So I feel validated, folks. Regular readers know that I have been covering Japan, and what I believe is a great opportunity for investors. Yes you heard that right. Japan is a great opportunity in 2024.

Last weekend, we had the Vancouver Resource Investment Conference. The final panel was about major investment opportunities. I heard things that I expected like uranium, gold, income producing real estate etc. But Grant Williams, who is talking about the everything bubble and a recession, mentioned Japan. And I think it took most of the audience by surprise. I was in the back nodding my head and had my arms up high celebrating like my favorite WWE superstar.

Just recently, the Japanese stock market, the Nikkei, topped 33 year highs. It has not seen these levels since March 1990. Just think about that for a second. Imagine your investments just fluctuating up and down for 33 years if you were one of those who bought Japanese stocks back in the day when Japan was hot. Since March 1990, many analysts have been calling for the Nikkei to take out previous record highs. And they might finally be correct after the price action in late 2023.

Warren Buffett has bet big on Japan. Grant Williams is bullish Japan. I am bullish on Japan. Here is why you should be too.

Let’s get the technicals in place first before we talk about the fundamental reasons why the Nikkei takes out previous record highs.

This is the monthly chart of the Nikkei. Each candle represents 1 full month of price action. The breakout above the 33,290 zone was when the Nikkei topped 33 year high levels. And you can see from the chart that previous record highs set in December 1989, is in sight.

The Nikkei began this uptrend market structure back in 2014 when it took out the previous monthly lower high.

From a technical perspective, the Nikkei remains in an uptrend as long as it remains above 30,434 which is the current higher low level.

Now that we have the chart out of the way, what are some reasons why the Nikkei is going to make new record highs almost 3 decades later?

Let’s start off with the easy one. A hunt for yield. You can argue that money is running into equities all over the WESTERN allied world. You are seeing record highs in US markets and many European markets. Japan just had a 33 year breakout so money is now betting on an all time record high breakout. The market psychology aspect of this is important, but I think there is much more to why money is running into Japan.

Those who follow the currency markets have probably seen this:

The Japanese Yen is getting smashed against most currencies. The reason has to do with interest rate differentials and overnight swaps. While most of the Western allied world began raising interest rates to tame inflation, Japan has kept rates unchanged at -0.1%. This means anyone who shorts the Yen through the foreign exchange market, or buys any other currency against the yen, makes a pretty penny just in holding overnight due to the interest rate differentials. You can see why many traders and funds who play forex would want to short the yen… and when we are talking tens or hundreds of millions of dollars, the overnight swap return provides a good return.

A weaker yen means Japanese exports look more appealing. And economic theory says that exports should increase. This is a good thing because Japan is an exporting powerhouse. And this is why many market analysts are bullish on Japan. They are attributing the Nikkei’s rise to strong earnings.

A weaker yen tends to help exporter shares as it increases the value of overseas profits in yen terms when companies repatriate them to Japan.

Corporate earnings have been stellar for Companies such as Shiseido, Asahi Group, Uniqlo brand owner Fast Retailing, Sumitomo, Panasonic, Honda, Nintendo just to name a few. Japan has always been seen as the place for value investing because these are good and strong companies which continue to make profits. I say value because Japanese companies tend to keep things the way they are, and rarely change. But with a weaker Yen, foreign money is bullish Japan.

Now one thing which could dent this would be the Bank of Japan raising rates. I say dent because this would be a big move in global markets. One could argue that a rise in Japanese rates might entice Japanese money invested in foreign bonds and markets to come back to Japan. However, I think the rise in Japanese rates would have to be quite substantial in order to elicit that kind of response from Japanese investors.

But remember:

Japan remains the most indebted country in government debt as a percentage of GDP. But can Japan ACTUALLY raise rates given the amount of debt they have? Can the Bank of Japan ACTUALLY normalize rates?

This is what makes the Bank of Japan so intriguing right now. If they want to strengthen the Yen, then raising interest rates helps immensely. But perhaps they will wait it out for other nations to start cutting interest rates. Plus they have a lot of foreign reserves from trade. The Bank of Japan could intervene in the currency markets. Many say the 150-155 level on USDJPY is the Bank of Japan’s line in the sand.

