According to the U.S. Environmental Protection Agency (EPA) the U.S produces more than 260 million metric tons of municipal waste each year.

These mountains of trash release 58 million cubic feet of methane daily.

That’s equivalent to the CO2 emissions from 21 million cars driven for one year.

The Circular Economy is a model of production and consumption whereby materials that are already in circulation are re-purposed to create new products.

The shift to the Circular Economy is gaining traction as an investing theme.

The issue of single-use-plastic has penetrated the general psyche.

“Sometimes I think about how the plastic packaging from a salad I had on a random Tuesday ten years ago is still out there somewhere,” writes Rachel Kitchin. “And I feel horrible.”

Another major tail-wind is regulatory.

Jurisdictions across the North America have instituted bans and fees on various types of plastics including bags, carryout containers, polystyrene and straws.

As federal plastic bans spread across the globe, the market for bio-degradable plastic alternatives is expanding dramatically.

“The circular economy provides a tangible framework for reducing our impacts, protecting ecosystems and living within the means of one planet,” states the 2020 Circularity Gap Report.

As landfills reach capacity, federal governments around the world are pushing diversion programs to the forefront.

Here is a round-up of some innovative “Circular Economy” companies.

WestRock (WRK.NYSE) is a $13 billion company that manufactures sustainable paper and packaging solutions.

WestRock has big customers in North America, South America, Europe, Asia and Australia.

- Record net sales of $4.8 billion increased 14% compared to the prior year quarter

- Net income of $250 million increased 40% compared to $179 million in the prior year quarter

- Adjusted Segment EBITDA of $811 million increased 15% compared to $708 million in the prior year quarter

- Earned $0.93 per diluted share and $1.00 of Adjusted Earnings Per Diluted Share, an increase of 35% and 32%, respectively, compared to $0.69 per diluted share and $0.76 of Adjusted Earnings Per Diluted Share in the prior year quarter

- Record third quarter North American per day box shipments increased 9% compared to the prior year quarter

- Successfully implementing published price increases across all major paper grades; pricing realization outpaced inflation in the quarter

- Generated net cash provided by operating activities of $751 million and Adjusted Free Cash Flow of $554 million compared to $740 million and $508 million, respectively, in the prior year quarter

- Reduced total debt by $270 million and Adjusted Net Debt by $482 million

“We saw strong demand for our products and solutions across our targeted end markets, and pricing gains outpaced inflation in the quarter,” stated CEO David B. Sewell, “It was another quarter of strong cash flows.”

“We remain well positioned for success and are committed to accelerating the opportunities we see across our differentiated portfolio,” added Sewell, “Innovating to develop new sustainable, fiber-based packaging solutions and driving productivity to generate improved returns.”

A month ago, WestRock partnered with Heinz to Remove 550 Tonnes of Plastic Packaging from Multipacks in UK Supermarkets as Part of £25 Million Investment in More Sustainable Solutions.

“Heinz has announced today that it is continuing its mission to remove plastic from supermarket shelves with the UK roll-out of the Heinz Eco-Friendly Sleeve Multipack, a new, convenient, super skinny paperboard sleeve for all its multipack canned products,” stated the PR.

Made with WestRock’s PEFC-certified CarrierKote® paperboard, the Heinz Eco-Friendly Sleeve is recyclable and comes from sustainably managed forests.

The RealReal (REAL.NASDAQ) is a $1.18 billion company that operates the world’s biggest online marketplace for authenticated, resale luxury goods, boasting an astonishing 20 million members.

The RealReal provides a safe and reliable platform for consumers to buy and sell their luxury items. REAL employs in-house gemologists, horologists and brand authenticators who inspect thousands of items each day.

“As a sustainable company, we give new life to pieces by thousands of brands across numerous categories—including women’s and men’s fashion, fine jewelry and watches, art and home—in support of the circular economy,” states REAL.

“We make selling effortless with free virtual appointments, in-home pickup, drop-off and direct shipping.”

Financial Summary for September, 2021

- September Gross Merchandise Volume (GMV) was approximately $127.3 million, an increase of 44% Y/Y and 44% compared to the same period in 2019.

- September Average Order Value (AOV) was approximately $481, an increase of 9% Y/Y and 10% compared to the same period in 2019.

- Watches, women’s shoes and women’s apparel were the fastest growing categories in September, which collectively represented approximately half of total GMV.

- Q3 Gross Merchandis Volume was approximately $367.9 million, an increase of 50% Y/Y and 46% compared to the same period in 2019.

