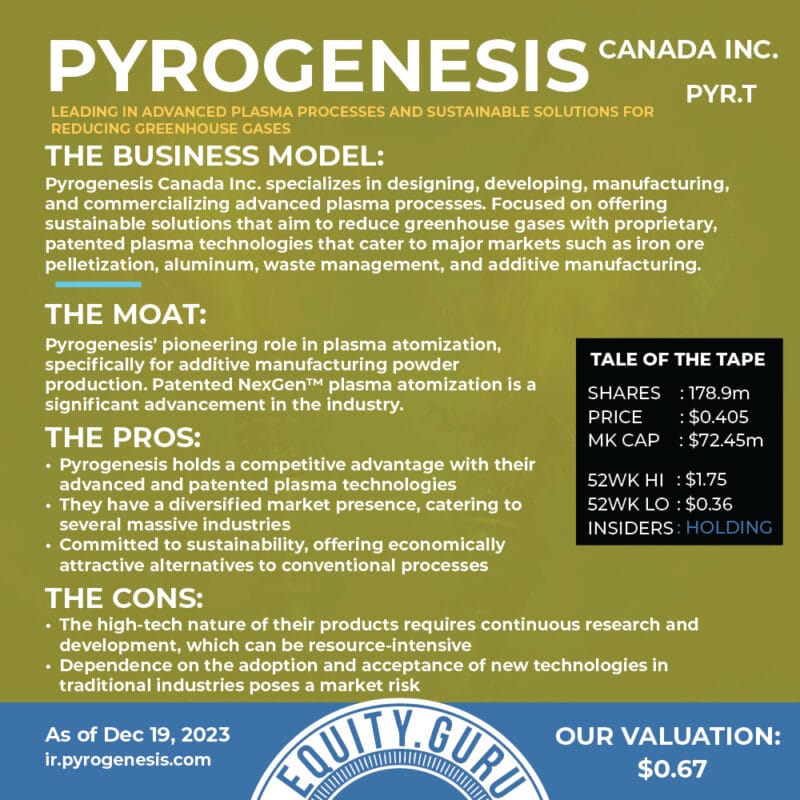

According to the EPA, 7.6 billion tons of industrial waste is generated every year in the U.S. across a broad spectrum of sectors and over 60% of that goes into landfills. Waste in landfills creates a host of environmental issues including greenhouse gas emissions of methane, groundwater and soil contamination where industrial chemicals leach into the environment, air pollution from such things as volatile organic compounds (VOCs). Aesthetically, landfills are an eyesore requiring long-term monitoring and maintenance to manage on-going environmental impacts. Companies like Pyrogenesis Canada Inc. (PYR.T), are working to provide environmentally responsible and sustainable alternatives to the “bury it and forget it” waste tradition.

Pyrogenesis is pioneering the field of plasma torch gasification of industrial waste, where the plasma, approximately as hot as the surface as the sun, burns the waste cleanly without producing harmful byproducts. The company, based out of Montreal, Quebec, has been innovating waste management for 30 years and has a multi-pronged business model that includes:

- Iron Ore Baking

- Upstream iron ore producers turn lower quality ore into marble sized pellets (pelletization) for transportation and later use in blast furnaces

- Biogas upgrading and desulphurization

- Pyro Green-Gas’ landfill biogas upgrading, purification, desulphurization, and pollution control systems convert landfill methane into RNG

- Aluminum Re-melting

- Plasma-heated re-melting furnace for secondary aluminum producers and recyclers

- Coke-oven gas conversion for steelmaking

- Plasma torches can replace gas burners in various steps of the iron and steel process

- Aluminum dross processing

- Patented hot dross Drosrite™ systems recover 98% of the aluminum in dross –a 20% higher rate, a 50% lower opex, a lower carbon footprint, and without the aluminum-contaminating salt required by the traditional method allowing for on-site in-line processing without leaving the factory.

- Titanium metal powders

- Patented NexGen™metal powder production system increases output, lowers cost, and improves yield of high-quality titanium powder.

- Shipboard waste destruction

- PyroGenesis PAWDS system safely destroys paper, plastic, food, oily rags, wood, and waste-oil on-board ships, with zero emissions.

- Solid and hazardous waste destruction

- SPARC destroys refrigerants and chemicals cleanly with no incineration, to 6N efficiency (99.9999%)

- Aluminum dross residue valorization

- Chemical residues, if treated correctly, can safely uncover raw chemicals that can be sold back into the market, or valorized.

- Aluminum spent pot lining valorization

- Transforms the spent lining into synthesis gas and aluminum fluoride: reusable raw materials.

What we think:

Pyrogenesis is in a highly competitive sector and some of its competitors have deeper pockets, but Pyrogenesis has innovation on its side and a growing relationship with the U.S. Navy. The company also has access to international markets in Italy and India with potential for further expansion. The challenge for the company over the next 12 months is the continued commercialization of its patented technologies while keeping R&D costs within reason. The continued mediation of internal process weaknesses will also add strength to the company’s bottom line, giving it room to further innovate the sector.

So how big are the markets its attempting to address? Well, the global waste-to-energy market is forecast to reach $52.67 billion USD by 2028; the global additive manufacturing market is expected to hit around USD 95.62 billion by 2032; and the global precious metals e-waste recovery market is expected to reach $13.91 billion in 2030.

That said, Pyrogenesis reported a comprehensive loss of $6.27 million in Q3 2023 compared to a loss of $4.1 million, in Q3, 2022. This $2.2 million increase is primarily attributable to:

- a decrease in product and service-related revenue of $2.0 million arising in Q3, 2023,

- an increase in cost of sales and services of $1.0 million, primarily due to a decrease in employee compensation, subcontracting, and manufacturing overhead and other, offset by the increase in direct materials, foreign exchange charge on materials, and amortization of intangible assets,

- an increase in SG&A expenses of $1.7 million arising in Q3, 2023 primarily due to an increase in the allowance for credit loss of $2.8 million, offset by decreases in professional fees, other expenses, and foreign exchange charge on materials,

- a decrease in share-based expenses of $0.3 million,

- an increase in R&D expenses of $0.4 million primarily due to an increase in employee compensation, materials and equipment, and other expenses,

- an increase in finance costs of $0.03 million in Q3, 2023 primarily due to the interest and accretion on the convertible debenture and royalty receivable,

- a favourable variation in the fair market value of strategic investments of $3.0 million.

Okay, Pyrogenesis isn’t making a profit and there is no near-term probability that it will do so, therefore, it will have to continue financing its efforts in the markets with the potential of share dilution. However, it provides a necessary service with worthwhile IP, therefore holds value and a very real potential for not only attaining a healthy EBITDA, but becoming an industry leader down the road. Remember, do your due diligence and speak with an investment professional before making any investment decision. Good luck to all.