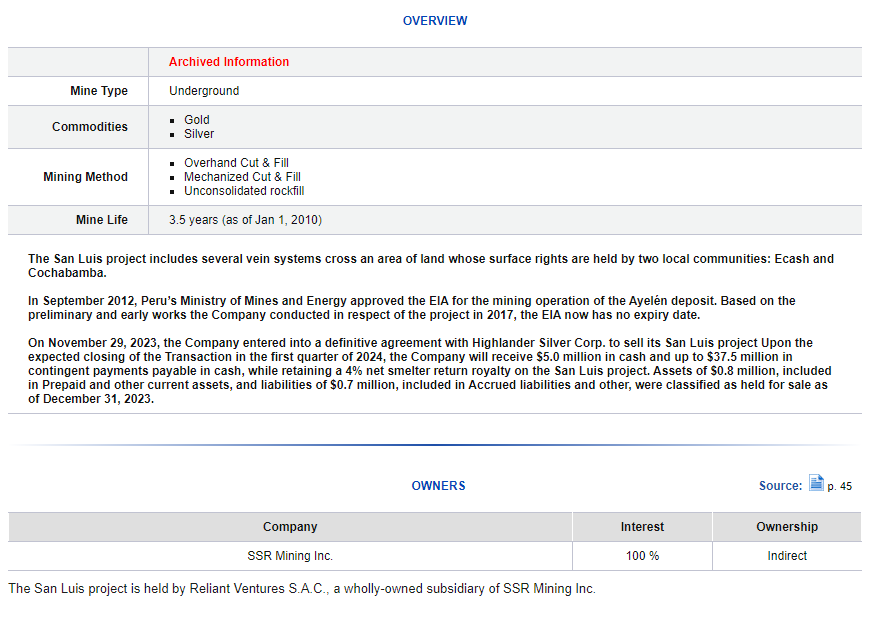

Highlander Silver (HSLV.C) is a mineral exploration company focused on the discovery of exceptional silver-gold projects in the Central Andes, leveraging the team’s significant technical and operational experience in Peru and South America more widely. Currently, the Company is developing the La Estrella project in central Peru. Highlander Silver announced entering into a share purchase agreement for the San Luis project from SSR on November 29th 2023.

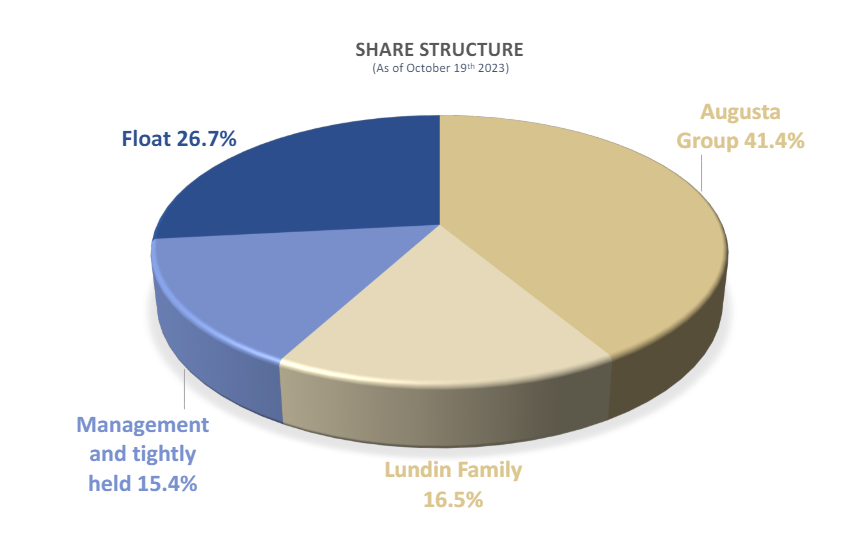

The Company is backed by the Augusta Group, a mining sector focused management group with a track record of value creation totaling over CAD $4.5 billion in exit transactions since 2011. The Company is led by Canadian billionaire Ricard Warke.

It is also backed by the Lundin Family. The Lundin Group comprises a portfolio of companies in the minerals, metals, renewables and energy sectors. The family is known for creating value for shareholders and communities by developing resource projects from ground up to production.

Personally, I like to invest in junior mining stocks which have support from successful mining teams, successful investors and/or successful mining entrepreneurs. Yes, they have a successful track record, but more importantly, they and their teams have done their due diligence. They have a team of experts at their disposal. Something I do not.

Two big groups are great. But now, let’s add another Canadian mining BILLIONAIRE to the mix.

Today, Highlander Silver announced it has negotiated a CAD $9.2 million fully subscribed offering of common shares with members of the Lundin family, as well as with Canadian Billionaires Richard Warke (chairman of Augusta Group) and Eric Sprott.

For those who follow the junior mining space, you have probably come across the name Eric Sprott and the Sprott investment name. Sprott has a decades-long foundation in physical metals and minerals, with deep relationships and expertise in the mining industry. They offer investments in precious metals, including gold, silver, platinum and palladium. Their critical materials investments include the world’s largest physical uranium trust and mining equity ETFs focused on the global transition to clean energy.

Sprott is a global asset manager providing more than 250,000 clients with access to precious metals and critical materials investment strategies, and has approximately US$28.7 billion in assets under management.

Big names. Big money. Big bets.

Don’t know about you, but I smell money and success. These are the kinds of big names you want partaking in finances.

The offering the Highlander Silver has announced consists of 20,514,222 common shares of the Company at a price $0.45 per share for gross proceeds of $9,231,400.

The Company plans to use the net proceeds to finalize the acquisition of the San Luis gold-silver project located in Ancash Department of central Peru, surface geological work and drill target definition at San Luis as well as general corporate purposes. The acquisition of the San Luis Project from SSR Mining is expected to occur in May 2024.

Highlander Silver President and CEO, David Fincham stated, “We very much appreciate the continued support from Richard Warke and the Lundin family, and we are delighted to welcome Eric Sprott as a new strategic investor in Highlander. The funds from this private placement will go towards advancing technical and community work focused on unlocking value at the bonanza grade gold silver San Luis project in Peru to the benefit of all our stakeholders.”

And how did the stock react?

At time of writing the stock is up 36% on this news, and is one of the top gainers in the Canadian Markets.

Chart wise I love what I see. The stock confirmed a reversal with a double bottom pattern breakout back in November 2023. The stock has been waiting for its first higher low in a new uptrend and it appears we are set to confirm this. What is required is a close above the recent highs above $0.63. I am writing this article while the markets are still open, but it looks like we will get our daily close barring any late market sell off.

With this close, our first higher low will be confirmed at $0.40 meaning the stock will remain in its uptrend as long as it stays above this price level. The next target and resistance comes in at previous record highs at $0.82. New all-time highs look promising given the market structure, reaction, and catalysts which will come with these funds.

Here is more information on the San Luis Project that Highlander Silver will be picking up:

Silver itself recently had a very important breakout above the $25.50 zone. A resistance level which has been held technically on the charts since July 2021. We finally got a confirmed weekly candle close above this price level in the first week of April 2024.

Breakouts tend to see the price retrace, or correct, to retest the breakout zone. This is what appears to be in play. We do have the Federal Reserve tomorrow and Powell’s comments are sure to move the US Dollar. This could lead to a further correction to retest the $25.50 zone. That is where I would watch for signs of buyers stepping in.