The Cobalt price continues to languish below US$20/lb. This is an unexpected development given that last year the price was at or > $40/lb. for much of March, April & May. In speaking with experts and reading industry analysis, the consensus is that the Cobalt price could settle in the $20-$25/lb. range later this year. I agree, that seems to be a sweet spot where end users are comfortable and the better quality Cobalt juniors can get financed.

That price range is not aggressive, but if it’s as high as prices are headed, it will knock out many Cobalt juniors that require $30+/lb. pricing. Of course, $20-$25/lb. might not seem that conservative when the price is at roughly $16/lb. (according to infomine.com). Of the 100+ names, surprisingly few can get financed in a sub $20/lb. environment. After an upcoming industry shakeout (Cobalt mgmt. teams are likely looking at cannabis deals by now), the survivors will thrive, perhaps enjoying a price of $30+/lb. in the early 2020’s.

First Cobalt’s Refinery Could be in Production Within 24 Months

Few Cobalt juniors will survive this pricing cycle, most face a slow death through equity dilution, waiting in vain for the Cobalt price to double or triple. However, First Cobalt Corp. (TSX-V: FCC) / (OTCQX: FTSSF) appears to be a survivor and could thrive next decade. Notice that news from peers has slowed to a crawl. First Cobalt is one of the few with news to report, such as today’s press release of May 8th. It’s about First Cobalt’s 100%-owned Refinery, a hydro-metallurgical Cobalt-Silver-Nickel facility, located ~5 km east of Cobalt, Ontario, and a few hours north by road or rail from the U.S. border.

In the image below — top left to right; cobalt sulfate produced using the FCC Refinery flow sheet; current autoclave circuit — bottom left to right; external & areal images of the facility.

Mgmt. Commissions Scoping Study to Find ways to Enhance Refinery Economics

Management has commissioned a study to estimate capital & operating requirements for a range of production scenarios using Cobalt hydroxide as feedstock in its Ontario, Canada Refinery (the only fully-permitted Cobalt refinery in N. America capable of producing battery-grade Cobalt sulfate). Once operational, it would be the sole N. American producer of refined Cobalt for the N. American EV market. Third-party discussions are underway to supply feedstock & investment capital to restart the Refinery within 18-24 months of securing feed. The Study will estimate production capacity, under various scenarios, using higher grade feed, and provide detailed capital & operating cost estimates.

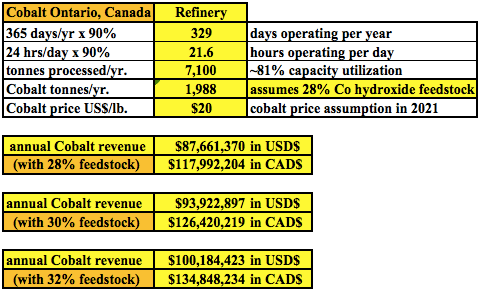

Below is a Refinery production model that estimates annual gross revenue from Cobalt alone (no by-product revenue). I stuck with a 24 tonne per day assumption, but management is looking at ways to as much as double it. But, that would require considerably more cap-ex. With 28% Cobalt hydroxide feed and the assumptions shown below, annualized gross revenue at $20/lb. of final Cobalt product could be ~C$118M. (US/CAD FX rate = 1.346). With 30% Cobalt hydroxide feed, annual production could rise to 2,130 tonnes, for gross revenue of ~C$126M. With 32% Cobalt hydroxide feed, annual production jumps to 2,272 tonnes and gross revenue could be ~C$135M. Finally, not in the image below, but with 30% Cobalt hydroxide feed, and a US$25/lb. Cobalt price (instead of US$20/lb.), annualized gross revenue could be C$158M.

Trent Mell, President & CEO, commented:

“First Cobalt is focused on becoming the first N. American refiner of battery-grade cobalt sulfate and is in discussions with potential sources of cobalt hydroxide feed material. The study is expected to identify upside within the Refinery by treating higher grade hydroxide feed and removing the autoclave circuit, which is the current bottleneck to increasing throughput capacity.”

Readers may recall that on April 3rd First Cobalt announced the production of battery-grade Cobalt sulfate using the current flow sheet by SGS Canada. The Company concluded that Cobalt hydroxide was the preferred feed material, and that throughput & costs could be enhanced by excluding the autoclave circuit. Management has engaged Ausenco Engineering Canada to complete a scoping study. Results are expected before the end of May.

From the press release,

“The conceptual study will update baseline production capacity & capital estimates, without the autoclave circuit, as well as explore additional production capacity for the Refinery under additional process flow sheets, estimating the capital & operating costs for each scenario. The report will support First Cobalt in further developing the business case for the restart, and serve as a foundation for future work to generate a financeable project.”

