Helium was one of the top commodity performers of 2022, and with recent supply imbalances, many investors are looking to cash in on the helium demand.

First off, why helium? (By the way, we are not talking about the Helium (HNT) cryptocurrency).

So what exactly is helium? After hydrogen, helium is the second most abundant element in the universe. It is also the second lightest making it easy to slip out of the Earth’s atmosphere. A lot of it is found deep under the Earth’s crust, and actually, in the same layer where natural gas is found. This is why helium mining occurs near current gas lines.

Extraction can be a challenge:

Helium is mined along with natural gas, using a drill rig to drill wells deep into the earth’s crust. A drill rig must penetrate a layer called the Cap Rock to reach a natural gas reserve. Once located, the natural gas and Helium rise and fill the rig, which are then led through a series of piping systems that transport the natural gas and crude Helium to a refining plant.

Most crude Helium tapped from natural gas reserves is only around 50% pure, so other gases must be separated through a scrubbing process. There is a significant amount of Nitrogen in crude Helium, as well as methane gases that must be removed. Cryogenic separation units compress the crude Helium, cooling the gases at subzero temperatures until they are liquified. Once liquified, the Nitrogen and methane gases are drained.

After this cooling process, heat and Oxygen are added to remove any Hydrogen left over. When Hydrogen and Oxygen molecules meet, they create water. The gases undertake an additional cooling process, in which the Hydrogen and Oxygen are drained from the mixture. Once Helium has gone through each of these steps, tiny particles are added to complete additional purification until the Helium reaches 99.99% purity.

Helium has many important applications. One intriguing thing for investors is the fact that helium cannot be substituted for many of these applications! We are talking about helium being used to cool magnets in MRI machines and in manufacturing semiconductor chips. Industries such as aerospace, fiber optics and welding all need a bit of the helium. Hence, shortages will be a real problem.

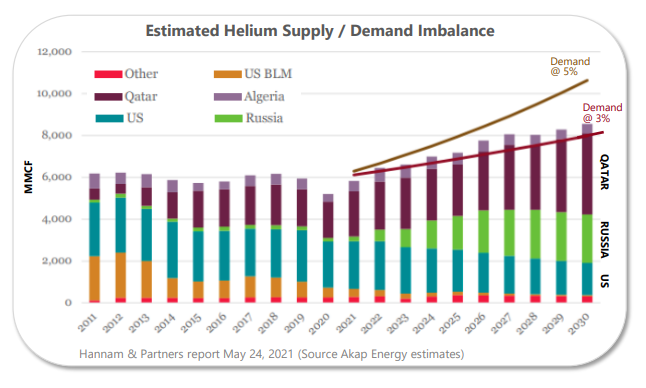

Helium supply has tightened and prices have climbed in recent years, owing in part to the gradual depletion of the U.S. strategic helium reserve along with a cascading series of four global helium shortages since 2006.

With the fundamental backdrop of less supply and high demand, helium prices will remain buoyed. Here are the other uses for Helium:

1. Heliox mixtures in respiratory treatments for asthma, bronchitis and other lung deficiencies

2. MRI magnets

3. High speed Internet and Cable TV

4. Mobile phone, computer and tablet chips

5. Computer hard drives

6. Cleaning rocket fuel tanks

7. Microscopes

8. Airbags

9. Detecting leaks, such as in the hull of a ship

10. Shielding in welding

A recent headline regarding helium which turned the heads of investors came from the land down under. The only helium production plant in the southern hemisphere located in Darwin, Australia has shut down after its gas supply was exhausted. BOC had been producing helium as a by-product from the Santos-owned Darwin LNG plant since 2010.

Australia will still get its helium, but it must be imported. This will likely mean it will cost more due to transportation versus being produced domestically.

BOC’s Darwin helium plant produced about 3 percent of the world’s helium supply, far behind the United States and Qatar which dominate the global helium market.

But for us Canadians, there has been a rush of activity in Alberta and Saskatchewan as helium startups on the Prairies hope to keep domestic supplies afloat. And this means an investing opportunity for us.

Canada is a player in this field. As Equity Guru’s Gaalen Engen mentioned in his recent Helium Shortage 4.0 article:

The U.S. Geological Survey has estimated that Canada hosts helium resources of approximately 70 billion cubic meters, making it the fifth largest helium reserve in the world. Most of these reserves are in Saskatchewan, but parts of Alberta, BC and Manitoba have shown good potential for development.

The Government of Saskatchewan launched its Helium Action Plan at the end of 2021 with the aim of being able to supply 10% of the global helium market by 2030. The provincial governing body also expanded the Saskatchewan Petroleum Innovation Incentive program to include helium projects.

