We have a system we use when looking at drill results of resource explorers.

We have a system we use when looking at drill results of resource explorers.

Looking over drill intercepts is tedious work, so we’ve shrunk it down to a checklist, to create a layman’s idea of whether a hole is good, great, or insane..

It’s our system, built by us for us, so others may declare it unhelpful for their own particular needs, or even wrong, but we’ve been using it for years and it guides us when we cover literally thousands of drill holes being revealed every month, as to what’s impressive and what’s just noise.

For copper projects, the system used for grading a drill section is as follows.

- Economic: 0.3-0.5%; Thickness required: ≥10m

- Good: 0.5-1.0%; Thickness required: ≥10m

- Bonanza: 1.0-5.0%; Thickness required: ≥5m

- AYFKM: >5.0%; Thickness required: ≥5m

For the uninitiated, AYFKM stands for ‘Are You Fucking Kidding Me.’

To hit an AYFKM hole is a rarity.

Here are some notable companies that did, and shook the richter scale in doing so.

- Molulu Copper-Cobalt Project: Drill Hole DD4-09BIS intersected 36.05 meters averaging 7.35% copper, with sections hitting up to 29.41% copper.

- Copper Mountain Mine, Copper Mountain Mining Corporation: Drill hole CM-DD-896 intersected a 104-meter zone grading 1.01% copper equivalent, including 8.85 meters at 5.37% CuEq.

- Kamoa-Kakula Project, Ivanhoe Mines: Drill hole DD1571 reported copper grades of 18.0% over 18.86 meters. This high-grade intersection is part of one of the world’s largest copper discoveries in recent years and is a for reals AYFKM hole.

So why are we talking about all these glorious big time hits?

Because the initial drill results from the first EuroPacific Metals Inc. (EUP.V) hole at the Miguel Vacas high-grade copper project, revealed today in their news release, are as follows:

- Drill Hole EBMV001:

- Continuous intercept of 22.8 meters grading 2.76% copper, including 9.0 meters grading 7.49% copper.

For mine, this hole is a bona fide beaut.

Let’s pout it into context with some other holes annonced by others today:

- Bemetals drills 16.16 m of 0.74% Cu at Pangeni – That’s ‘good’, and saw the company jump 18%.

- U.S. Copper drills 205 ft of 0.644% Cu at Moonlight – Also ‘good’, stock up 10%.

- Aldebaran drills 1,018.6 m of 0.6% CuEq at Altar – Good again, saw the stock jump from $0.90 to $1.20 over a week.

- Gladiator drills 20.44 m of 2.17% Cu at Whitehorse – That’s a bonanza, and saw the company jump from $0.30 to $0.46 in days.

So EUP showing 22.8 meters of 2.76% copper is a company making event.

Now, it’s important not to conflate the numbers for one hole with the numbers for an entire project, because anyone can luck out with a single drill dropped at just the right place, and at just the right angle, and in this case EUP management were literally plunging a hole alongside a historic hole that had shown good results a decade back, so they had some idea this would be a good debut.

To be fair to EuroPacific however, they’re doing that so they can post a compliant NI 43-101 resource estimate on the project, and quickly shift the thing closer to production.

Five more holes are on the way. If they match the first, there’s going to be movement.

The market is already taking notice of that first hole, with shares in EUP up 37.5% today to $0.055, up from a close of $0.04 yesterday.

Also, and let’s say this loud for those at the back:

Miguel Vacas Copper Mine (Borba 2): Miguel Vacas is a historical copper mine that ceased operations in 1986 but left behind promising high grades of copper averaging 1.2-1.4%. The mine has shown significant potential through near-surface drilling results, indicating robust opportunities for redevelopment and mineral extraction.

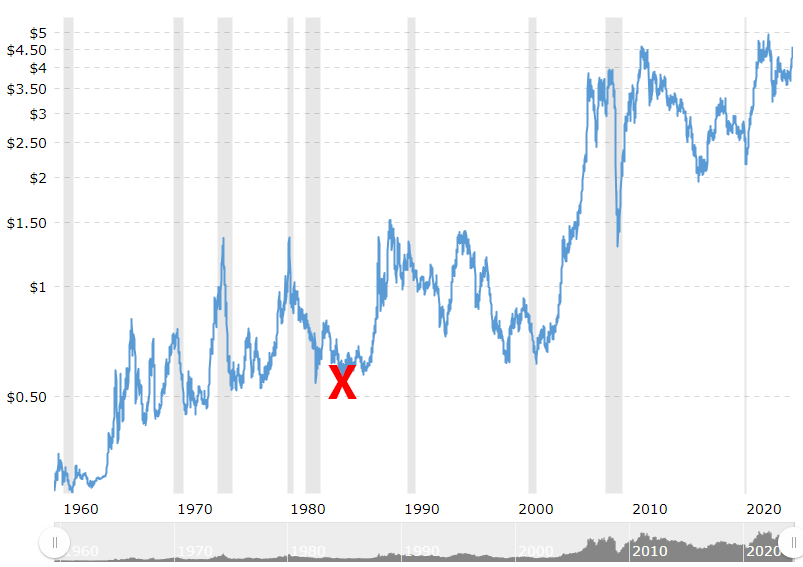

This is where copper prices were when the mining stopped at Miguel Vacas – and where they are now:

The existing non-compliant 43-101 on the project says:

- Oxide Ore: Approximately 1.2 million tonnes with an average grade of 1.23% copper, located from the surface to a depth of 80 meters.

- Sulphide Ore: Estimated at 4.4 million tonnes with an average grade of 1.24% copper, extending from 80 meters to 250 meters depth.

IN SHORT:

EuroPacific Metals Inc. is rapidly advancing its Miguel Vacas high-grade copper project in Southern Portugal, looking to validate previous historic exploration and expanding the mineralized zone both north and south of the existing pit.

So far, EuroPacific has completed five drill holes, all of which have successfully intersected the main copper-rich breccia/shear zone. The sixth drill hole, currently underway, is the southernmost drilled to date and continues to show promising signs of mineralization.

CEO Karim Rayani expressed excitement about the initial results and the potential for further discoveries.

“We said we wanted a resource estimate here quickly and we’re going for it,” he said. “These projects are good areas with past production that the market has forgotten, and now copper is in demand again, we’re not wasting any time reminding the world what’s here.”

Beyond Miguel Vacas, EuroPacific is strategically positioned with several other promising gold and copper-gold projects in Portugal. The company recently increased its ownership in EVX Portugal to 100%, ensuring full control over the Borba 2 property, which includes the Miguel Vacas project. This strategic move solidifies EuroPacific’s presence in the region and underscores its commitment to exploring and developing high-potential geological settings in Europe.

I dunno, man – seems to me there’s something worth watching here.

— Chris Parry

FULL DISCLOSURE: Europacific Metals is now an Equity.Guru marketing client, and we’re watching for dips to buy on the open market.