EuroPacific Metals (EUP.V) holds brownfield gold, and copper-gold projects located in Portugal. The Company is focused on exploration in highly prospective geological settings in Europe jurisdictions. EuroPacific Metals owns a total of 100% equity interest in EVX Portugal, a private Portugal based company, that holds the legal exploration rights from the Portugal Government on the Borba 2 exploration properties, covering approximately 328 square kilometers in the Alentejo region in Southern Portugal. Miguel Vacas is the most advanced prospect within the Borba 2 license.

Borba 2 Copper Gold Projects: The Borba 2 exploration license spans an area of 318 square kilometers and includes several past-producing mines with significant copper and gold findings. It features historic mines and new targets that promise copper and gold mineralization. These include:

- Miguel Vacas Copper Mine (Borba 2): Miguel Vacas is a historical copper mine that ceased operations in 1986 but left behind promising high grades of copper averaging 1.2-1.4%. The mine has shown significant potential through near-surface drilling results, indicating robust opportunities for redevelopment and mineral extraction.

- Mostardeira Copper Gold Project (Borba 2): Located near Estremoz, this project includes a copper-gold mine historically mined for high-grade copper along a significant shear zone. Recent sampling has shown high-grade intervals of gold and copper, suggesting substantial untapped potential in the region.

- Almagreira Gold Project (Borba 2): The Almagreira Gold Project is characterized by gold epithermal mineralization within altered volcanics and carbonates, indicating a substantial mineralized structure. The project remains open for exploration, with potential extensions along strike and at depth.

- Bugalho Gold Copper Mine (Borba 2):This project features primary and supergene copper mineralization along with significant gold occurrences, located within quartz-carbonate breccia matrices. The high-grade mineralization demonstrated in dump samples underscores its prospective value and exploration potential.

Today, the stock is in a ripping 37% rally (at time of writing) on news of initial assay results from the first drill hole, and the completion of the fifth drill hole of the 2024 exploration program at the Miguel Vacas mine area located approximately 180 km east by road from Lisbon and approximately 70 km east from Évora, the Alentejo region capital.

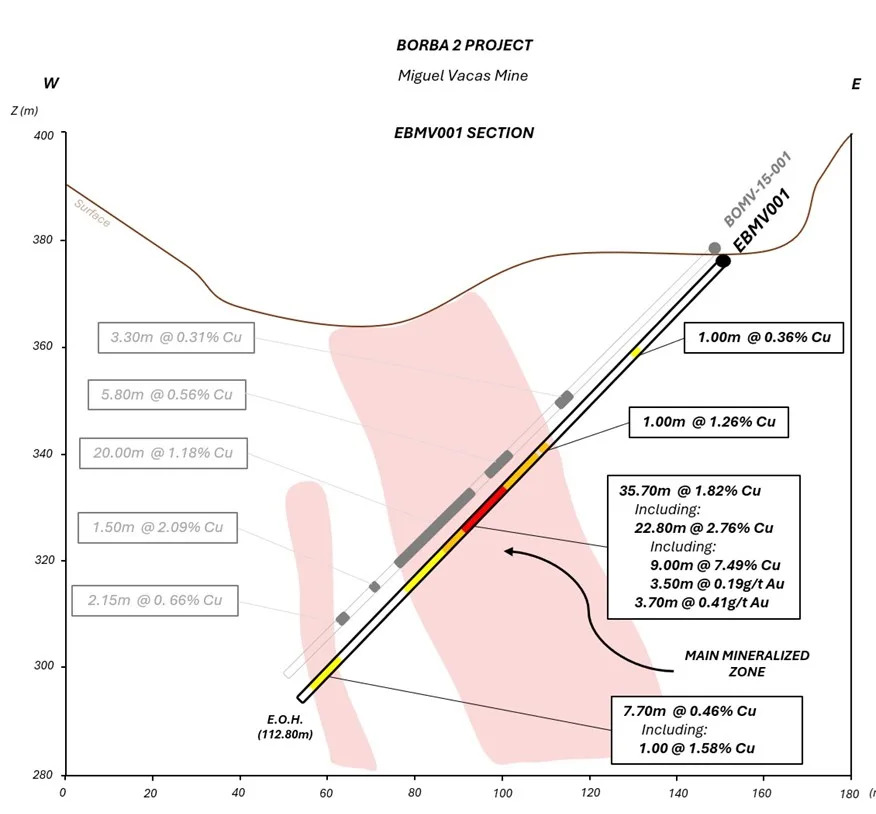

Assays for the first hole (EBMV001), confirmed previous core observations and returned better than expected results including a continuous intercept of 22.8m grading 2.76 % Cu, including 9.0 meters grading 7.49 % Cu.

The hole intercepted a broad mineralized interval with copper secondary minerals associated with a wide (>30m thick) polyphase breccia/shear zone and has shown significatively better results lying approximately at the same position.

A total of 5 holes have been completed to date and all intercepted the main cupriferous breccia/shear. The sixth hole is now in progress, and it is the southernmost drilled to date by EuroPacific. All drill intercepts show a wide breccia zone with the same paragenesis to that of hole EBMV001 which varies from 8m to up to 35m. All holes have successfully intercepted the mineralized breccia zone.

Detailed core sampling is in progress and all samples taken have been sent to ALS Laboratories for assaying. Core samples are cut in half onsite and dispatched to the ALS Laboratories for analysis.

The 2024 drill program is now in the middle of the 1,500 meters campaign with the objective of further defining a shallow open pit resource of oxide Copper mineralization recoverable by hydrometallurgical methods. Step out drilling will be undertaken on a later stage focused on the assessment of the sulphide rich (> 80m) part of the deposit below the oxidized blanket.

Chief Executive Officer, Karim Rayani stated:

“We are very pleased with these initial results from the Miguel Vacas Copper Project. The first intercept not only confirms and validates the high-grade nature of the deposit but the continuity of the zone. We have also opened the potential for a new extension to the North, which is very exciting. We look forward to receiving the next sampling results from the other holes which have already confirmed the presence of mineralized breccia to the south of the Miguel Vacas pit.”

For more information on the fundamentals, be sure to check out Chris Parry’s recent article on EuroPacific Metals here.

The stock is up double digits in percentage terms on today’s news. A very positive reaction.

We have great fundamental news, and we have a good technical setup. When the fundamentals and technicals align, we tend to have a very positive outcome. The stock is triggering a double bottom pattern after some basing. You can see the “W” shape. It shows a reversal as the trend shifts.

$0.05 is the major resistance zone. At time of writing, the stock is confirming a breakout and close above this level. Ideally, a nice strong green candle close is what we want to see. A bonus would be a close above the wick high at $0.06. A candle close back below $0.05 would nullify the breakout and bullish momentum.

Volume is also large at 820,000 shares traded. Much more than the average volume. This adds strength to the current breakout.