Nobody understands graphite exploring. You know this, I know this. We can fake it for a bit based on general mining knowledge, but graphite doesn’t get much investor love because people don’t really understand it. They don’t know what good graphite is, what a good property is, what end users are looking for..

So here’s what you need to know; Sri Lankan graphite isnt like other graphite.

A lot of graphite explorers are pulling up Amorphous Graphite which has a lower purity level compared to flake graphite, often found with a carbon content ranging from about 40% to 85% if you’re lucky. To get this ore to a point where its useful for anodes and rechargable batteries and such, you’ve got to spend a lot of time and money and energy taking the raw materials and sqeezing/shaking/burning/grinding the impurities out.

Processing graphite is harder than finding graphite, because it involves crushing, grinding, flotation in water and reagents to form a slurry, where the graphite attaches itself to air bubbles and impurities sink, then you’ve got to dewater it, dry it out, remove the silica, aluminum, and iron by chemical leaching, thermal treatment, or high-intensity magnetic separation.

Then you have to screen the ore into different shapes and sizes that are needed for different end uses, then start micronization (grinding to a fine powder) and spheronization (forming spherical particles) so the end result can be consistent enough to be useful as a batch.

This is a LOT of work, costs a LOT of money, and is a bit shit for the environment, if we’re honest.

So amorphous graphite can F off.

On the other hand, Flake Graphite carbon content (or purity) is typically anywhere from 85% up to 95% in the ground, which is nice. Higher-grade deposits are less common but highly sought after because they require less processing to achieve purity levels suitable for many applications, but the processing they DO require is, again, plentiful and painful.

The beauty of the bunch is Vein Graphite, which is the rarest and purest form of natural graphite, with purity levels often above 95% carbon content directly as mined. Some vein graphite can even exceed 99% purity without any beneficiation, and these deposits are primarily found in Sri Lanka.

If you want to get to 99.99% purity, starting off at 95% instead of, say, 80%, is everything.

Alright, enough pointy head talk. You’re an expert now. Let’s move on.

ENTER APPLIED GRAPHITE TECHNOLOGIES (AGT.V)

