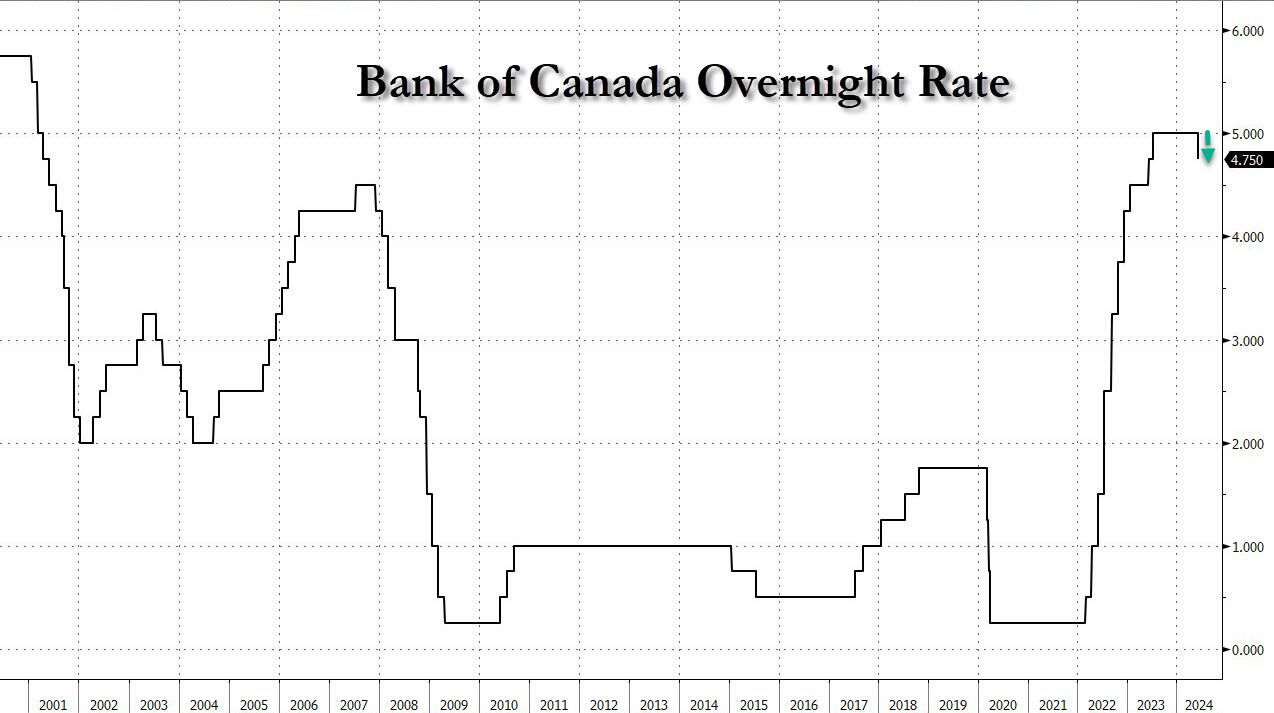

As expected after months of dovish commentary, the Bank of Canada cut interest rates by 25 basis points from 5.00% to 4.75%. The central bank has become the first G7 central bank to implement an easing cycle and cut rates with the central bank indicating it is “reasonable to expect further cuts” IF inflation eases.

Governor Tiff Macklem said in his opening remarks:

“If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time.”

This 25 basis point comes under a year since the central banks last 25 basis point rate hike in July 2023.

This will give some relief to Canadian consumers and mortgages. Some analysts believe this cut will spur big purchases but that remains to be seen. Analysts are forecasting another interest rate cut in July with the markets pricing in a 35% chance that rates drop to 4.5% in July.

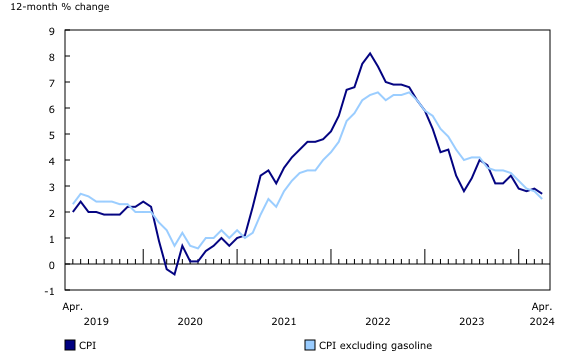

As always, CPI Inflation data will be key.

Some more important commentary from yesterday’s meeting includes:

- “Further progress in bringing down inflation is likely to be uneven and risks remain.”

