In August, 2011 a new fad called “planking” – went viral.

Sometimes called “The Lying Down Game” planking involved posing your body rigidly in comedic situations.

Do you know what else happened in August 2011?

Gold hit an all-time high of $1,917 an ounce. Over the next 7 years, gold got taken behind the woodshed and kicked in the face – over and over again.

Guess what?

Battered and bruised, gold just stumbled out from behind the woodshed.

It’s pissed off, ready to shake out its hair and kick some ass.

The orgy of global money printing (The U.S Fed has printed more than $2 trillion since the global economic crisis began in 2008) – plus inflation – make gold’s come-back a foregone conclusion.

Timing the come-back precisely is impossible.

Anyone who says they can time it is stupid or lying.

We think it’s coming “sooner rather than later”. Yes – there’s some vagueness baked in there (we’re geniuses – not clairvoyants).

This much we know: the spot gold price of gold is still depressed ($1,330 USD/ounce) making this an opportune time to load up on junior gold stocks.

When bullion explodes to the upside – the junior explorers (with good projects) will go up in multiples.

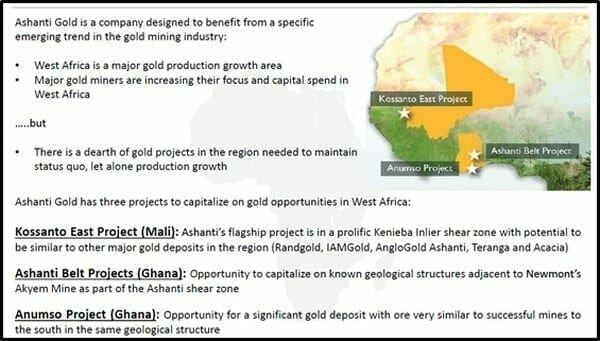

Ashanti Gold (AGZ.V) is a West African-focused gold development company, run by the CEO Tim McCutcheon, a former investment banker with a track record of finding inefficiencies in financial systems – and exploiting them for profit.

On April 23, 2018 Ashanti announced it has raised $2,643,210 by issuing 17,621,397 $0.15 units consisting of one common share and a half warrant at $0.26. The warrants expire on April 20, 2020.

According to the press release, “Net proceeds of the private placement will be used to fund the exploration costs related to the Kossanto East property in Mali, work on the Anumso property in Ghana.”

Mr. McCutcheon is an investment banker who toiled in institutions such as Bear Stearns, Aton Capital and Pioneer Investments.

Before switching teams (from banker to explorer) he wrote analyst coverage of gold companies in Eurasia, including Bema Gold, High River Gold, Centerra, Polyus, and Polymetal.

Successful merchant bankers get up early and get shit done. McCutcheon and his team have done that. 2017 was the first full year of operation. The accomplishments look like this:

Corporate activity:

- Raised $4.2M in equity

- Option agreement with Kinross in Ghana

- Formation of Elite Advisory Board

In Mali:

- Constructed on-site camp for crew and staff

- Drilled 6000m at the Kossanto East project

- Confirmed past results, highlight results include: 47m @3.29 g/t (including 12m @8.89 g/t), 41m @2.22 g/t, 25m @1.53 g/t (including 12m @2.73 g/t), 25m @1.13 g/t (including 5m @2.34 g/t), 13m @2.34 g/t (including 8m @3.24 g/t), 33m @1.00 g/t, 60m @1.05 g/t, 17m @2.74 g/t (including 1m @30.13 g/t)

- Acquired 100% of project

In Ghana:

- Drilled 2000m at the Anumso project

- Confirmed past results, highlight results include: 8m @ 1.46 g/t, 6m @2.11 g/t, 9m @1.60 g/t, 4m @1.73 g/t, 3m @4.95 g/t

- Soil sample program identified new targets

- Metallurgical test work: over 90% gold recovery, first 70% gold recovery from gravitation, remaining via cyanide process

Gold CEOs usually talk about Africa the way skiers talk about Switzerland. High mountains! Clean air! Powdery snow! McCutcheon has a more analytical take. As a guy who used to write cheques to gold explorers – he asked himself: “What are the de-risking factors for gold projects?”

