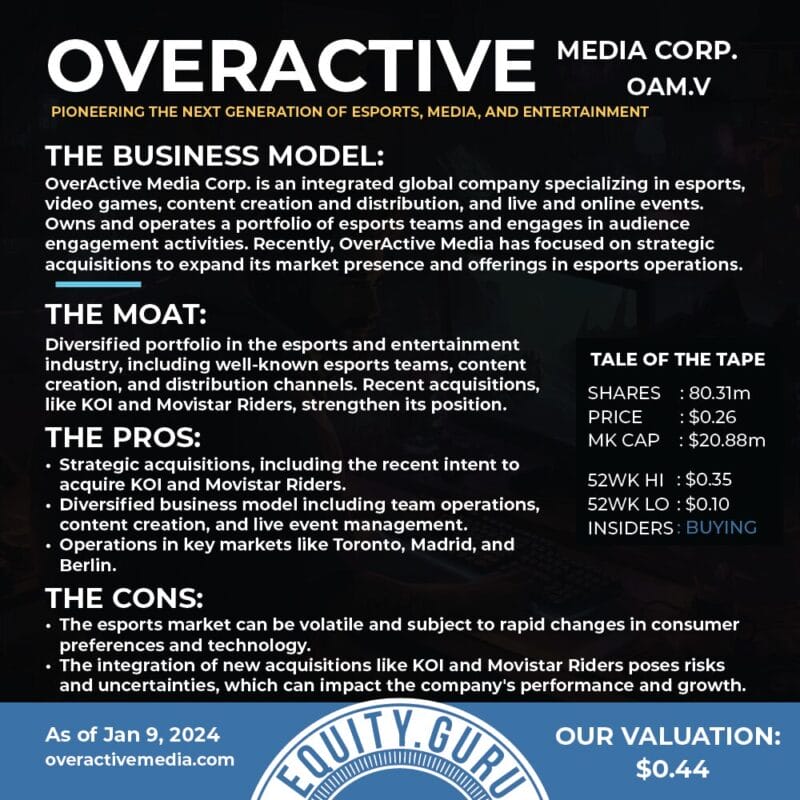

Originally a niche pastime, esports has burgeoned into a global phenomenon, blending technology, entertainment, and sports into an interactive spectacle. Esports’ ascent to mainstream relevance began in the late 1990s and early 2000s with the rise of internet connectivity and online gaming platforms, further propelled by the advent of live streaming services. Marked by organized multiplayer video game competitions, often between professional players and teams, esports has transformed digital gaming into a spectator sport, attracting massive global audiences and significant investment from major brands. Companies like OverActive Media (OAM.V) are working to cut themselves a significant slice of the lucrative global esports market.

What was

Competitive video gaming notably began in 1972 when a competition was held at Stanford University, featuring the game, “Spacewar,” developed in 1962 and played on a minicomputer that looked like it could have been a prop on “Forbidden Planet.” In the 1980s, competitive gaming gained momentum with tournaments involving games like Space Invaders, Donkey Kong, Street Fighter, and Mortal Kombat, drawing thousands of participants and spectators.

The 1990s witnessed a significant evolution in the esports landscape with the introduction of influential games like Unreal Tournament and Counter-Strike, the latter becoming one of the world’s most popular esports games. This era also saw the rise of online multiplayer gaming, especially in the console domain, with services like Xbox Live enabling gamers to compete remotely in titles like Halo 2, paving the way for other online games including Call of Duty.

The 2000s were pivotal for esports, marked by the increased popularity of games like StarCraft and Counter-Strike. The advent of broadband internet and video content, along with new online services, allowed more gamers to connect and compete online. This decade also witnessed the founding of some of today’s most well-known esports teams such as Fnatic, Optic Gaming, T1, and TSM, and the emergence of tournament providers like ESL and Dreamhack. With growing sponsorships, the prize pools and the standard of play in esports significantly rose.

The following decade, the 2010s, saw esports gaining momentum with the rise of MOBA (Multiplayer Online Battle Arena) games like League of Legends and Dota 2, which garnered massive followings. The International, Dota 2’s championship event, for instance, had a prize pool exceeding $34 million in 2019, a testament to the industry’s growth. Additionally, the introduction of games like Rocket League, Overwatch, Fortnite, and Valorant further diversified and expanded the esports scene, with events like the 2019 Fortnite World Cup featuring a $30 million prize pool.

What is

Seems like a home run for anyone involved in the sector, but all that glitters is not gold. Esports, like any emerging tech sector, went through a bubble as investment fervor created overvalued transactions like MTG’s purchase of a 74% share in ESL for $84 million USD and Cineplex snapping up 80% of WorldGaming for $15 million. According to sources, ESL generated approximately $30.62 million in 2019 and brought home a net profit of $630,000, while WorldGaming limped home with $14.2 million in revenues during 2023.

