Marvel Discovery Corp (MARV.V) has had it challenges on the public market over 2023. Even though the company’s SP rose 12.5% over the last five days to $0.045 CAD per share, YTD Marvel’s value declined 50% leaving the junior explorer with a diminished market cap of $4.99 million.

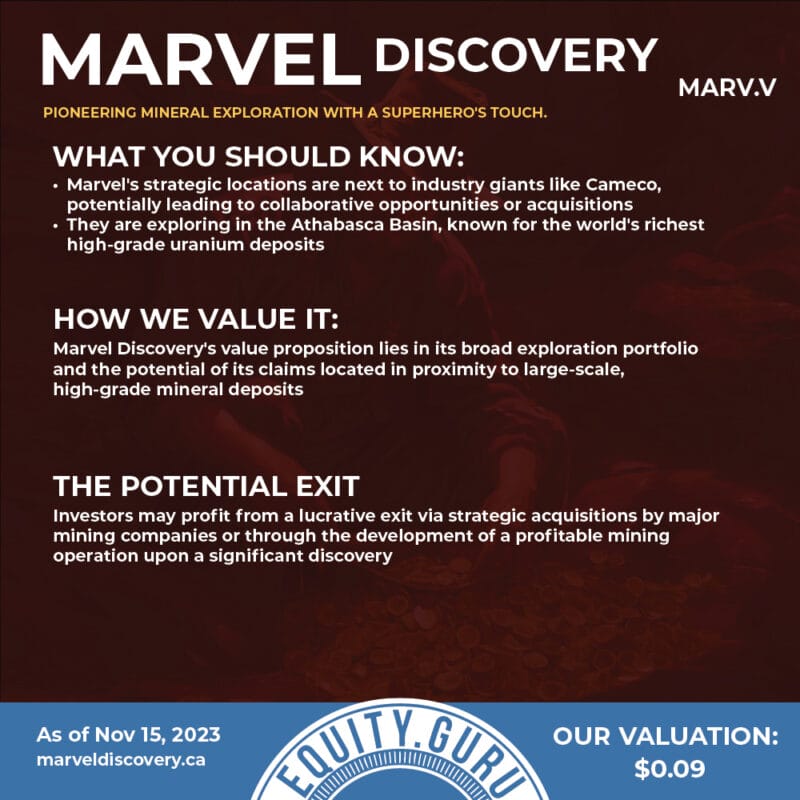

This doesn’t mean the miner hasn’t been busy, the company expanded its portfolio with the acquisition of the Costigan Lake Uranium Property in the storied Athabasca Basin while it grew its land holdings at the KLR-Walker Uranium Project.

Here’s what we see:

Back at the end of October, Marvel announced that it and its JV partner, Falcon Gold, received assay results from the late spring, early summer 2023 exploration program conducted at the Kraken project located in Southern Newfoundland. Samples from the first pass reconnaissance program identified multiple anomalies including a gold-silver-copper-lead-arsenic anomaly, multiple tungsten and molybdenite anomalies as well as multiple critical and rare earth anomalies including beryllium, cerium, lanthanum, lithium, niobium, tantalum, vanadium and zirconium.

An summary of the exploration effort concluded that:

- 16.9% of results deemed anomalous for Lithium, with highest Lithium returning 143ppm

- 5.6% of results deemed anomalous for Lanthanum, with highest Lanthanum returning 84ppm

- 9.0% of results deemed anomalous for Cerium, with highest Cerium returning 162ppm

- 33.1% of results deemed anomalous for Tantalum, with highest Tantalum returning 29ppm

- 33.1% of results deemed anomalous for Niobium, with highest Niobium returning 110ppm

- 74.2% of results deemed anomalous for Beryllium, with highest Beryllium returning 83ppm

Multiple sample stations returned anomalous Zirconium (up to 442ppm Zr), Vanadium (up to 165ppm V), Barium (up to 2706ppm Ba), Tungsten (up to 581ppm W), Molybdenite (up to 100ppm Mo) and Bismuth (over limit >1,000ppm Bi) - Silver-Gold-Copper-Lead-Arsenic anomaly with up to 49.6ppm Silver, 17ppb Gold, 1,556ppm Copper, 1,497ppm Lead and 325ppm Arsenic

CEO, Karim Rayani, commented on the results, “To get numbers like these on a first phase sampling program is truly remarkable, we were focused on gold and lithium, and to have found multiple new rare and critical element discoveries in the camp suggests a significant potential for further discovery is within this treasure chest. The Hope Brook project is surrounded by multi-million-ounce deposits held by Matador and First Mining and to think we have not even touched 5% of the project. We look forward to reporting on our next phase plans once all data has been analyzed.“

Marvel Discovery announced a non-brokered private placement of $750,000 CAD by issuing up to 12 million flow-through units and up to 3.75 million non flow-through units. Each FT unit consists of one FT share and one-half of one share purchase warrant. Each full warrant will entitle the holder to purchase one non FT share at a price of $0.10 per share for a period of two years from the closing date.

Each NFT unit is priced at $0.04 per unit and will consist of one NFT share and one share purchase warrant. Each warrant will entitle the bearer to purchase one NFT share at a price of $0.075 for a period of two years from the closing date.

Gross proceeds from the FT units will be earmarked for exploration and development of the company’s projects in Quebec and the gross proceeds from the NFT units will be used for general working capital purposes. The company was quick to point out that none of the funds generated from the PP will be used for IR. Something to note for investors as this can be interpreted as the money will be put toward generating SP value through actually exploring while keeping the lights on.

As stated before, it’s been a hard year. While Marvel Discovery Corp has been actively pursuing exploration and expansion initiatives, it has faced challenges in market performance. A shrinking market cap may raise some investors’ hackles, the company’s ongoing exploration efforts could open up a whole new world of value for those who choose to buy in or hold. Of course, there are no guarantees and it could take up to six months for results to bolster value if the findings are positive. Regardless, Marvel deserves some attention. Please remember, do your due diligence and speak with an investment professional before making any changes to your investment portfolio.