So with the weaker Yen, Japanese Companies are making big bucks. Their stocks are rising which is causing the Nikkei to rise.

Now some argue that the weaker currency is causing the stock market to rise. They point out higher stock markets in hyperinflated nations such as Zimbabwe, Argentina and Venezuela. The truth is that equities tend to rise in periods of inflation because equities can bring in the highest rate of return which can keep up with inflation.

But I think there is a major difference between Japan and these nations. First off, Japanese companies are strong companies. I listed some earlier in this article and I am sure most of you have heard of these companies. These companies are seeing their profits rise due to exports. I don’t see the same for hyperinflated countries. I just see domestic money trying to make a yield and thus jumping in the stock market.

And money flows are very important. Japan is a well developed nation. Heck, it has the 3rd/4th largest economy in the world and its financial markets are well developed. You are seeing foreign money run into the Japanese stock market because of fundamentals. You are not seeing foreign money running into the hyperinflated nations for many obvious reasons but a large part is the fact they know the financial markets and regulations in those countries are poor or sub standard. You can get your money out of Japan.

So the move in Japan is definitely not similar to hyperinflated nations.

So how can one play this?

You can play the Nikkei through futures, or through CFDs (one way I am playing it) in certain parts of the world. As a Canadian, I can trade CFDs.

If you are Canadian you can also bet on the Nikkei through a Canadian hedged ETF. The second way I am betting on Japan.

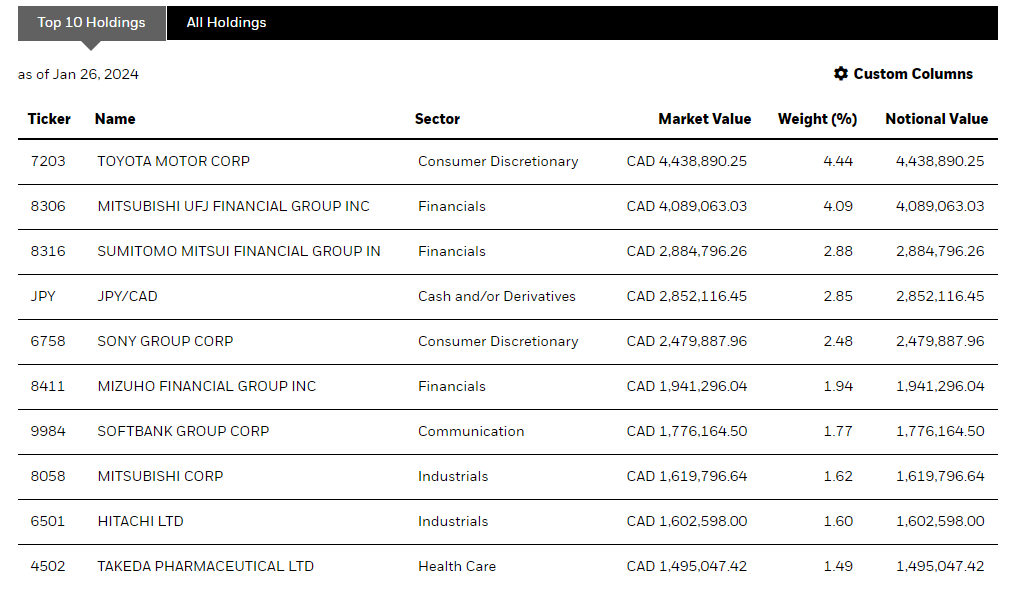

BlackRock has the iShares Japan Fundamental Index ETF traded on Canadian Markets through the ticker CJP.NE. You can read more about the ETF here.

The ETF is making new all time record highs and there is more to go if you bet on the Nikkei to make new all time record highs.

With that said, I hope I have laid out a good case on why I am betting on Japan. The key takeaway is that a weaker Yen is causing Japanese corporate earnings to rise. This is garnering the attention of Warren Buffett and many other foreign investors. This move on the Nikkei is due to this and is not similar to hyperinflated stock markets like Argentina etc.

Let me leave you with one final hypothetical.

Just doing a Fibonacci on the most recent move on the Nikkei gives us these target levels above once we breakout into new all time record highs. Not too shabby.

Happy investing.