The French philosopher and writer, Voltaire (1694-1778) once wrote a satirical verse, insinuating the esteemed Régent Philippe II had impregnated his own daughter.

Although local scholars agreed the verse was structurally innovative, Voltaire was sentenced to 11 months imprisonment in the Bastille – a federal incarceration facility not known for its enlightened rehabilitation programs.

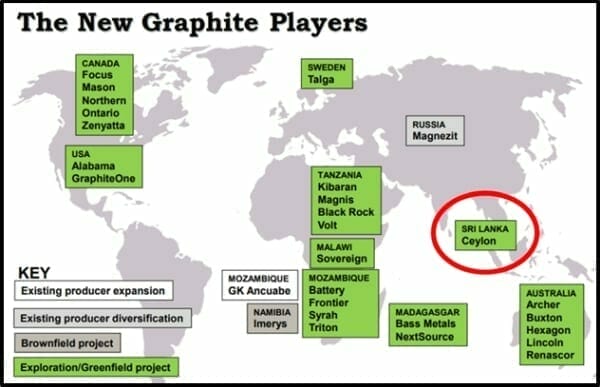

Ceylon Graphite (CYL.V) owns most of the known graphite deposits in Sri Lanka – a country which – 100 years ago – met 40% of the world’s demand.

Like Voltaire, CYL is flamboyantly original.

And like Voltaire, the company is being punished for it – or at least – insufficiently rewarded.

The stock has been drifting sideways for the last 9 months.

What’s so “original” about Ceylon Graphite?

Let’s start with mine costs.

Typically, the upfront capital costs of building a mine will run anywhere from $50 million to $1 billion.

Ceylon’s mine capex? About a $1 million.

The reason for this lies the history and the geology of Sri Lanka. Last century, there were more than 200 small mines in Sri Lanka and the country exported 33,000 metric tons of graphite a year.

The Sri Lankan miners dug with crude hand-held tools. When they hit rock – they shrugged their shoulders and walked away (this was pre-dynamite).

Ceylon’s land package contains hundreds of these abandoned shafts, with high-grade graphite clearly visible – caked into the walls of the old mines.

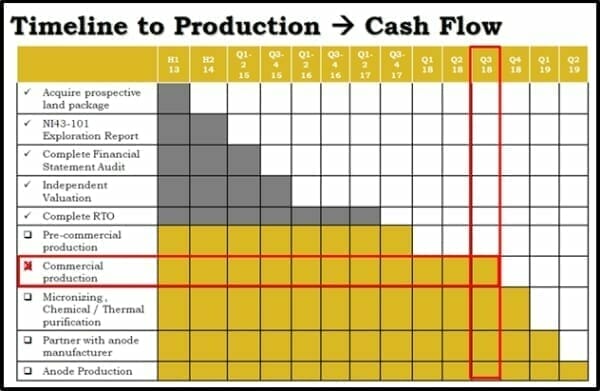

On April 12, 2018 CYL announced the discovery of two new large graphite veins at a depth of over 200 ft at their K1 site.

Samples were taken from the veins and sent to the Geological Survey and Mining Bureau of the Government of Sri Lanka for carbon testing. Laboratory tests indicate a Cg level of 89.2 %.

Ceylon Graphite now has discovered four sizeable veins within the last 15 days,” stated the press release, “The Company anticipates that there are additional similar sized or larger veins at lower depths.

“The next steps include the purchase of an underground drilling machine,” stated Bharat Parashar, Ceylon CEO, “then drilling along the veins to ascertain the quantum of resource available; and completing the mining license application process.”

“With the discovery of four reasonably large sized veins, we are now close to being a near-term graphite producer of some of the world’s purest naturally occurring graphite.”

The micro-mines that Parashar is envisioning aren’t going to be kicking out huge volumes of ore. It’s a volume game. The end goal is to have a lot of small, efficient underground graphite mines.

Parashar estimates his cash costs at $200/tonne; large flake graphite sells between $1,250 and $5,000 per tonne.

The key point for investors is that Ceylon’s graphite is high grade, close to the surface, and the permitting process is simple and truncated.

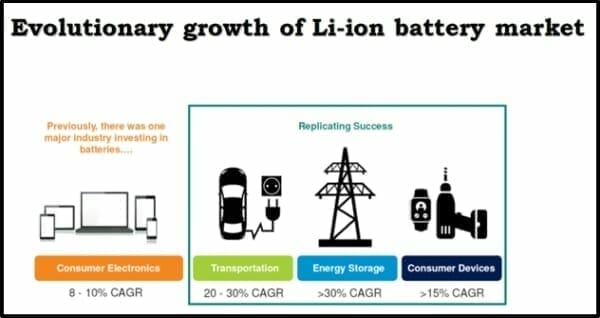

To review: Sri Lanka has something both the US and China needs: premium grade large-flake graphite – required for electric vehicles.

China’s massive “One Belt, One Road” initiative was much talked about at the recent Hong Kong Mines and Money conference.

It is the largest mega-project in history, covering more than 68 countries that contain 65% of the world’s population and drive 40% of the global GDP.

The Belt and Road initiative opens up 7 corridors.

- New Eurasian Land Bridge – Western China to Western Russia

- China–Mongolia–Russia Corridor -Northern China to Eastern Russia

- China–Central Asia – Western China to Turkey

- China–Indochina Peninsula – Southern China to Singapore

- China-Bangladesh–India Corridor – Southern China to Myanmar

- China–Pakistan Corridor – South-Western China to Pakistan

- Maritime Silk Road – Chinese Coast to Mediterranean

“Sri Lanka has recently signed a $1.1 billion deal with China to develop the southern deep-sea port of Hambantota – playing a key role in the “One Belt, One Road” initiative.

We are comfortable sticking out our necks, declaring CYL to be smart and original.

But it never hurts to have company.

There were hundreds of resource companies at the Asia Mines and Money Conference. Six of them were short-listed for the Asia Pacific Mining Exploration Company of the Year.

Guess who won?

That’s right: our little $9.8 million market-cap buddy Ceylon Graphite.

A recent report by Allied Market Research predicts that the global graphite market will increase 44% in the next 7 years from $13 billion to $18.8 billion.

After his release from prison, Voltaire issued the following statement:

“Originality is nothing but judicious imitation.”

Maybe so, although it’s not clear to us who Parashar is imitating.

Sri Lankan Graphite has a purity similar to ultra-expensive Synthetic Graphite ($20,000/tonne).

Building a little galaxy of high-grade, low-capex mines is a truly original concept.

Full Disclosure: Ceylon Graphite is an Equity Guru client, and we own stock.