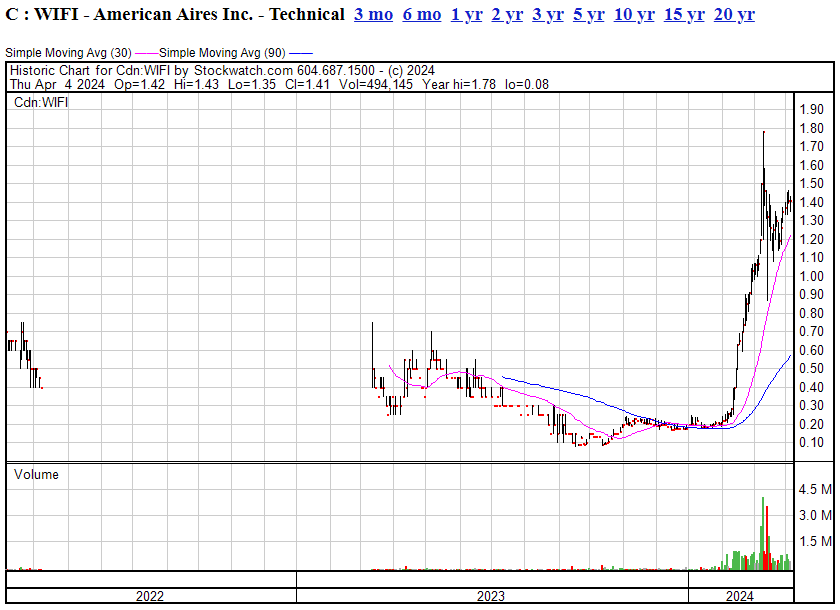

Buying the pump can be a dangerous game, but no company on the North American markets right now is driving its pump as hard as American Aires (WIFI.C), a company that long time readers will recall from back in 2019 as a big ass pump that didn’t make much sense at the time, but made some short term folks wealthy before it slid off a cliff.

The business model back then was, the company sold electricity shields for electronic devices on Amazon.com. They rolled out a Euro-accented pitchman who claimed to have all the research in the world to suggest we were all frying our nuts with iPhones and he had a weird wire mesh design that could alleviate that, he swore.

American Aires sells anti-EMP shields for your devices – basically a $350 cellphone cover with wire mesh that’ll allegedly protect your panty hamster from getting fried by text messages.

Here’s what it looks like.

They’re pretty, for sure, but you’d have to sell a lot to justify it as a pubco and once the hotel meeting room pitch presentation tour stopped, it all went downhill.

WIFI went dark for a year in 2022 and re-tooled, raised some cash, rolled back hard, paid off some debt with shares, etc etc, and came back in 2023 to mild interest.

But everything changed in February of this year when, with the stock at $0.225, the company did a $4 million raise at a generous $0.15 a share (with a full warrant) – and went bonkers.

Some pumps die because the early guys have cashed out and moved on. Some die because every mark/trader has been and gone. Some die because the sector falls out of favour or some loudmouth like me announces that the emperor has no clothes.

WIFI initially conked out because the product couldn’t justify the pitch, and the deal guys were cheap with their marketing dollars.

So why is WIFI back all of a sudden?

- Because the crazy generous raise rolled every marketer in town into the deal

- Because the product is on topic right now as a crazy conspiracy theorist’s wet dream

In 2019, these things cost a lot less, but 2019 wasn’t a time when people would post on twitter that there are subliminal messages going out on the Home Shopping Channel that’ll turn your kids into pedophile transsexuals working for the WEF – and be unquestionably believed by hundreds of thousands.

Today, in a time when anti-vaxxers and terfs and Bohemian Grove believers are the core audience of many social media networks, American Aires and its ‘Moroccan mesh patchouli crystal chest pendant that eats electricity’ offerings come into their own as seemingly rational purchases that’ll protect you and your followers from the space lasers.

