After the markets were breaking down on earnings and geopolitical headlines, traders were all anticipating the Federal Reserve announcement on Wednesday November 1st. Once again, the markets were not expecting the Fed to raise interest rates. Instead, everyone was focused on Powell’s words and rhetoric. Is he hawkish? Meaning the Fed will keep its foot on the accelerator pedal and be open to more interest rates. Or is he dovish? Meaning Powell would not be hawkish and perhaps give an indicator that the Fed is finished raising rates.

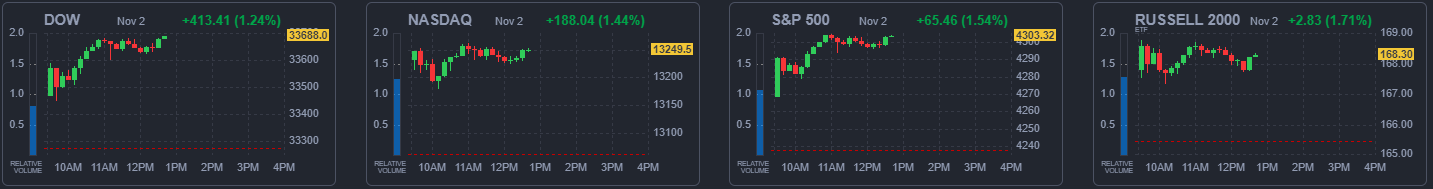

Judging by the reaction of the stock market and other markets which we will take a look at, many are betting on the end of Fed hikes.

That said it should be made clear: The Fed has left the door open to more rate hikes by adopting a pragmatic approach depending on the data. The markets just think it is over given economic data and perhaps… more government aid going to places such as Israel and Ukraine.

“The idea that it would be difficult to raise again after stopping for a meeting or two is just not right,” Powell said. “The Committee will always do what it thinks is appropriate at the time.”

“We haven’t made any decisions about future meetings,” Powell said. “That is the way we’re going to be going into these future meetings, is to be you know, just determining the extent of any additional further policy tightening that may be appropriate to return inflation at 2% over time.”

“A few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal. The process of getting inflation sustainably down to 2% has a long way to go,” Powell said.

The Fed held rates for the second consecutive meeting in a row:

“Slowing down is giving us, I think, a better sense of how much more we need to do, if we need to do more,” Powell said.

Federal Reserve Chair Powell said the strength of consumer and small business’s finances may have been “underestimated” as spending remains strong:

“We may have underestimated the balance sheet strength of households and small businesses, and that may be part of it,”

I think this point is important since the Fed does want to slow down the economy to slow money velocity which plays a part in bringing down inflation. The big question going forward is whether the rates we are at right now will suffice to bring the real economy down as rates remain high for longer… or will the Fed deem it necessary to raise rates higher to weaken the real economy.

And Powell did indeed mention the slowing down of the economy when discussing a slowdown in growth and a slowdown in the labor market:

“I still believe, and my colleagues for the most part still believe, that it is likely to be true … that we will need to see some slower growth and some softening in the labor market to fully restore price stability,” Powell said.

When it comes to rate cuts. Nope. The Fed is not even thinking about it:

“The fact is the committee is not thinking about rate cuts right now at all. We’re not talking about rate cuts,” Powell said. “We’re still very focused on the first question, which is ‘have we achieved a stance of monetary policy that’s sufficiently restrictive to bring inflation down to 2% over time, sustainably?’ That is the question we’re focusing on.”

So going forward, we shall keep our eyes on inflation and labor data. It should be noted that the US GDP for Q3 came in higher than expected. 4.9% vs the 4.7% estimate. The economy is still strong and this data will be considered by the Fed.