To further cement Saskatchewan’s position as helium leader in Canada, North American Helium opened its $30 million CAD Battle Creek Helium Purification Facility, the largest facility of its kind north of the 49th parallel.

That same year, Royal Helium (RHC.V), an explorer based in Saskatchewan, announced a helium discovery at its Climax project, noting it had the potential to be one of the largest helium discoveries in the province’s history.

In October 2023, five helium startup companies came together to form the Helium Developers’ Association of Canada, an industry group representing companies at various stages of exploration and production.

The group believes Canada has the resources and know-how to become a greater player in the global helium market, and says it is particularly well-suited to producing helium for North American consumption. It’s pushing for favourable government policies to ramp up production as soon as possible.

But other nations such as Russia and Qatar are also ramping up production. This means the world could see oversupply later on in this decade. However, Canada would be a stable, friendly, and valuable provider for helium. And factoring in geopolitics, Canada would ensure the supply of Helium to the United States and North America.

Here are three Canadian Helium stocks that investors should keep an eye on in order to make gains from the helium trend.

Royal Helium (RHC.V)

Market Cap ~ $54 million

Royal Helium is an exploration, production, and infrastructure company with a primary focus on the development and production of helium and associated gases. The Company controls over 1,000,000 acres of prospective helium permits and leases across southern Saskatchewan and southeastern Alberta, making them one of the largest helium leaseholders in Canada.

All of Royals’ lands are in close vicinity to highways, roads, cities and importantly, close to existing oil and gas infrastructure, with a significant portion of its land near existing helium producing locations.

Royal Helium’s helium reservoirs are carried primarily with nitrogen. Nitrogen is not considered a greenhouse gas (GHG) and therefore the plant has a low GHG footprint when compared to plants in other jurisdictions that rely on large scale natural gas production for helium extraction. Helium extracted from wells in Saskatchewan and Alberta can be up to 90% less carbon intensive than helium extraction processes in other jurisdictions.

Royal is well positioned to be a leading North American producer of this increasingly high value commodity.

The stock is clearly in a downtrend with a major gap being formed in November 2023. This came from a private placement.

Recently, the stock closed and broke below a major support zone around $0.205. Now, the stock has pulled back to retest the breakdown zone. In technical terms, one would expect to see sellers pile in here and force another leg lower. The next support target would come in much lower around the $0.10-$0.12 zone.

But the stock could turn things around.

We would want to see a daily candle close back above this $0.205 zone. This would signal a false breakdown, and the bulls taking back control. A close above $0.22 would see us take out the current lower high, the price level which keeps the downtrend going. The final bullish trigger would be a gap fill with the stock closing above $0.27.

Avanti Helium (AVN.V)

Market Cap ~ $33 million

Avanti Helium is focused on the exploration, development, and production of helium across western Canada and the United States. Its exploration and development assets include approximately 78,000 acres within the Greater Knappen area, which covers land in both Southern Alberta and Northwest Montana, US. It also owns approximately 63,000 acres of prospective helium permits within Southwest Saskatchewan.

Avanti’s Sweetgrass pool project in Montana is on track to achieve helium production in the first half of 2024, the company reported in October. Avanti is working on obtaining a finalized offtake agreement for production at Sweetgrass. This means cashflow coming into sight.

The stock also gapped down in early November 2023 on financing news.

Now, the stock is within a range with support at $0.36 and resistance at $0.44. Bulls want to see a daily close above $0.44. However, there is a large gap that the stock would need to fill. Gaps tend to be an area of resistance which sees sellers jump in. BUT, if bulls can close and fill the gap, then it is a very bullish sign. This means the stock needs a close above the $0.50 zone in order to fill the gap and see the bulls take control.

Desert Mountain Energy (DME.V)

Market Cap ~ $29 million

Desert Mountain Energy is engaged in the exploration, development and production of helium, hydrogen and noble gas projects in North America. The Company is primarily looking for elements deemed critical to the renewable energy and high technology industries.

It holds interest in the Holbrook Basin helium project covering an area of 74,421 acres located in Eastern Arizona. The project is in Holbrook Basin, which is dubbed the “Saudi Arabia of helium,” which is a reference to its rich supply potential. The region is known for its high purity, which is easily eight to ten times higher than the industry average.

An interesting technical pattern and perhaps one which could trigger relatively soon. The stock is ranging and basing and is now forming a triangle pattern. A break and close above the trendline would trigger this breakout pattern. The next major resistance would come in around the $0.50 zone.