“Similar to our August results, our September GMV reflects continued strength in our women’s apparel and shoe categories, as well as increased strength in the watch category,” stated Julie Wainwright, founder and CEO of The RealReal, “At-home supply continued to increase as a percent of total supply in September, which positions us favorably in advance of the fall and holiday shopping seasons,” said.

The RealReal believes that disclosing monthly GMV and AOV will provide additional transparency regarding the effects of the COVID-19 pandemic on its business.

On October 04, 2021 The RealReal founded National Consignment Day to raise awareness of the importance of resale in creating a more sustainable future for fashion and to drive shoppers to take action by recirculating items they no longer wear.

“Fashion is one of the top polluting industries, contributing 10% of the world’s total carbon footprint,” stated REAL, “Clothing production has approximately doubled in the last 15 years to 80 billion garments per year. A garbage truck’s worth of textiles is landfilled or burned every second, even though 95%of trashed clothes could be re-worn, recycled or reused.

“It’s time to get real about the future of fashion. If the industry continues on its current trajectory, its share of the world’s carbon footprint could jump to 26% by 2050 and it will miss the 1.5-degree pathway laid out by the Paris Climate Accord by more than 50%,” declared Wainwright.

Sims Ltd (SGM.ASX) is a $2.86 billion company that is a leader in metal recycling and electronics recovery, and an emerging leader in the municipal recycling and the renewable energy industries.

SGM’s objective is to “create a world without waste to preserve our planet.”

“Our business model is built on the premise that purpose and profit go hand-in-hand. They are not an either/or proposition,” stated Sims Limited CEO and Managing Director Alistair Field, “Guided by our purpose, we are entering into new adjacencies and creating new business opportunities that enable the circular economy by helping to keep resources in use at their highest possible value for as long as possible.”

“We identified three pillars – Operate Responsibly, Close the Loop, and Partner for Change — after conducting a thorough materiality assessment with our stakeholders in FY19. We also are rolling out goals and performance indicators under each pillar, so that we can measure and track our progress,” Field said.

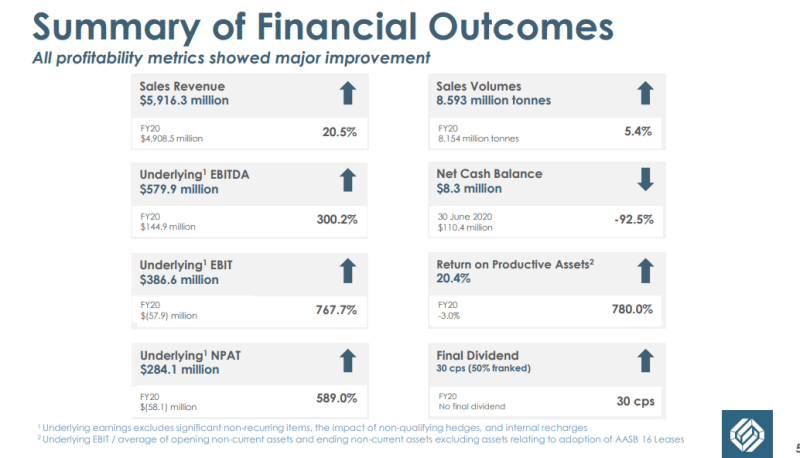

SGM has full year 2021 sales of about $5.9 billion.

Loop Industries (LOOP.NASDAQ) is a $600 million company with a mission to “accelerate the world’s shift toward sustainable PET plastic and polyester fiber and away from our dependence on fossil fuels.”

Loop Industries owns patented and proprietary technology that depolymerizes no and low-value waste PET plastic and polyester fiber, including plastic bottles and packaging, carpets and textiles of any color, transparency or condition and even ocean plastics that have been degraded by the sun and salt, to its base building blocks (monomers).

The monomers are filtered, purified and polymerized to create virgin-quality Loop™ branded PET resin suitable for use in food-grade packaging and polyester fiber, thus enabling our customers to meet their sustainability objectives.

Loop Industries is contributing to the global movement towards a circular economy by reducing plastic waste and recovering waste plastic for a sustainable future.

On October 15, 2021 Loop published a business update.

Loop recently partnered with iconic global beverage brand evian, unveiling a new “evian Loop” prototype virgin-quality water bottle made from 100% recycled content.

The monomers used to produce the evian Loop bottles were made at Loop’s small-scale production facility in Terrebonne, Quebec. Evian plans to begin selling water bottles made from Loop™ PET initially in South Korea next year, and subsequently in other global markets.

The waste plastic used to produce these bottles include polyester fibers from carpets and clothing which are considered unrecyclable and destined for landfill and other natural environments.