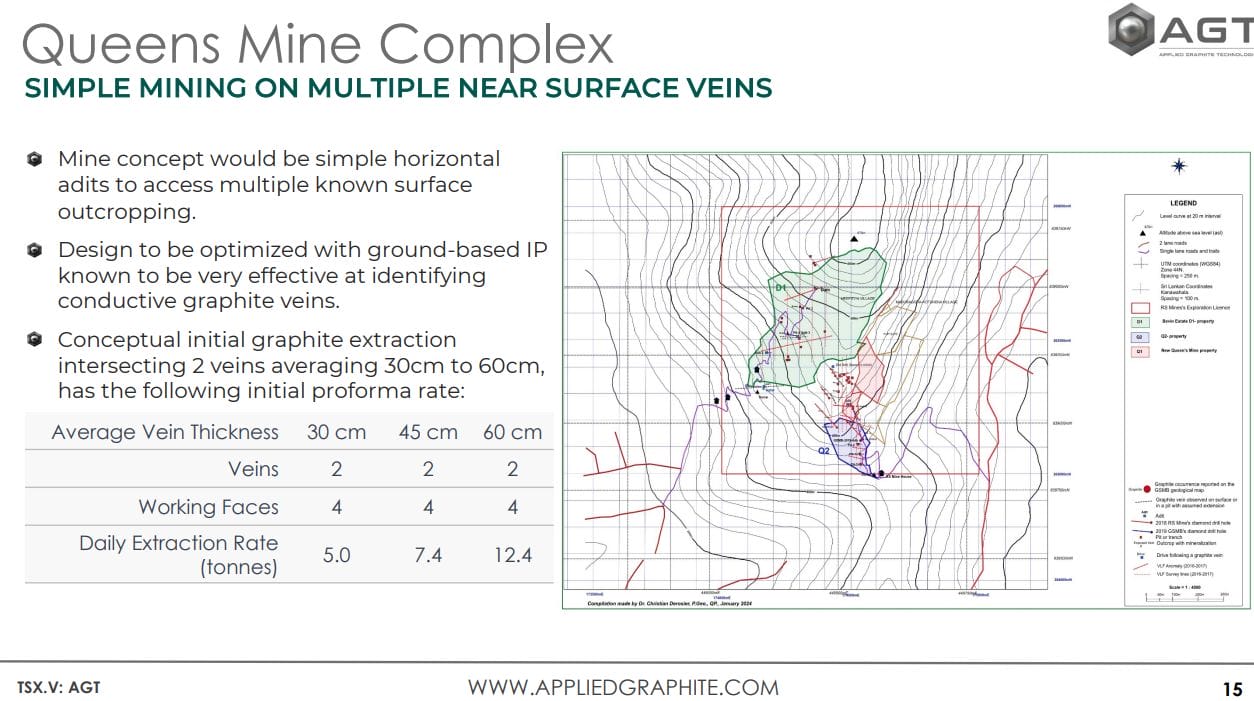

AGT has just entered the public markets with a project, the Queens Mine Complex in Sri Lanka, that has produced before and thus doesn’t require a lot of hand holding.

This project is located in a region known for the world’s highest grade natural vein graphite and AGT owns 100% of the property in this area, which is in proximity to current and historic mining operations. The area has seen historical drilling and geophysics to define initial mine life and the vein graphite from this location hits 95% carbon content.

At Parry Research/Equity.Guru we’ve developed an internal grading system for mineral resource explorers that assesses a level out of 10, depending on how much work has been done on the property and, here, we’re giving AGT’s project an assessment of Level 8, establishing it at the pre-production phase.

Although AGT is in the early stages of re-establishing mining operations at the Queens Mine Complex, their strategic position and near-term goal to generate cash flow from direct-from-mine sales indicate they are on the verge of production. Their presentation outlines a growth plan timeline that includes mine development, permitting by Q3 2024, and an operational startup plan that scales from 5 to over 50 tonnes per day from 2024 to 2027.

This suggests they are transitioning into the Production phase, despite not having commenced full-scale commercial production yet.

Summary: AGT is positioned to exploit the unique vein graphite resources of Sri Lanka, aiming to cater to the growing demand for natural graphite, especially in the EV battery sector. Their operational plans and strategic location near historical and operational mines, combined with the high-grade nature of their graphite, place them in a favorable position for transitioning to full-scale production.

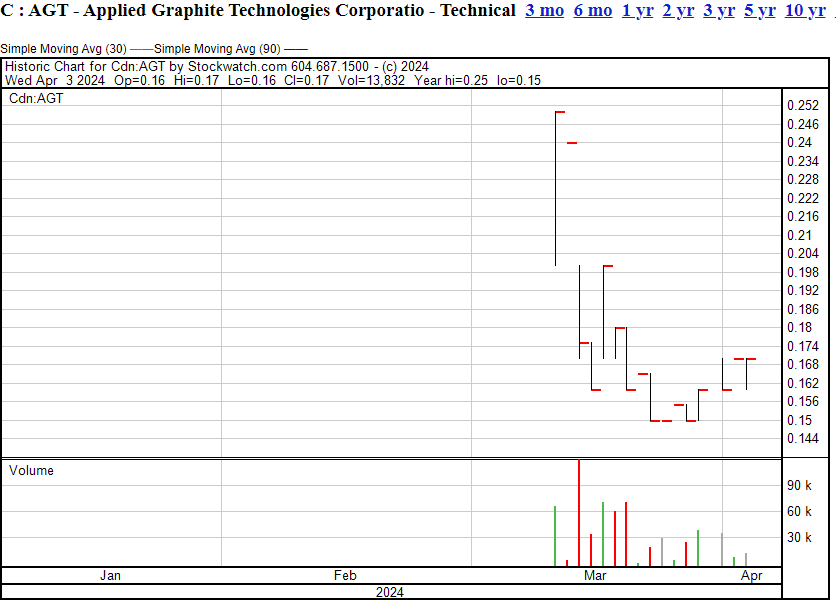

Early trading has seen the company share price drop from $0.25 initially to $0.15 over the opening few days, but is now beginning to pick up on low volume, indicating someone wanted to flush it early but is perhaps done with their weak hand, cheap paper, jiggery fuckery.

I have a suspicion graphite is going to have a moment, and Sri Lanka *should* be where that moment happens so watchlist it.

— Chris Parry

FULL DISCLOSURE: Not a client. Found it while going through some presentations and thought it novel enough to elevate. I *do* own some, courtesy of a shell a broker slipped me into a while back, which ensures I’ll be watching closely. Memo to brokers: If you want me paying attention to your deals but don’t want to pay marketing fees, having those pre-public discussions is how you do it. Don’t be a stranger.