With the January 2024 inflation data coming out higher and hotter than expected in the US, investors are re-evaluating the battle against inflation. Is it over? Is it too early to declare victory? The Fed has said that the battle is not quite over but progress is going well. But just not well enough for a March rate cut.

After this data, we did see some breakouts in yields:

Keep an eye on those yields. As they rise, they do put pressure on the markets. Remember: yields rising means that bonds are being sold. When bonds are being bought, yields drop. There is an inverse correlation between bond price and bond yields.

If we get further inflation surprises, those yields will likely rise.

AS a technical trader, one chart has stood out, and could increase the risks of an inflation surprise. Yes, I am talking about oil.

Above is the chart of West Texas but Brent Crude has the exact same market structure.

From a simple market structure perspective, we have seen a downtrend with lower highs and lower lows (from September-December 2023) and is now in a range. You can see that the interim trend is up as can be seen with the uptrend line I have drawn. Oil has bounced multiple times here as support.

Resistance is clearly the $80 zone. You can see oil has rejected this zone multiple times in the past few months.

But is this about to change?

Obviously, we will have to watch for a daily candle close above the $80 for a breakout confirmation. However, from a technical perspective, I see bulls putting in a good effort.

Zooming in closer, I want to highlight the engulfing candle we printed just last week. Yes the sellers stepped in defending this resistance. But the next two days saw the bulls jump in and we even had a strong Friday February 16th 2024 daily candle close above the red engulfing candle. Today’s candle is showing a rejection at resistance but expect a battle here.

Can we get a major sell off here and the continuation of the downtrend? Sure. I would watch to see if my trendline gets taken out. I would watch for a close below the $72 zone.

If oil does breakout, then the inflationary repercussions will be obvious. Costs go up as energy goes up. Think of transportation costs and those costs having to be transferred to the consumer. Rising oil prices may lead to the Fed having to keep interest rates higher for longer than the markets expected.

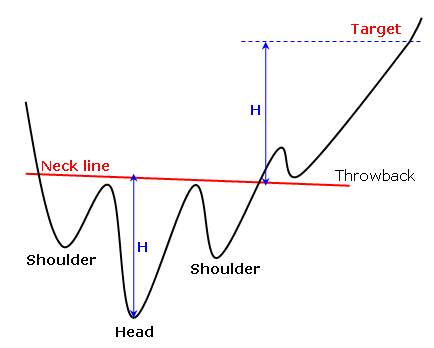

Oh and to add to the bullish case. Oil is displaying a very popular reversal pattern known as the inverse head and shoulders pattern.

Very bullish if oil breaks out.

But let’s talk about a few things.

Last week, we heard that Japan and the UK went into recession. The Euro Zone barely missed a recession. Central Banks have talked about a ‘soft landing’ but let’s be honest. The whole point of raising interest rates was to cause a recession in order to kill demand and money velocity. But will a recession be severe enough to do so?

The US economy has not fallen into recession. US retail sales did fall in January, but US NFP continued to show a strong labor market. These data points are worth watching but many eyes will remain on US CPI given the recent inflation data.

An economic slowdown is negative for oil, but with the US currently bucking the trend, we are seeing oil and even copper rise.

Now just some speculation and random comments on my part.

Let’s talk some geopolitics. Yes, there are things happening in the Middle East. If a major event happens in the region it would be enough to cause a breakout. A Houthi missile did hit a British oil tanker this weekend.

But something I was thinking about has to do with the current geopolitical sphere. East vs West. Relations aren’t the greatest. Russia is a member of OPEC+. Iran, Saudi Arabia, and the UAE are not just members of OPEC+ but also new members of BRICS. If Russia wanted to cause oil prices to rise and cause some confusion regarding monetary policy due to a rise in inflation, this would be the time to do so with traders and investors watching the reversal pattern on oil.

The US could continue to sell off their emergency oil reserves to flood the oil market with supply to bring down prices. And that opens a whole new chessboard if certain members in the East are trying to get the US to commit to a larger conflict. But we won’t go there.

Anyways, watch that oil chart. A breakout could see some fear in equity markets as investors begin to price in an inflation uptick surprise.

Happy trading.