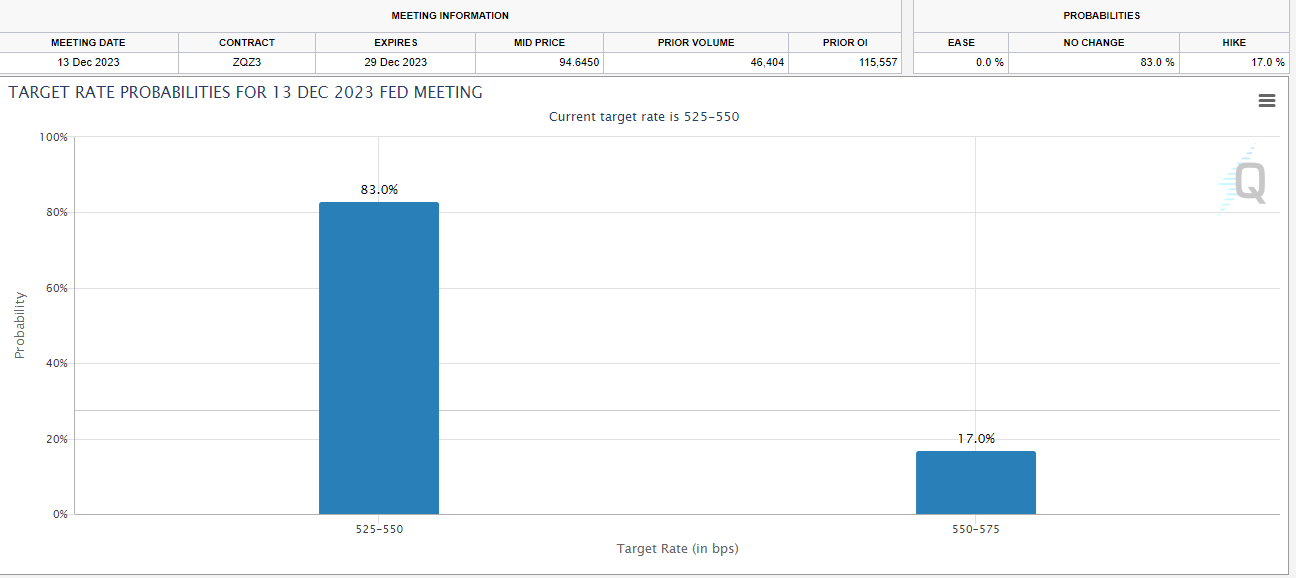

However, the market sees this as the Fed being done raising rates for the end of the year. How do we know this? The CME FedWatch Tool now projects a 80% chance the Federal Reserve doesn’t raise rates again this year, up from a 54% chance a month ago.

The market is pricing in no rate hike in December. The probabilities could change given the data coming out from now until December 13th 2023. But as of now, the markets are pricing this in.

Let’s take a look at two other key markets.

The US Dollar fell on the Fed announcement. It did not breakout above recent highs and is now retesting the support zone once again. A break below would be bearish for the Dollar and could mean the markets really think the Fed is done. I say could because the Dollar is also rising given its safe haven status. A Dollar bid on geopolitical fears, and a Dollar drop as those geopolitical fears subside.

Yields are also falling. This is a big sign that the markets are thinking the Fed is done. HOWEVER, from a technical perspective, our higher lows (marked in blue) are still intact and thus any drop in yields is still corrective or a pullback. These charts will be the key charts to watch when it comes to rate expectations. If we break these higher low levels, then expect stock markets to continue higher.

Before we look at the stock markets, let’s take a look at oil. Oil prices have fallen even with the events in the Middle East. I mention oil because higher oil prices can give us an inflation surprise and may cause the Fed to begin raising rates again if inflation looks like it is going to run away.

With economic data still strong one would expect oil prices to rise. Some claim that this will occur especially once China data picks up again. And then of course, any escalation in the Middle East, perhaps involving Iran, could lead to a surprise spike here on oil.

I am one who trades the chart I see and not the chart I want to see. I have to say that the recent price action has been extremely bullish on stock markets. For the S&P 500, 4400 remains a key resistance zone… one that looks like it will be tested.

A bullish sign is that the current lower high at 4250, looks like it will be broken with today’s daily candle close. This is bullish. For stock market bears, your hope is markets reject 4400 with a large red candle. Of course, anything geopolitical could bring in fear again.

The same can be said about the Nasdaq. We are closing back above a resistance zone and today’s daily candle looks like it will take out the current lower high. Resistance comes in at 15,500.

In summary, the charts look bullish for the markets. The markets are repricing data as seen from the current CME Group report for the December 2023 meeting. The Fed remains pragmatic so things can change depending on upcoming inflation and labor data.