We first wrote about NNO (NNO.V) on March 8, 2016, when the stock was trading at .31.

Since then we’ve written about 29 more articles, including: locking down IP, partnering, CEO podcasts, collaborators, wealth creation, innovation, Chinese delegation, technology moats etc.

NNO is now trading at $1.76 – a 460% gain since we wrote the first article.

According to Investopedia, The Valley of Death “refers to the period of time from when a start-up firm receives an initial capital – to when it begins generating revenues.”

We’ve been tracking NNO as it has walked through this treacherous valley – famous for dissolving dreams (and money) in acid.

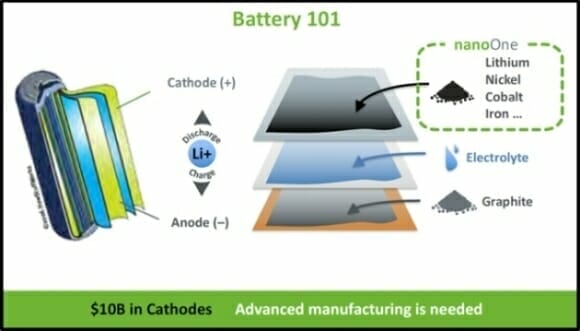

NNO has developed proprietary technology to build a better and cheaper battery. NNO’s scaled process can make cathode materials using the cheaper lithium carbonate in place of the more expensive lithium hydroxide.

It’s like having a patent for tastier, cheaper, easier-to-cook flour – and then receiving a royalty from every loaf of bread baked with that flour.

It could be a game changer.

We are not the only people who think so.

The Chairman of the Board is Paul Matysek – responsible for an astonishing $2 billion in corporate enterprise growth. Matysek owns a bit of NNO stock.

The Canadian government also cut NNO a cheque for $4.6 million.

On June 15, 2018, we toured the Nano One facility – firing questions at CEO Dan Blondal which he gamely answered.

These short videos will get you inside the belly of this battery-tech beast.

Editor’s note: NNO is operating a working pilot factory – so the audio is occasionally compromised by whirring machinery.

Q: Who paid for the pilot plant?

Q: What happens inside the reactors?

Q: How wide is the application of your battery technology?

Q: What is “vertically integrated patent protection”?

Q: How do you test your product for real-world conditions?

Q: What conversations are you having with battery manufacturers?

Q: What is the Blue-Sky story for Nano One?

After a 460% stock price run – we typically advise our readers to take some money off the table.

That’s not happening with Nano One.

Why?

Because we think NNO is emerging out of the valley, into the sunshine.

Investing in Monster Beverage (MNST.NASDAQ), Tesla (TSLA.NASDAQ) or Lululemon (LULU.NASDAQ) as this pre-commercialisation stage would have produced returns-to-date of 900%, 2100% and 3200% respectively.

Full Disclosure: Nano One in an Equity Guru Marketing client. We also own stock.

NNO has been dropping over the last months. Do you think it’s a good time to buy in the market? Why has been going down consistently?

Dan, it’s your money, I like to sleep well at night, so I’m not going to advise you what to buy – or when. Enthusiasm is difficult to fake. You can probably tell from the article, and the videos, that I believe in this company. An up-down stock-price wave motion is typical for small cap companies. Often it has to do with levels of investor patience. NNO is not a brand new company. My impression is that investors want commercialization NOW. But NNO isn’t selling hydraulic pogo-sticks. They are dependent on the innovation cycles of battery makers. They’ve got six customers testing the product, and expect to have 12 more by the end of 2018. Thanks for reading/watching.

How does NNO stack up in terms of future growth compared to companies like Monster, Tesla, and Lulu?

Martin, thx for reading. NNO stock price has gone up a lot in the last 2 years. So it’s legitimate to ask: “Is that it?” “Have I squeezed all the juice out of this orange?” The reference to Monster, Tesla, and Lulu – is intended to underline the fact that post-proof-of-concept, pre-commercialisation can be a good investment entry point. Of course, this all depends on NNO’s technology gaining traction in the battery industry. I hope the videos with the CEO will help you to make an informed assessment of their prospects.

Cool videos Lukas. Nice to get a ground floor view of this one.

Thank you Greg.