On May 27, 2021, Loop acquired a 19 million square foot parcel of land in Bécancour, Québec for approximately $4.9 million. The site is located near existing industrial infrastructure, which reduces project costs, permitting time and does not result in the destruction of wetlands or forest. Loop intends to use the proceeds from SKGC’s strategic investment toward the funding of its planned Infinite Loop™ manufacturing facility at this recently acquired site.

On August 31, 2021 Loop also received a NOL from Health Canada, which states that the PET produced by Loop’s recycling process is suitable for use in the manufacture of water bottles and articles for contact with all food types under all conditions of use. In this letter, Health Canada confirms it sees no reason to object to the use of Loop’s recycling process, provided it is technically suitable for the intended end-uses.

“Our ‘design one, build many’ engineering philosophy will allow for multiple facilities to be built within a similar timeframe,” stated Daniel Solomita, Founder and CEO of Loop Industries, “We see modular construction of our facilities as another important pillar as it will enhance time to market and reduce risks associated with construction execution and delays.”

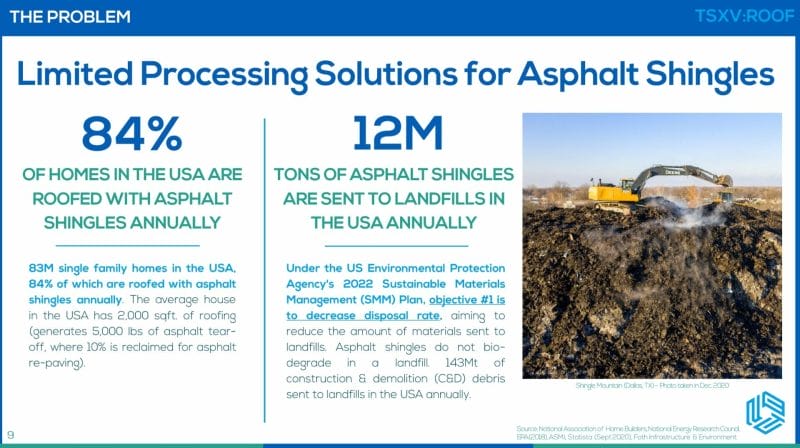

Northstar Clean Technologies (ROOF.V) is focused on the recovery and repurposing of single-use asphalt shingles. Northstar recently raised $12.24 million and subsequently listed on the TSX Venture Exchange.

Northstar’s Bitumen Extraction and Separation Technology (BEST) uses a proprietary process to separate the liquid asphalt, fiber and aggregate sands from discarded or defective asphalt roofing shingles destined for landfill.

Northstar has a fully constructed facility in Delta, BC in the commercialization phase with steady-state production expected in Q4 2021.

ROOF has five expected revenue streams: 1. tipping fees (paid by waste haulers and roofing contractors), 2. Sale of Asphalt, 3. Sale of Fiber, 4. Sale of Aggregate and 5. Carbon credits.

The market size for asphalt shingles in the U.S. is CAD $2.2 billion.

On July 27, 2021 Northstar announced that it has engaged Wellington Dupont Public Affairs to lead government engagement on the reduction of single-use asphalt shingle disposal into landfills across Canada.

“Wellington will support federal, provincial, and municipal engagement on the execution of the Northstar’s expansion plans across North America, in addition to evaluating various potential non-dilutive funding strategies, including government grants, to support expansion plans,” stated Northstar.

On October 21, 2021 Northstar announced the completion of commissioning runs at its Empower Facility in Delta, British Columbia.

“The commissioning successfully demonstrated the operation of the Company’s proprietary process design technology, with the commissioning runs processing asphalt shingles into oil, aggregate and fiber,” stated ROOF, “The two weeks of commissioning runs were also successful in identifying the areas of the process requiring additional optimization to move the Empower facility to steady state production.

“We remain confident that our proprietary, next generation Bitumen Extraction Separation Technology (“BEST”) works, and we also have a clear path to steady state production,” stated Mr. Aidan Mills, CEO of Northstar, “which we expect to achieve in the first quarter of 2022.”

“The preliminary results of the engineering RFP process have been very encouraging and we are confident we will have a strong partnership to announce in the next few weeks,” added Mills.