To be clear, you’d have to sell a shit ton of these to justify the $120m valuation the company has right now, but the thing with a $120m valuation is, it allows you to buy your way to sustainability.

In September, the most recently posted financials on WIFI showed $400k in the bank, and $2 million in sales alongside $1.9 million in expenses on its way to a small $200k loss.

To be sure, WIFI isn’t worth today’s $120m market cap on that data, but it has rolled its present stock success into some marketing deals with UFC athletes and reseller deals and A LOT MORE MARKETING that might keep the momentum going long enough to actually figure out a business at the end of it all.

Here’s a sample of that from a recent news release:

- Torque Capital Partners for consulting services, reporting to the company’s CEO, the enhancement and execution of the company’s corporate development objectives, and investor relations initiatives to increase investor awareness and interest in the company. 12 months. $163,000

- Clarkham Capital Ltd. to provide investor relations and consulting services with a focus on the German stock market and the German-speaking investor community. The services will include the preparation of articles and coverages on several financial platforms and newsletters. The services commenced on March 5, 2024, and end on June 5, 2024. 185,500 euros.

- SmallCap Communications Inc. to provide social media management and communications services to the company. The services commenced on March 5, 2024, and will continue for an initial term of three months: $2,500 monthly. The company will also pay to SmallCap a fee of $199 for each influencer booking made.

Memo to SmallCap Communications Inc: Raise your rates.

IS THAT JUSTIFIED?

The casual observer might look at those figures and think, holy shit, that’s a huge amount of money spent on something that should be a lot less expensive, but when you’re taking a company from a $15m market cap to $120m in two months (and let’s be honest here, it wasn’t the products making the stock go up that hard), you could add a zero to the cost of each of those marketing deals and still be getting a filthy ROI as a company.

DO THEY EACH WORK AS ADVERTISED?

Who would even know? When you put a million bucks worth of marketing together across ten marketing providers, any one of them might be doing all the lifting but nobody gives a shit who that actually is – because a million dollars spent to get a $100 million return is good business, EVEN if the regulators will be sniffing through your trash, EVEN if that sort of rise sets off all sorts of alarms at the exchange, EVEN if some of those marketing deals bring no return and, as we’ve seen with recent regulatory settlements, EVEN if you’re breaking all the rules along the way (which I’m not suggesting WIFI is doing, by any stretch).

I once talked to a banking exec who was whining that it cost $500 in advertising to get a single new bank customer. When I suggested they just deposit $300 into the account of any new customer and save money on advertising, I was told, “that’s ridiculous” with a sneer.

But that’s essentially what WIFI is doing, by spending their money on marketing, not to customers but to stock traders who only care about who is doing promo and not who is selling widgets for a good margin.

DO THE PRODUCTS WORK?

Who cares? It’s a meme stock. Precisely NOBODY is buying WIFI because they think they’ll sell a million $300 iphone covers this quarter, or this year, or ever.

They’re buying it because the pump is hot and heavy and may keep going for a bit, and right now everyone is getting paper rich.

But:

CAVEAT EMPTOR

Three things happen when a stock runs this hard.

- The guys with a lot of stock will eventually give in to the desire to cash out, even if they swore not to

- The other guys with a lot of stock will not want to be the second or third guy out

- When the guys with a lot of stock decide to sell, they’ll also short

This might happen tomorrow.

It might happen next month, or in three months.

But, short of the company pulling off some sort of transformational transaction that justifies the valuation really soon, it will happen.

Godspeed, traders. Get your bag, but keep your head on a swivel.

— Chris Parry

FULL DISCLOSURE: No commercial interest, won’t be buying because the valuation is hard to justify, won’t be shorting because that shit sucks, and won’t be criticizing because there’s nothing inherently wrong with marketing a deal hard, especially when there’s been zero effort to disguise things as a real company and everyone can see right out in the open what game it is being played. Anyone losing money on this one going forward should have no reason to moan about it. Buy the ticket, take the ride.