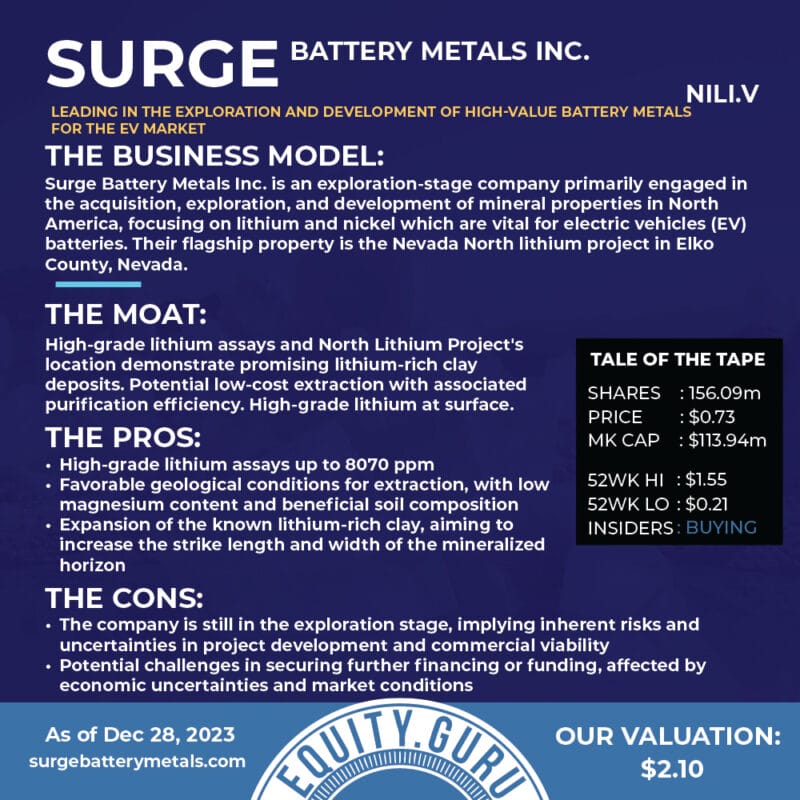

Nevada is part of America’s lithium triangle which extends into California and Oregon. Volcanic and geothermic activity resulted in the creation of lithium-rich brine deposits found in Nevada’s numerous salt flats, including the storied Clayton Valley, home to the only operating lithium mine in the US for years. What was once only used for ceramics, glass and a small selection of industrial products, lithium has become the lynch pin in our transition to renewable energy. In the last thirty years, there has been a proliferation of lithium exploration projects in the state, driven by the EV revolution and the importance of supply chain security. This surge of activity brought about Thacker Pass, one of the largest deposits of lithium in the U.S. Surge Battery Metals Inc. (NILI.V) is a Canadian-based explorer is hoping repeat the discovery success of Thacker Pass with its flagship Nevada North Lithium Project.

The Nevada North Lithium Project located in the Granite Range southeast of Jackpot, Nevada about 73 km north-northeast of Wells, Elko County, Nevada. Drilling in late 2022 revealed a strongly mineralized zone of lithium bearing clays for a strike length of almost 1,620 meters. Soil samples taken at the time showed potential for growth, so the company followed up in 2023 with the aim of increasing the strike length to over 3,500 metres and more than doubling the width from 400 metres to 950 metres.

Assays are still pending but initial results from the first hole had a high of 8070 ppm lithium with an average of 4,067 ppm lithium at a 1,000 ppm cut-off.

Surge Battery Metals’ story is more than a steadily increasing lithium mineral potential, it has pedigreed leadership that turned Millennial Lithium into a $490 million USD takeout target for Lithium Americas. Graham Harris, chairman and director of Surge, has more than forty years of industry experience under his belt, raising more than $400 million in development and venture capital. The remaining management team has over 150 years of combined experience in exploration, development, lithium mining, extraction, processing, government and finance.

What we think:

Surge has added to its land holdings within the boundaries of its North Nevada Lithium Project when it announced recently that it had signed two mineral property purchase agreements to purchase a total twenty-five (25%) of the mineral rights to private lands comprising approximately 880 acres.

In mid-December, the company also announced the commencement of additional mineral processing test work on 2023 drill samples from its high-grade lithium clay discovery at Nevada North. Testing is aimed at determining at a bench scale how the mineralized material can be processed to separate the lithium from the mineralized rock, and from there to refine and optimize the conceptual flow sheet to produce a saleable product. The end goal is to precipitate lithium carbonate from the leach solutions to simulate the full extractive process at a bench scale.

Lithium exploration has never been in a better place in the U.S. as the Inflation Reduction Act set aside $70 billion in funds for critical domestic supply chains. The $7,500 government rebate on the purchase of EVs further fuels the sector by incentivizing end users of the revolutionary mineral.

Surge Battery Minerals has tremendous opportunity to capitalize on this cultural trend as it preps to provide its maiden reserve estimate for Nevada North in Q1 2024. If those numbers work out as expected, it could be an incredible year for the company and those who have invested in it. As always, do your due diligence and speak with an investment professional before making any portfolio decisions. Good luck to all.