The difficulty of managing a profitable sports organization largely made up of teenage athletes who were still attempting to graduate from high school and the complicated process of generating steady and sustainable revenue, became apparent to investors and the industry suffered for it. However, esports was only down and not out for the count. Smart industry participants evolved their offerings and consolidated the industry. OverActive Media is a prime example of this.

In 2022, OverActive became wrapped up in the industry’s malaise, dropping 82% in the market. Changes had to be made and while others fell by the roadside, OverActive took stock of its troubled involvement with Activision Blizzard owned Overwatch League and streamlined operations, even making a leadership change with Co-founder and CEO, Chris Overholt, stepping down from the captain’s seat.

The company launched a content creator academy with 20 influencers representing the Toronto Ultra, Toronto Defiant and MAD Lions brands. This creator space investment not only gave OverActive the ability to groom new generations of talent, but also added a combined social media reach of 15 million across TikTok, Twitch, YouTube, Instagram, Facebook and Trovo.

Then in November, OverActive temporarily severed ties with the troubled Overwatch League, receiving a $8.26 million CAD termination payment which bolstered the company’s cash position to over $15 million. Now, as I said, this isn’t forever.

OverActive is playing it smart and waiting to see how the next phase of Overwatch esports turns out, as Co-founder and interim CEO, Adam Adamou, commented, “Our commitment to our teams and esports is stronger than ever, and we believe this move is a crucial step to ensuring their continued success. We are eager to share more about our vision for Toronto Defiant and our plans to return to Overwatch esports. We expect more information to come on this front soon.”

This move allowed the company to reinvest in its core business and make accretive acquisitions such as the recently announced non-binding letter of intent with KOI and Movistar Riders for a proposed purchase of assets related to KOI’s esports operations as well as all the issued and outstanding shares of Movistar Riders. Management estimates that once complete this transaction could add $10 to $12 million in revenues in 2024. OverActive also believes that the deal with increase its direct audience reach to over 100 million people across its brand portfolio.

The purchase would give OverActive a slot in the VALORANT Champions Tour EMEA League as well as service agreements with influencer Ibai Llanos plus former footballer and entrepreneur Gerard Pique. Llanos is a bit of a global icon, after co-founding KOI, he operated the third most-followed Twitch channel. Pique is nothing to sneeze at either, a FIFA World Cup Champion, UEFA EURO Champion and three-time UEFA Champions League winner, he founded the wildly popular King’s League in 2022. The King’s League is one of the world’s most-watched sports channels on digital platforms, with over 100 million views in 2023 alone.

“Adding KOI and Movistar Riders to OverActive will solidify our position in Spain, EMEA and Latin America,” said Adam Adamou, CEO, OverActive. “Both brands are active in complementary esports titles, have industry-leading talent and social influence, top-tier relationships, and related services that bring strong synergies across our combined portfolio of assets. We have spent much time with Ibai, Gerard, Fer, Carlos, Gabriel and their respective teams, and we are all aligned in wanting to make an immediate impact through this combination.”

What we think:

What’s this all mean?

The global esports is working its way back from the brink and is projected to hit $5.27 billion USD by 2029, at a CAGR of 20.05% per year. The Asia Pacific region, especially countries like Japan, Korea, China, and India, is expected to emerge as a highly lucrative market for esports, driven by initiatives to promote participation and technological advancements like 5G networks. North America, spearheaded by the U.S., continues to dominate the esports market, with significant contributions expected from leagues such as the Overwatch League and the NA League of Legends Championship Series. However, this growth comes with unique challenges that industry participants must navigate.

For instance, the absence of a unified global standard for organizing tournaments and defining professional criteria can hinder market growth and player development. Additionally, varying regulations across different regions regarding gaming, broadcasting, and monetization complicate the organization of international events. Speaking of global adoption, esports still faces skepticism and cultural barriers in some regions. Tournament organizers will also have to ensure safety and integrity as the online nature of esports makes it susceptible to hacking, cheating, and other cybersecurity threats. Finally, the intense nature of professional gaming can lead to high levels of stress and burnout among players, impacting the longevity of careers and the stability of teams.

Operating in an industry that depends on the fickle nature of technology, fame and entertainment, OverActive has a full plate moving forward if it hopes to succeed. The next 12 months will give a good indication if the company’s efforts are capable of establishing a solid profit generating entity. So investors should take note and put this one on their radar to see where it heads. Remember to do your due diligence and speak with an investment professional before making any portfolio decisions. Good luck to all.