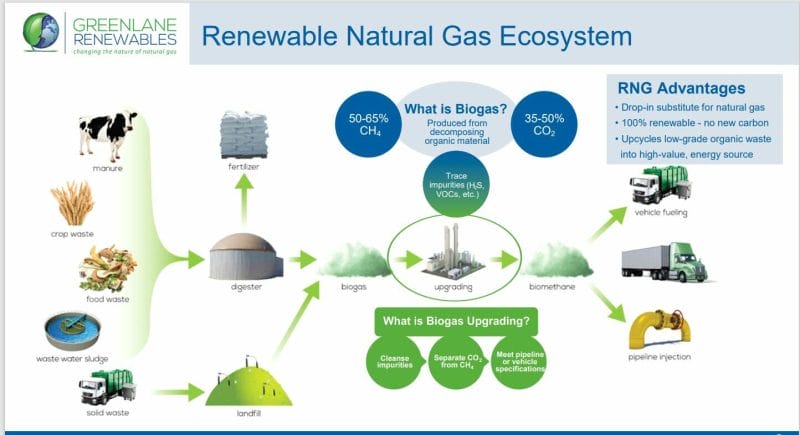

Greenlane Renewables (GRN.T) is a $243 million company providing biogas upgrading systems that are helping decarbonize natural gas.

GRN’s systems produce clean, low-carbon and carbon-negative renewable natural gas from organic waste sources including landfills, wastewater treatment plants, dairy farms, and food waste, suitable for either injection into the natural gas grid or for direct use as vehicle fuel.

Greenlane is the only biogas upgrading company offering the three main technologies: waterwash, pressure swing adsorption, and membrane separation.

On September 16, 2021 Greenlane Renewables announced that its 100%-owned subsidiary, Greenlane Biogas North America has signed with Green Impact Partners, through its EPC contractor, a biogas upgrading system supply agreement for $6.1 million (US$4.8 million) for a renewable natural gas (RN) project in the State of Colorado.

Green Impact Partners’ GreenGas Colorado Project consists of two dairy farms, broke ground in July 2021, and has an expected completion date in the second half of 2022. The project will utilize two of Greenlane’s pressure swing adsorption (“PSA”) upgrading systems, one for each of the two dairy farms in the project. Greenlane’s order fulfillment for this project will commence immediately.

“We’re excited to work with Green Impact Partners on its GreenGas Colorado project to showcase our market-leading biogas upgrading systems,” stated Brad Douville, President and CEO of Greenlane. “RNG is a rapidly growing industry with new entrants and increasing amounts of project capital being deployed.”

Q2, 2021 Financial Highlights:

- Record revenue of $12.6 million, an increase of 200% over the $4.2 million reported in the second quarter of 2020.

- Gross profit of $2.9 million, Gross margin1 of $3.2 million (26% of revenue).

- Net loss of $1.1 million (or $0.01 per share).

- Adjusted EBITDA of $0.1 million2.

- Sales order backlog3 of $41.9 million as at June 30, 2021.

- Sales pipeline4 valued at over $800 million as at June 30, 2021.

- Cash and cash equivalents of $36.5 million and no debt, other than payables and bonding resulting from normal course operations, as at June 30, 2021.

- The Company announced new contract wins totalling $16.0 million in the quarter for the supply of biogas upgrading systems for a wastewater treatment plant and first commercial-scale project in Colombia, the 19th country that Greenlane has sold upgrading equipment into, a project in Spain and a large landfill gas-to-RNG project in the United States.

- Subsequent to June 30, 2021, the Company announced new biogas upgrading system supply contract wins totalling $12.8 million for three more projects in the United States.

“From a profitability standpoint, over the last 18 months, our quarterly revenue growth rate has been 3.4 times greater than the quarterly growth rate in operating expense1, generating positive adjusted EBITDA starting in Q4 2020,” stated Douville.

GRN has active system sales opportunities of $800 million.

On September 27, 2021, The Circular Plastics Taskforce completed the first phase of its efforts to implement a circular economy for plastics in Quebec and Canada.

Last year, the Canadian government announced a federal ban of single-use plastic products, with regulations to be finalized by the end of 2021.

Every year, Canadians discard 3 million tonnes of plastic waste, and only 9% gets recycled. Single-use plastics make up most of the plastic litter that is found in lakes and rivers. Every year, Canadians use 14 billion plastic bags and 20 billion straws.

Currently, 35 countries have banned single-use plastics completely, including France, the U.K. and Bangladesh.

In Kenya, anyone selling plastic bags risks a four-year prison term.

In the investing community, the circular economy is having a moment.

As we have learned (graphene, cannabis, blockchain etc.) having a weak business model in a hot sector leads to much shareholder bleeding.

WestRock, The RealReal, Sims Ltd, Loop Industries, Northstar and Greenlane Renewables have distinguished themselves through market penetration, strong financials or innovative proprietary technology.