McCutcheon does a pretty good job of explaining his acquisition methodology in this video:

Kossanto East Project Update: (Mali): on February 13, 2018 Ashanti announced results of its on-going exploration program at Kossanto East, Mali.

Anumso Project Update (Ghana): on January 18, 2018 Ashanti announced results from its recent soil sampling program on the Anumso project, Ghana.

Ashanti Belt Project Update (Ghana): AGZ has the right to earn 100% of Red Back’s interest in the Project by spending a million bucks on exploration over two years.

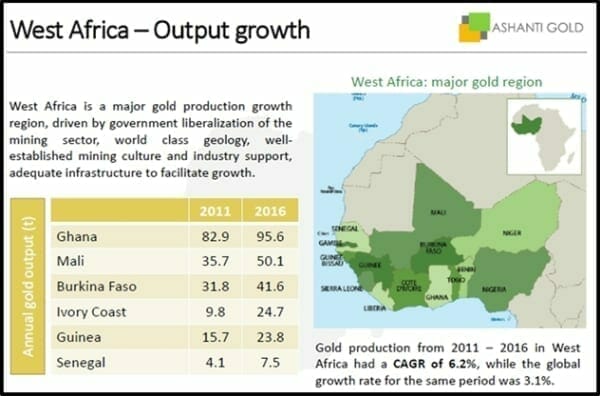

Western Africa has overtaken Southern Africa as the continent’s gold-mining epi-center. New gold projects are coming on stream in Burkina Faso, Ghana, Mali and Sierra Leone.

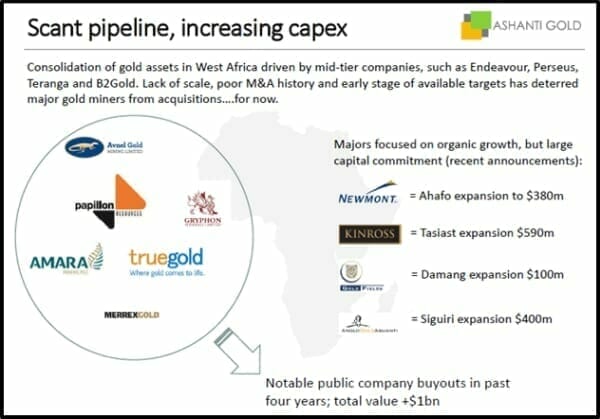

McCutcheon put together a team that had been Kinross’s JV exploration partner in Ghana. They had a significant database of experience. “We identified an opportunity to cherry pick the best assets out of the Kinross portfolio”, stated McCutcheon.

While traditional gold explorers are singularly focused on the minerals, McCutcheon also sees the financial macro-picture – specifically – where the project acquisition money has bottle-necked.

Yesterday, the yield on the 10-year Treasury notes rose to 3%, for the first time since 2014. That means house mortgages just got more expensive. For corporations, it increases the cost of doing business.

The market reacted swiftly.

The Dow lost 1.74% – closing at 24,024.

Higher yields on Treasury notes is a push-pull event for gold. Attractive interest rates will lure investors into fixed income investment. But higher yields also predict inflation. Your 3% yield is not looking so good with inflation running at 2.4%. Historically, high inflation causes a run on gold.

Gold futures gained about $9 yesterday, with the June 2018 contract at $1,330.

There is an old saying in this business: “You get punished more for being wrong than you get rewarded for being right.” In other words, 9 times out of 10 – an eloquent waffle is a better bet than a bold proclamation.

Ashanti is trading at .17 with a market cap of $6.7 million.

Forget the waffle. Gold is going up. By the time it rises 10% – Ashanti’s stock price will be a 100% higher than it is now.

Full Disclosure: Ashanti Gold is an Equity Guru marketing client, and we own stock.