The advent of cryptocurrency has given rise to ancillary companies piggybacking off of its success. These companies have either sought to capitalize on the opportunity to profit off the cryptocurrency’s infrastructure by either mining crypto directly, controlling nodes and flow of a coin, or by acting directly as a trust.

All of these come with substantial risk.

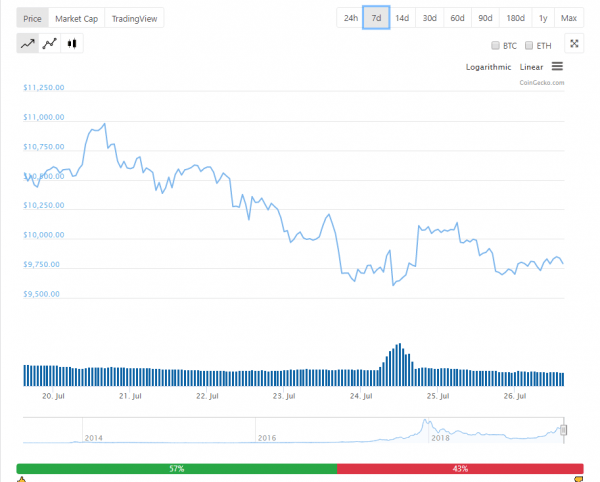

Bitcoin plummets by thousands of dollars—from north of $16,000 on July 8 to $12,927.75 at the time of writing—and predictably, the pundits sounded off like the world is ending. Meanwhile, experienced HODLers shrug their shoulders.

It’s another Friday for us.

Volatility is what we expect. Volatility is a staple of cryptocurrencies, and those of us who put our faith in them usually have ironclad stomachs, high risk profiles and aren’t afraid of a few thousand dollars either way. We see the opportunity when it tanks because we know it’ll rebound eventually. If Bitcoin were to taper off and no longer be subject to rapid bounces, then we’d get worried.

It’s also worthwhile pointing out that Bitcoin is still on track for its best quarterly performance since 2017, and the vast price fluctuations are characteristic of major bull periods. It’s an angry bull. It bounces and kicks and if you’re scared, it will throw you off before the race is run. Hodl on and see where it takes you.

The following companies are experienced bullriders.

Grayscale Bitcoin Trust (GTBC.Q)

Bounces and craters in bitcoin’s price can play havoc on the balance sheets of investors with their money in cryptocurrency-adjacent companies like Grayscale Investments, which trade at Grayscale Bitcoin Trust as well as Grayscale Ethereum Classic. The company has expanded their holdings to include other cryptocurrency, including Ethereum, Zcash, and more.

GBTC, though, is a trust that holds only Bitcoin, and until regulators get around to approving an official Bitcoin ETF, it’s probably the fastest way stock investors can get some exposure to cryptocurrency short of actually buying it themselves.

GBTC is mostly correlated one to one with the price of Bitcoin with the exception of a fluctuating premium and some minuscule management fees.

The premium can get a little crazy depending on the price of Bitcoin so that’s worthwhile to keep an eye on. During Bitcoin’s highest point in December 2017, investors were willing to absorb a 100% premium, but on average it fluctuates between 20%-$40%. If the premium ever gets back to its all-time high or somewhere in the ballpark, it might be best to skim your profits into an actual Bitcoin wallet.

It’s also worthwhile to note that the fund’s price volatility mirrors that of Bitcoin in that it does extremely well when Bitcoin is charging, but tends to hibernate beside the coin during bear markets.

Late last month, GBTC announced a 91-for-1 stock split. This means that each investor in the ETF, which tracks the bitcoin price, will receive 91 additional extra shares for every share they hold. It will make GBTC cheaper and more accessible to individual investors.

Neptune Dash (DASH.V)

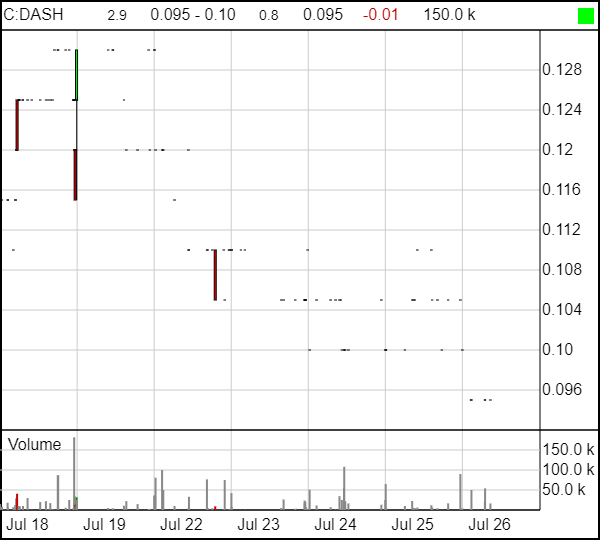

Neptune Dash builds and operates Dash masternodes and invests in blockchain-related technologies.

Neptune Stake, Neptune Dash’s subsidiary, adds diversity to the company’s cryptocurrency portfolio by foregoing the traditional proof-of-work mining method in favour of investing in proof-of-stake tokens.

That’s ultimately pretty smart business (and represents a solid opportunity) as it means that the company isn’t reliant only on proof-of-work mining for their returns, especially given the halving due to drop next year. That’s how they survived the winter when so many other companies hunkered down and either starved, or ended up in some horrifying Mad Max like scenario.

Like Greyscale above, their fates are tied in an indirect way to the price and trajectory of Bitcoin.