- “If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate.”

- “But total consumer price index (CPI) inflation has declined consistently over the course of this year, and indicators of underlying inflation increasingly point to a sustained easing” “Inflation could be higher if global tensions escalate, if house prices in Canada rise faster than expected, or if wage growth remains high relative to productivity.”

- “With the economy in excess supply, there is room for growth even as inflation continues to recede.”

- “Although Q1 growth was weaker than bank forecast, consumption growth was solid while business investment and housing activity also increased.”

Other important details from the Bank of Canada statement includes:

- With continued evidence that underlying inflation is easing, the Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points.

- Recent data has increased our confidence that inflation will continue to move towards the 2% target. Nonetheless, risks to the inflation outlook remain. The Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

- The Bank remains resolute in its commitment to restoring price stability for Canadians.

- Three month measures of core inflation suggest continued downward momentum in CPI

With the Canadian Loonie being connected to oil, and oil being an important source of rising prices being the lifeblood of the economy, watching oil will be key in gauging the potential inflation trend.

The summer months tend to be bullish for oil prices, however the chart has broken below $80. This is quite bearish from the technical side of things and oil remaining below this zone likely means further downside towards the $70 zone.

The TSX rose on the rate cut decision but this has already been priced into the markets. A strong close above 22,200 will see the TSX retest previous record highs, and likely breakout into new all time record highs.

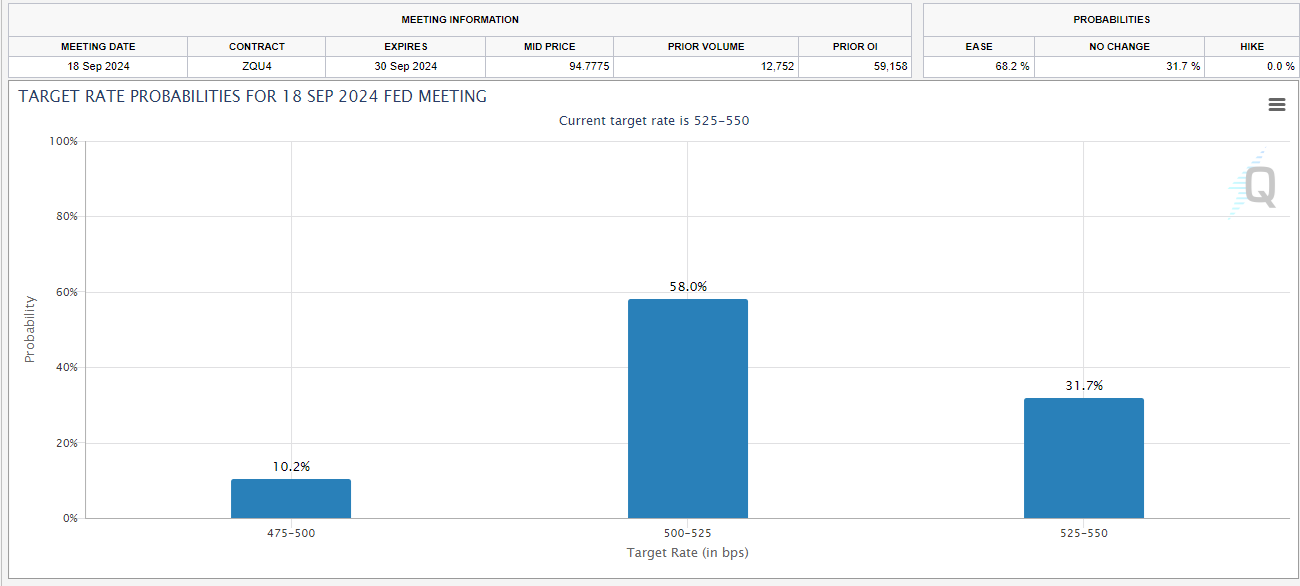

Meanwhile the Loonie continues to drift in this flag pattern after breaking out above 1.36. In terms of rate differentials, the US Dollar is now higher than the Loonie, but then again, markets are pricing in rate cuts from the Federal Reserve as well.

For the currency traders out there, await the breakout of the flag pattern for momentum direction.

At time of writing, Fed Fund Futures are showing no US rate cut in Summer. The probabilities that favor easing come in the month of September 2024.

Another rate cut by the Bank of Canada next month is likely to see a breakout of USDCAD. And for those classical economists… a weaker currency tends to drive inflation. There have already been discussions about this especially with the US being our largest and most important trading partner.