Stock markets continue to frustrate the bears, and from a technical perspective, things look very bullish.

Let’s start with the major fundamental reason. The Federal Reserve and Interest Rates.

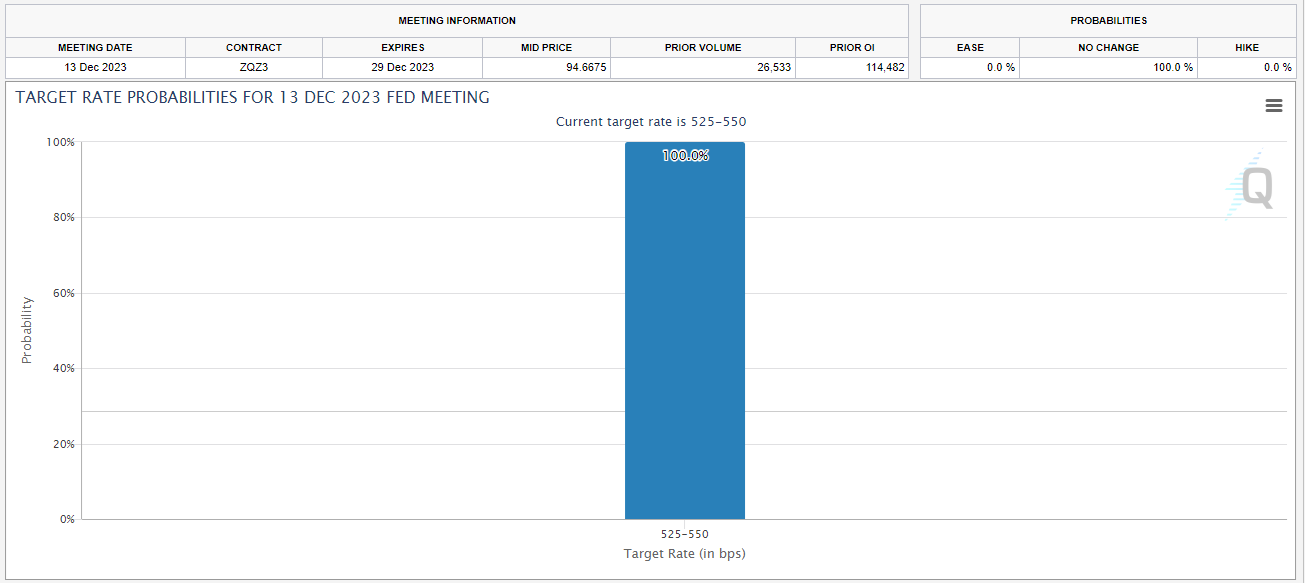

On Wednesday November 1st 2023, the Fed did not raise interest rates and the market took Jerome Powell’s comments to be dovish. I mean literally. Stock markets rose on the bet that the Fed is done raising interest rates. Even the CME FedWatch tool projects no rate hike for December 2023. This was a nearly 60% change in probabilities from a month ago just indicating the shift in market perspective. And this is very bullish.

Now, there is a 100% probability of no rate hike in December.

Markets are on fire and even geopolitical events cannot affect them. Market participants are solely focused on the trajectory of monetary policy and do not think there is any risk from current events in the Middle East.

I want to however remind readers that on November 9th 2023, Fed Chair Jerome Powell shifted to a hawkish stance by stating that the Fed is encouraged by the slowing pace of inflation but are unsure whether they have done enough to bring inflation down to its 2% threshold. Here is what he said:

“The Federal Open Market Committee is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2 percent over time; we are not confident that we have achieved such a stance,”

The Fed is “not confident” that they have done enough to bring down inflation? The markets see this as Powell keeping the door open to further rate hikes IF inflation begins to turn.

But so far so good on the inflation front. CPI data for the month of October 2023 came out yesterday. Inflation was flat from the prior month and core CPI hit two year lows.

The consumer price index, which measures a broad basket of commonly used goods and services, increased 3.2% from a year ago despite being unchanged for the month. Economists surveyed by Dow Jones had been looking for respective readings of 0.1% and 3.3%. The headline CPI had increased 0.4% in September.

Excluding volatile food and energy prices, the core CPI increased 0.2% and 4%, against the forecast of 0.3% and 4.1%. The annual level was the lowest in two years, down from 4.1% in September, though still well above the Federal Reserve’s 2% target.

“The Fed looks smart for effectively ending its tightening cycle as inflation continues to slow. Yields are down significantly as the last of investors not convinced the Fed is done are likely throwing in the towel,” said Bryce Doty, portfolio manager at Sit Fixed Income Advisors.

Markets spiked after this CPI report as it increases the chance that the Fed is done hiking and they will just keep rates high until inflation drops. The soft landing is back in play: raising rates to a level and holding them there until inflation comes down AND avoiding an economic slowdown.

Now let’s look at some charts.

The US Dollar broke below a major support zone and it appears a trend shift has occurred. The Dollar is to head lower as long as it remains below 105.50. A less hawkish Fed and no more pricing of more rate hikes is what got the trend shift.

But there is one more market when combined with the Dollar, showing the market is pricing in no more rate hikes.

Longer term bond yields have broken below the current higher low. This means that there is a very good chance yields will drop. It remains to be seen if this is just a corrective wave in an uptrend for yields, or if this is the beginning of a new downtrend. If it is corrective, then we would expect to see only one leg lower. Meaning if yields spike higher then yes, this was just a correction in an overall uptrend.

Remember: if yields continue to drop or remain stable, this will be stock market positive on the narrative the market is pricing in the end of the Fed rate hike cycle.

And now let us finally look at the charts of the major US stock markets.

Before we dive into the charts, it should be mentioned that Michael Burry from the Big Short fame, has closed his bets against the S&P 500 and the Nasdaq. He is now focused on shorting semiconductors.

The S&P 500 took out the 4400 zone. Going forward, this remains the major support. The current higher low comes in around 4360. There is a resistance zone being tested currently, but a retracement is likely to be corrective and bought up as long as we remain above 4360. Note that a downtrend line has been broken as well. Bullish.

Much of the same can be said about the Nasdaq. We are currently testing a resistance zone right now but the Nasdaq remains bullish above 15,200.

The Dow Jones is currently testing a major resistance zone, however the higher low comes in at 33,800. Same as the S&P 500 where a pullback would be corrective and likely see buyers step in.

The small cap Russell 2000 index is worth watching. This market has been soaring and saw its biggest single day gain of 2023 on Tuesday November 14th 2023. And it appears to have confirmed and triggered an inverse head and shoulders pattern. This chart looks extremely bullish. The Russell is worth watching because it tends to lead the other larger US markets. So the recent largest single day gain is worth paying attention to and points to a major shift in equity markets.

In summary nothing seems to be able to bring these markets down… other than perhaps a Black Swan event from the geopolitical sphere. It should be noted that the US government is spending a lot more. Another shutdown has been averted. It just means more money will be issued in the system, and the hunt for yield sends money into the stock markets.