NOTE: Everything that follows was, at the time of writing, based on information provided by the company that we believed to be accurate.

Since that time, the company has opted to not pay service providers, including us, their agreed fees.

It is our belief the company can not afford to pay its bills.

For more information, see this update.

We leave the original story up only as a mea culpa.

—

Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF) is a Western Canadian oil and gas exploration and production company that has undergone significant restructuring since 2021. It is currently positioned for substantial growth and profitability. If you’re looking for an energy investment that blends operational efficiency, environmental stewardship, and strong financial returns, Prospera Energy presents an enticing opportunity. Here’s why this company should be on your radar.

Market Macro

The Canadian oil and gas sector is running strong. Despite challenges such as refining margins slumping and global demand softening, geopolitical factors like tensions in the Middle East have supported a rebound in oil prices, with Brent crude hovering around $78 per barrel. Canada’s oil production is expected to continue its upward trajectory, with key infrastructure projects such as the Trans Mountain pipeline expansion in commercial operation and the Coastal GasLink project closing out phase one construction. These developments are expected to alleviate pipeline bottlenecks, improve commodity pricing, and enable Canadian producers to access global markets more efficiently. Things are definitely looking up for market participants.

Strong Reserves and Growth Potential

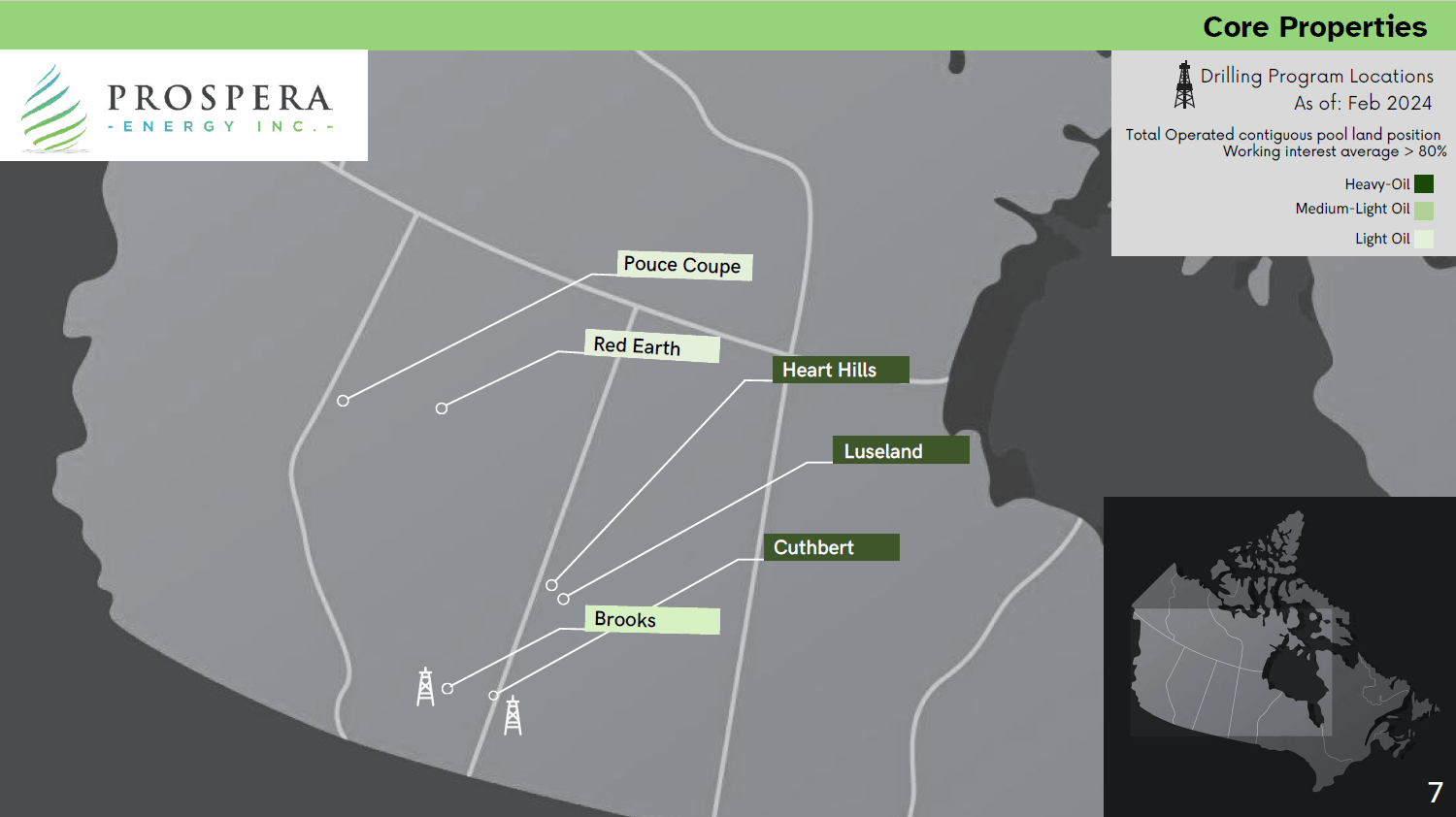

Prospera Energy is sitting on a substantial asset base with 400 million barrels of original oil in place (OOIP) across its core properties. The company’s strategy centers on optimizing recovery through horizontal drilling, which has already led to remarkable production increases. For example, their 2023 exit production rate exceeded expectations at 1,800 barrels of oil equivalent per day (boepd), with the potential to reach 5,000 boepd by the end of 2024.

With over 150 drilling locations identified and high-graded for development, the company’s future is bright. This extensive portfolio provides long-term growth prospects, making Prospera a compelling investment for those looking for exposure to energy markets.

Proven Profitability and Operational Efficiency

Since its restructuring, Prospera has consistently improved its financial performance. The company has reduced its production costs from $68 per barrel of oil equivalent (boe) to as low as $34 per boe. This drastic cost reduction, paired with increased production, has significantly boosted the company’s Net Present Value (NPV) to $72 million—an incredible turnaround from its pre-restructuring value of -$3.4 million.

Prospera is focused on maximizing shareholder value through cost-efficient production and profitable growth, making it an attractive investment for those seeking strong returns.

Commitment to Environmental, Social, and Governance (ESG) Initiatives

In a world where environmental sustainability is becoming a critical investment criterion, Prospera Energy stands out. The company is committed to reducing its environmental footprint through innovative ESG technologies. Its decarbonization strategy involves minimizing emissions and utilizing hydrochemolytic bitumen upgrading (HBU) technology to enhance oil quality. By reducing reliance on diluents, Prospera not only boosts profitability but also positions itself as a responsible and sustainable operator.

