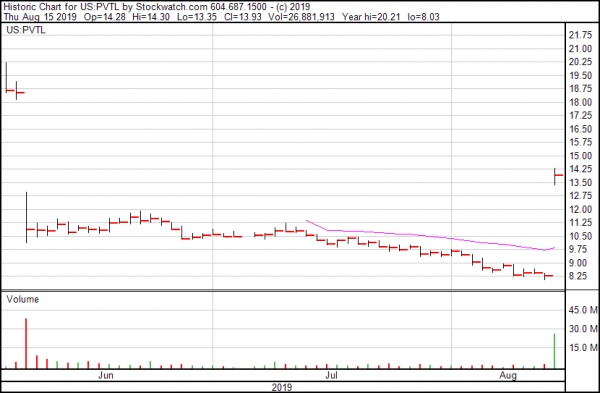

Pivotal Software (PVTL.Q) jumped 68.67% in after-hours trading after VMware (VMW.NYSE) announced their intention to buy all their stock for $15 a share.

The offer comes just in time for Pivotal, which has been reeling from a devastating first quarter due to missed revenue targets, botched sales issues and two class-action lawsuits.

“We are proceeding to negotiate definitive agreements with regards to a transaction in which VMware would acquire all of the outstanding shares of Class A common stock of Pivotal for cash at a per share price equal to $15.00,” according to the press release.

Pivotal Software is a software company that leverages their cloud-native platform and developer tools to serve some of the world’s largest companies. A few big names include Ford (F.NYSE), Boeing (BA.NYSE) and Comcast (CMCSA.NYSE). Pivotal’s main product Cloud Foundry is used by developers to build, deploy and operate cloud-based software and applications.

VMware is a software company specializing in cloud computing and virtualization software and services. They were the first commercially successful company to virtualize the x86 architecture.

Michael Dell and Dell (DELL.NYSE) owned 131.3 million shares of Pivotal Class B stock, not including the 44.2 million shares of Pivotal Class B stock held by VMware, according to the filing.

This comes on the back of Pivotal’s disastrous earnings report last month which saw the stock plunge as much as 45% to a low of $10.89, shredding their market down to around $3 billion. Before then, Pivotal’s worst day since its IPO had been in September, when its shares dropped 20%.

“We had a solid start to the year with 43% subscription growth and customer expansions continued to fuel our strong net expansion rate of 143%. However, sales execution and a complex technology landscape impacted the quarter,” said Pivotal chief executive officer Rob Mee.

What is a complex technology landscape? Investors didn’t know either.

According to analyst Charles King of Pund-IT,

“He may have been referring to economic concerns, including fears of a possible recession or the trade tariffs being pursued by President Trump. Both of those are of concern to businesses. Plus, when organizations are afraid they tend to push strategic technology initiatives, which are Pivotal’s specialty, to the back seat. That translates into bad news for IT companies and their shareholders.”

Regardless, Wedbush Securities analyst Daniel Ives said the quarter was a “train wreck” and called the company’s operating results as “disastrous,” asserting that Pivotal’s “management team does not have a handle on the underlying issues negatively impacting its sales cycles and the activity in the field which gives us concern that this quarter will be the start of some ‘dark days ahead’ for Pivotal (and its investors).”

Right now, the company’s market capitalization is a little north of $800 million in the face of two class-action lawsuits.

According to plaintiff Jason Hill in California Superior Court, the company sold 42 million shares under the IPO at $15 per share, including a downswing in deferred sales and growth.

“With the benefits of these misrepresentations and omissions, the IPO was extremely lucrative for defendants, who raised more than $638 million in gross sales,” the class claims. “But when the truth of defendants’ misrepresentations and omissions became known, the price of Pivotal shares declined sharply.”

—Joseph Morton