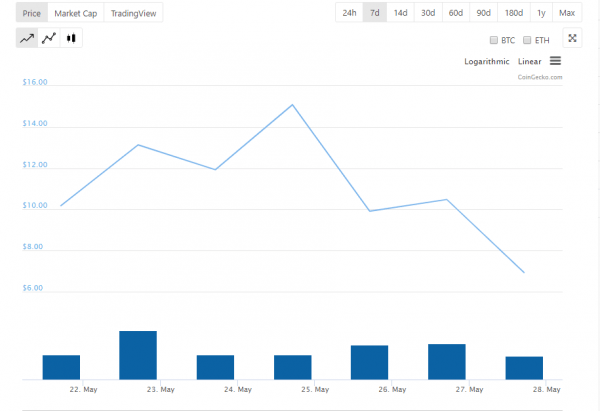

If Bitcoin’s up, then the altcoins—like Dash—are usually going for a ride as people gasp at the price of Bitcoin and FOMO takes over, and they look around for somewhere cheaper to put their money. A lot of the time this ends up in Litecoin or Ethereum, and we can see that by the price runs on those coins. A fair amount of time, though, it ends up in Dash.

Let’s compare trajectories:

As bitcoin investors start to falls off.

Dash follows suit.

And Neptune Dash isn’t far off the mark.

Neptune Dash doesn’t just deal in Dash, though. Recently, for example, they’ve expanded their cryptocurrency portfolio to include the newly released Cosmos Atoms, and have launched a Cosmos validator to validate movements on the Cosmos blockchain.

Voyager Digital (VYGR.V)

Where Neptune Dash offers the opportunity to invest in the infrastructure of the cryptocurrency itself, Voyager Digital, a crypto-asset broker, goes back to giving both retail and institutional investors a solution to trade crypto.

Voyager Digital arrived on the TSX:V with $60 million by way of a reverse takeover, absorbing the basically defunct shell of UC Holdings, a mineral exploration company company that hadn’t been operating since 2015.

Voyager initially wanted to launch a commission-free mobile trading app for retail investors in Q4 2018, but decided to fast-track their plans to bring on institutional investors after receiving feed back and interest from that community.

“We are entering the market and offering our entire back-end services and our APIs to clients who have the distribution whether it’s institutional or retail. We have the banking, custody, execution and exchange relationships and have built this entire ecosystem around it. Now institutions have a sophisticated and dynamic crypto offering to they can bring to their customers,” said Steve Ehrlich, CEO.

The app collects data points for verification purposes, and to ensure the company’s compliance with the Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations required by any financial institution.

As an added bonus opportunity, the company offers a phone-based hot wallet with 20 coins on offer, including all of the major coins but also with some interesting choices like VEChain, Tron, Iota and Neo, as well as custom coin pages and live news feeds.

The biggest issue with this company is their security. Cryptocurrency is still unregulated and uninsured, and regardless of the reputation of the company it’s always a huge risk trusting digital currencies to a third-party hot-wallet. It’s not that Ledger Vault, the company that Voyager uses for their multisig hot wallet, isn’t stable. It is. But there are too many potential points of entry into the network to be entirely comfortable. Especially with no cold storage backup.

Although, I’ll admit in the interest of full disclosure that my bias towards cold storage wallets is pretty well known.

Voyager Digital closed today at $0.71, and has a $45 million market cap.

Blockchain Foundry (BCFN.C)

You might think it’s a little sneaky and unnecessarily promotional of me to feature one of equity.guru’s marketing clients in an article about blockchain and cryptocurrency adjacent companies, and you would be absolutely right, if I didn’t actually feel that this company had some interesting things going for it.

Here’s the opportunity they represent:

Their latest syscoin update produces multiple different options for the investor, including a potential answer to the blockchain scaling problem, and a inter-blockchain bridge between the syscoin to ethereum allowing the possibility of entering into smart contracts, and running a business using only decentralized apps (d’apps).

First, the scaling problem:

Without getting too overly technical about it, ZDAG is the protocol used to move data that doesn’t need to be on the blockchain to increase throughput capacity. Kind of like removing any unnecessary files from a hard-drive to speed up a computer.

“The Z-DAG protocol is extremely innovative and presents a practical solution for many of the performance issues that are currently bottlenecking the continued scalability of blockchain systems,” according to Whiteblock CEO Zak Cole.

Here’s what they’re saying about it on Twitter:

@APompliano have you taken a look at the syscoin to ethereum bridge? This is huge. Security of btc, contracts of eth, scaling by zdag on the syscoin chain. There is also a 600k sys bounty if you can hack the bridge on testnet

— CrypticPest (@Al73r) July 20, 2019

So they’re involved in some interesting, and both potentially groundbreaking and lucrative things, but there’s still no money coming through the door. The company has $63,000 in cash after spending the nearly million dollars raised in a private placement over the past year, $12.6 million debt, and a concentrated loss of $1.1 million.

This isn’t anything to be worried about, it’s new company with an unorthodox product that’s only been around for a year.

The takeaway, though, is that if BCFN’s ZDAG technology successfully makes the consumer capable of buying their morning coffee with crypto, then these guys could be the ones to bring non-stablecoin crypto to the mainstream, and that’s a massive opportunity no crypto-enthusiast should miss out on.

I did a postcast with Jag Sidu, the CTO of Blockchain Foundry, in which we discussed many things related to crypto and blockchain. Tune in.

Keep hodling until next time.

—Joseph Morton

Full Disclosure: Blockchain Foundry is an equity.guru marketing client.