For investors who prioritize ESG factors, Prospera’s ongoing efforts to reduce environmental impact while enhancing operational efficiency are compelling reasons to consider investing in this company.

Strategic Acquisitions and Development Plans

Prospera’s three-phase development strategy further strengthens its long-term outlook. The company plans to acquire additional light oil assets to diversify its production mix and attain a balanced portfolio of 50% light oil, 40% heavy oil, and 10% gas. These acquisitions, combined with the horizontal well program and Enhanced Oil Recovery (EOR) applications, will enhance production, extend the reserve life index to over 25 years, and create significant value for shareholders.

Attractive Return on Investment

For investors seeking a strong return, Prospera Energy is a standout opportunity. The company’s development projects have demonstrated a payback period of less than six months, with an impressive return on investment (ROI) exceeding 200%. This quick turnaround, combined with robust cash flow from operations, makes Prospera an appealing choice for investors looking for high-value, short-term returns alongside long-term growth potential.

Leadership

As you well know, smart public market investors don’t just bet on the horse, they also know success is heavily dependent on the rider, so it is comforting to know that Prospera Energy’s management team brings a wealth of experience in oil and gas operations. CEO Samuel David, a 35-year industry veteran, is focused on optimizing production and ensuring regulatory compliance. David’s leadership has already overseen a successful restructuring that transformed Prospera into a profitable company. Supporting him is CFO Chris Ludtke, who brings 20 years of expertise in finance and economics within the energy sector, ensuring the company’s financial health remains robust.

Additionally, Peter Chung, the Senior Reservoir Engineer, with 17 years of experience in research and reservoir engineering, plays a pivotal role in maximizing resource recovery through technical advancements in well management. This experienced leadership team is well-equipped to continue guiding Prospera Energy along its path to continued production increases, economic operations, and environmental stewardship.

Ground floor opportunity

Sure, the restructuring, although entirely positive, is taking longer than management had hoped but this slow burn presents a long timeline of cheap buying. What does this mean? Well, Prospera currently trades at $0.04 CAD per share and a tiny $17.08 million market cap, so it won’t take much good news to make this stock upwardly mobile, offering what could be considerable gains for a relatively small investment.

In the end

Strong leadership, a considerable asset base, operational efficiency, commitment to ESG principles, and an aggressive growth strategy, Prospera Energy’s ongoing transformation continues to unlock substantial shareholder value, making this Canadian oil and gas company a smart choice for those looking for a long term energy sector success story. But don’t take my word for it. Do your due diligence and speak with an investment professional and see how you feel.

Full disclosure: Prospera Energy is an Equity.Guru marketing client.

With 427. million s/o there is no room to move and there are issues.