Revenue from 2,000 tonnes of Cobalt Product/yr. Could be Substantial

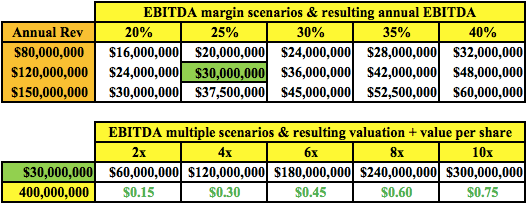

In the next 2 charts I take things to a logical conclusion… if we have an estimate of annual gross revenue, we can estimate EBITDA margins and an EBITDA multiple from metal producing peers to come up with a Company valuation. However, I don’t choose a specific margin or a multiple, I leave that up to readers. Why? I don’t have enough information to make a stock price prediction. And, small changes in assumptions can make a big difference. For example, the difference in realized price of US$20/lb. vs. US$25/lb. or in the feedstock grade of 28% vs. 32%. Instead, I show a range of possibilities that I think are reasonable. I assume moderate equity dilution, rounding up outstanding shares to 400 M, which is conservative as management says they can get the Refinery up and running with minimal or no additional equity issuance.

In the first chart are assumed EBITDA margins from 20% to 40% and annualized revenue from C$80,000,000 to C$150,000,000. I took a 5% discount to gross revenue to account for possible fees/deductions at the Refinery. The results are annual EBITDA estimates in CAD$. Then I took the C$30M EBITDA estimate in the second chart and applied EBITDA multiples ranging from 2 to 10 times. For example, at a 4x multiple of C$30M EBITDA, First Cobalt could be worth C$120M (assuming no debt). Divide that by 400M shares = C$0.30/share. These are just rough numbers. Note, annualized revenue & EBITDA run-rates like those shown below are likely at least 2 years away, so it might make sense to discount share price estimates back 1 or 2 years at a 10%-15% discount factor.

First Cobalt Acquires Shares in eCobalt Solutions

Switching gears to other recent news…. the Company acquired 9,640,500 shares (~6% of issued & outstanding) of a Cobalt pure-play, eCobalt Solutions, (“ECS”) that also has a project in Idaho. In addition, First Cobalt is issuing 21,265,809 common shares at C$0.17 to fund the investment in ECS. eCobalt Solutions’ primary asset is described as being “an advanced-stage development Project with near-term primary Cobalt production potential.” Both ECS & First Cobalt had market caps of ~C$50M at the close on Monday, May 7th.

There has been some speculation as to what First Cobalt might be up to. I noticed that combined, ECS & Jervois Corp. would have about C$16 M in cash. First Cobalt might be trying to draw attention to the fact that in Idaho, it & ECS are the only games in town and that it makes sense for their projects to be combined. Also, some or a lot of ECS’ & Jervois’ cash could be invested in First Cobalt’s Refinery to generate nearer-term cash flow for both First Cobalt and a merged ECS & Jervois.

Some shareholders are wondering about the arbitrage opportunity, is First Cobalt merely trying to make an attractive short-term return on its investment if the deal between Jervois & ECS closes? Based on the latest closing price of Jervois @A$0.26, I believe that First Cobalt has an unrealized gain of roughly C$300,000 on its 9,640,500 shares of ECS (if the merger had closed on May 7th). Locking in that gain would be like issuing those 21,265,809 shares of (TSX-V: FCC) at ~C$0.18, in a bad market, with no warrants attached. That alone would be a pretty good outcome. But, is there more to the story here? I don’t know, I think it was a dynamic, thinking out-of-the-box move, that opens up options for the Company.

Conclusion

The natural resource space is dead, will it ever come back? Yes, there’s blood in the streets, but despite one’s bearishness, the global economy is still growing, and 1 or 2 billion of the planet’s 7.5 billion want to access not just reliable & safe electricity, but also the Internet and smart phone. Once there, they are one step away from electric scooters, bikes EVs. The Li-ion battery is, without question, here to stay for at least the next 2 decades. Cobalt is not getting engineered out of batteries, even if its content in a battery declines, slowly, over many years, the number of batteries sold way more than makes up for that.

First Cobalt’s Refinery could be in production (when no one else in N. America is) in 1H 2021. As one looks at the hypothetical valuation metrics above, consider this. the Company could probably sell a minority stake in the Refinery, and get free-carried through cash flow break even. Dozens of companies could write a check for C$30-C$40M, imagine what that might do for the share price….. There are several near-term catalysts here — the scoping study report, talks on off-take, talks on strategic investment, debt/debt facilities, talks on securing feedstock, discussions with Royalty / Streaming companies, and the possibility of a higher Cobalt price in coming months. If readers want to bet on a pure-play Cobalt junior, there are very few to choose from. First Cobalt Corp. TSX-V: FCC) / (OTCQX: FTSSF) is my one and only bet in the Cobalt space.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Cobalt Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of First Cobalt Corp. and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.