On October 19, 2018 Supreme Cannabis (FIRE.V) announced that it has completed a “bought deal offering” – raising $100 million.

It will deploy the money for the construction and development of its existing and planned facilities in Canada and also for general working capital purposes.

Supreme Highlights:

- secured six provincial supply agreements

- Listed in provinces from coast-to-coast.

- Supreme Cannabis’ 7ACRES product to be listed as a “premium offering.”

7ACRES’ 340,000-square foot hybrid greenhouse is situated in Kincardine, Ontario. It combines the best practices in indoor cannabis cultivation with the power of the sun. The result is indoor-quality buds with sun-grown characteristics.

Supreme’s annual production capacity is targeted to reach 50,000 kilograms once the 7ACRES facility is fully operational.

A “bought deal” indicates that an investment bank or brokerage firm buys the entire offering, intending to sell the shares later to other investors. Basically, the under-writing institution is taking a risk. If there are no 2nd-wave buyers, a bunch of jittery CFAs lose their Christmas bonuses.

In this case the “syndicate of underwriters” include, GMP Securities L.P., BMO Capital Markets, Cormark Securities Inc., Eight Capital, Beacon Securities and P.I. Financial Corp.

According to GMP’s corporate literature, GMP “strives to find the right balance between maximizing profit and safeguarding liquidity. Who Dares, Wins.”

The unsecured convertible debentures pay 6% per year – with a maturity date 36 months from closing.

The Debentures will be convertible, at the option of the holder, into common shares at any time prior to the close of business on the last business day immediately preceding the Maturity Date at a conversion price of $2.45 subject to adjustment in certain circumstances. Supreme can may force the conversion if the average trading price is greater than $3.43 for 10 consecutive trading days.

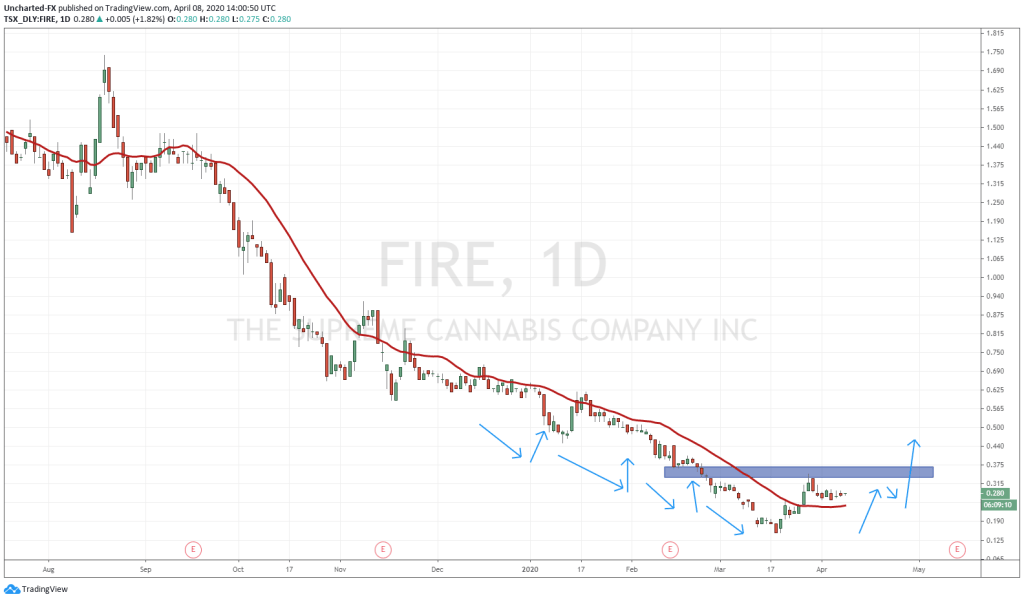

Supreme hit a high of $3.28 on January 2, 2018 and is now trading at $1.78.

To some extent, prior to legalisation, publicly traded cannabis companies have been “selling the sizzle”.

Now it’s time to sell the steak.

Ironically – that’s a harder sell.

By mid-morning, October 19, 2018, 95% of the companies comprising The Canadian Marijuana Index are in the red.

Prior to legalised recreational pot, “Supreme management focused on developing and maintaining 7ACRES’ position as a leading brand of premium cannabis flowers at scale. Sales of cannabis are completed via Business-to-Business (B2B) transactions.”

The B2B model is designed to allow 7ACRES to grow its revenue through high value bulk sales while maintaining its focus on cultivation, without the expense of patient acquisition and retention or retail order fulfillment and logistics.

The September 24, 2018 MD&A and Financials, signalled Supreme’s adaption to the new world.

“Following the launch of the legal adult-use recreational market on October 17, 2018, sales will also be transacted with provincial distributors and retailers. The current B2B model prepares 7ACRES for the B2B sales model in the recreational market.”

Supreme has assembled a marketing team with deep expertise from the beverage, alcohol, tobacco and cannabis industries. 7ACRES now has six provincial supply agreements, secured coast-to-coast distribution as the first exclusively premium brand for the Canadian recreational market.

On September 10, 2018, Supreme entered into a supply agreement to provide dried cannabis to Tilray Canada (TLRY.NASDAQ).

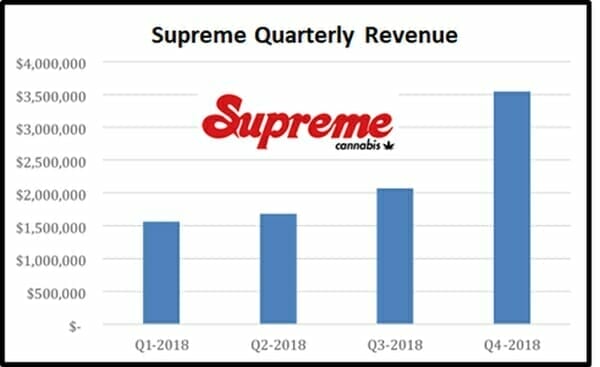

The value of this initial supply agreement is estimated to be $2 million. Prior to legalisation, Supreme is already booking robust revenue growth.

Revenue growth from the current fiscal year is due to three main factors:

- The addition of retail partners

- Increased cannabis production capacity

- Higher prices

The increase of $1,476,011 or 71% in revenues for the three months ended June 30, 2018 as compared to the three months ended March 31, 2018 are due to an increase in the quantity of cannabis sold by 51% and an increase in the average price of cannabis flower by 29%.”

“Profitability is the most significant metric for our shareholders,” stated Supreme CEO John Fowler in an excellent Pharma Board Interview, “Beyond our ability to lead in terms of profitability, I would like The Supreme Cannabis Company to be recognized as a dedicated actor in the social field.”

With an extra $100 million in the till, Supreme now has the financial muscle to execute all its plans.

Full Disclosure: Supreme Cannabis is an Equity Guru marketing client, and we own stock.

I’m a Supreme Stock holder for several years now. David Stadnyk days,.

I was very disappointing to hear that 7 acres was not ready for sale Oct 17. Reports I hear put us a week behind. I know your big on calling out your “customers” when they fail.

No mention of Supreme’s late start in this review?

Adam, we got dazzled by the good things Supreme is doing. Also, the launch of rec weed has been so wonky. I live in Vancouver. We have no legal pot shops. The subplots are swirling like Texas Tumbleweed. But you made a fair point. We will follow up on it in future coverage when – hopefully – the fog has cleared.