…

The market may not fully appreciate Cabral’s meticulous approach to exploration, judging by the share price action of late. But we’re fast approaching a point in time when Cabral will be announcing the mobilization of drill rigs to the Cuiu Cuiu project.

My guess is that all of this painstaking groundwork will pay off handsomely in the long run. CEO Carter and team are dialing into Cuiu Cuiu’s untapped potential.

With 31.4 million shares outstanding and a current share price of $0.20, Cabral sports a very modest market-cap of $6.3M.

This one is currently biding its time in the deep discount bin. I suspect that situation won’t persist much longer.

END

~ ~ Dirk Diggler

FULL DISCLOSURE: Cabral is an Equity Guru client. We own the stock.

Feature image courtesy of the Financial Post