GTEC Holdings (GTEC.V) completed its transaction with Fire and Flower Holdings (FAF.T), selling them some of their Cannabis Cowboy (CCI) dispensaries in exchange for cash, so they can pay their debts.

GTEC’s been underwater on debt for awhile, and this down market isn’t making it any easier, but they’re far from out. But rather than dilute their shares (and alienate their shareholders) they’ve decided to sell off assets, and this has brought them enough cash to make them solid for 2020. Or at least move onto handle other problems.

“This transaction exemplifies our dedication to strengthening our balance sheet with a disciplined and non-dilutive approach, while realizing profits from non-core assets. This strategy demonstrates management’s commitment to be aligned with our shareholders. We are confident that the strengthened balance sheet will accelerate the development of our core cultivation business and accelerate our transition to profitability,” said Norton Singhavon, founder, chairman and chief executive officer of GTEC.

Repaying the loan

You might remember from an earlier story where we wrote about GTEC’s $4 million investment into CCI through shareholder loans, which they used to built 27 recreational stores in Alberta. Well, they needed that money back to handle their outstanding debts, coming due in 2020.

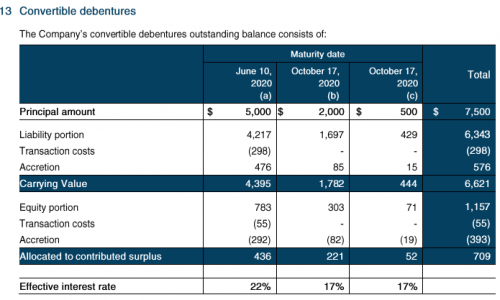

And here are the debts from their MD&A:

The cash also gives GTEC the opportunity to get back to drawing revenues, by helping them finish their two facilities under construction. The company intends to increase their production output from its current 4,000 kilograms to approximately 9,000 kilograms in 2020.

The difference between this and the former deal is that GTEC won’t be keeping its 25% stake in CCI. Instead, GTEC will be divesting all of their remaining interest in CCI in exchange for $1 million, payable with 80% in Fire and Flower shares, and a 20% note to be re-paid in cash. The note will be for two years and bear an 8% interest rate per year, secured against CCI’s BC assets. The divestment should close approximately October 10th, 2019.

The offered cash still won’t be enough to let GTEC reopen talks with Canopy Growth (WEED.T) about buying their facility in Kelowna, B.C. to help them with their own considerable cashflow woes. That’s ultimately the right choice. When you’re trying to cut costs to cover your debts, taking on more costs is obviously counterproductive.

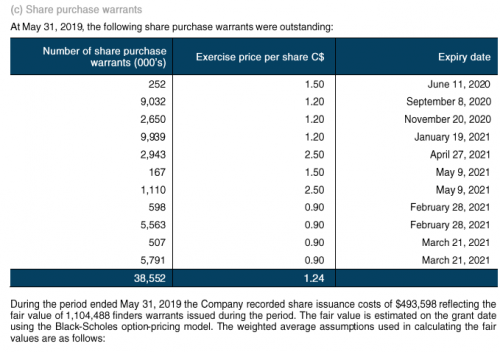

But let’s consider their outstanding warrants for a second because they represent another problem GTEC will need to face.

GTEC’s choice to not further dilute their stock makes sense only when considered in the light that the stock is already extremely diluted, and while the probability of getting the price into the ranges where these warrants could be called in is low, it still doesn’t bode well for the company’s long-term share price if they do.

And finally, their chart:

Their dip from mid-summer displays not only the influence of the cannabis-bubble coming to an abrupt end, but also the fair amount of short-interest being levied against companies in the industry right now.

If there’s an upside to all of this, it’s that GTEC has decided against taking out further debt to raise capital, and instead has shown itself capable of making the hard decisions when it’s a pressing time for a company. It’s unfortunate they had to do that in the first place, but market volatility, and an unstable market can lead to some unforeseen shockwaves.

More than anything, it’s the decisions you make when the markets are down that define you.

—Joseph Morton

Full disclosure: GTEC Holdings is an equity.guru marketing client.