We often consult with public company leadership teams about their strategy in talking to the market, and most CEOs we meet come in one of two extreme flavours.

The first wants to never stop talking. Anything they do is a news release. Anything they say is a news release. Any movement of bowels is a news release. It’s Sunday at 4pm, where’s my news release? I’ve ordered cheeseburgers and number 4 pencils, the people need to know!

The second thinks talking to the market is a crime worthy of eternal shame, that to do so is to welcome the vampires into your home and is something akin to punching yourself in the mouth, splashing red wine on your shirt, smearing lipstick on your neck, and coming home to the wife at 2am calling her Brenda.

The truth – the sweet spot – is somewhere in the middle.

To not talk about your public company at all means to surrender the conversation to the sweaty masses and the greasy short sellers. If you don’t talk for yourself and answer investor questions, they’ll fill the vacuum with speculation and you’ll soon be expending energy denying rumour and innuendo.

But to talk too much can mean finding yourself in a place where nothing you say matters anymore. Good news or bad, it doesn’t matter because the market becomes newsblind.

For mine, though I think they’re good companies with decent technology and a lot of potential, NextechAI.3D (NTAR.C), and its spinoff companies Toggle3D.AI (TGGL.C) and ARway (ARWY.C), are in that place where no matter what they tell the market at the moment, the news is met with resistance. That’s a late stage pubco phase, usually one that kicks in over year two of the existence of a company, and it can be a tough one to shake.

Nextech is a 3D modeling company that uses AI tools (hence the long name), and we helped them get their story out to investors for a bit. Over the term of our contract, we’ve helped shine a light on WAY more stories than we usually budget for, because this is a group that puts out WAY more stories than most.

I understand the urge to keep firing releases into that vortex. Initially, early on in the life cycle of a business, good strong news releases grip the market and the imagination of investors, and the stock chart reflects that interest. But when slimmer times come along, and the news grips less, and you find the stock dipping when you think it should be at least holding,going harder on the news front is the easy option.

Maybe it works a bit and things kick back in. Maybe you get a new promoter or two on board and find an upswing and take a deep breath.

But everything is cyclical in finance, so there will come a time where, unelss you can drop a few really gamechanging news items into the mix, or find profitability, it’s going to get stale.

Ever company faces this. Every single one.

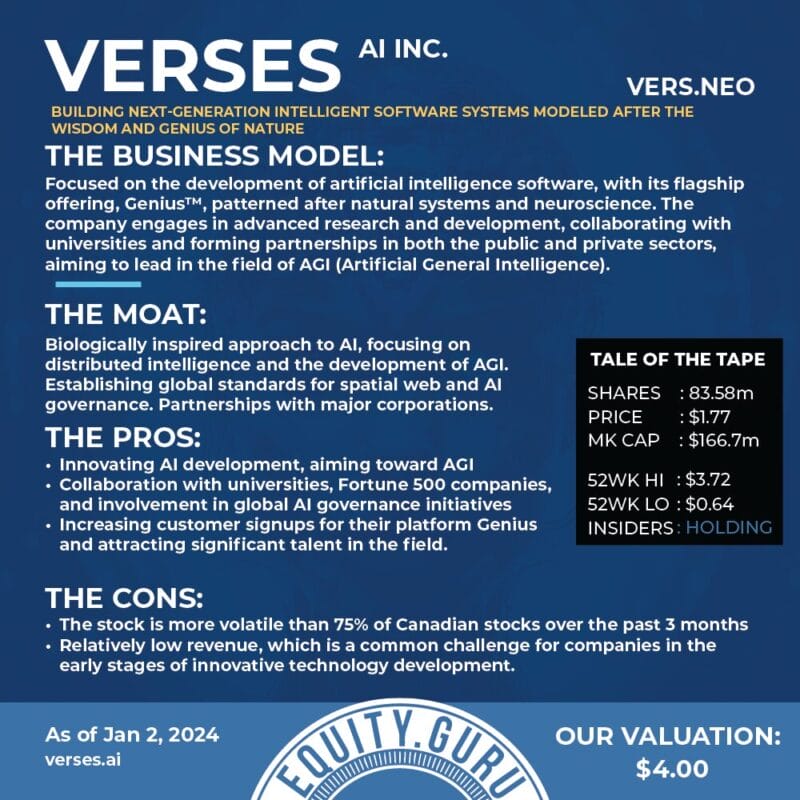

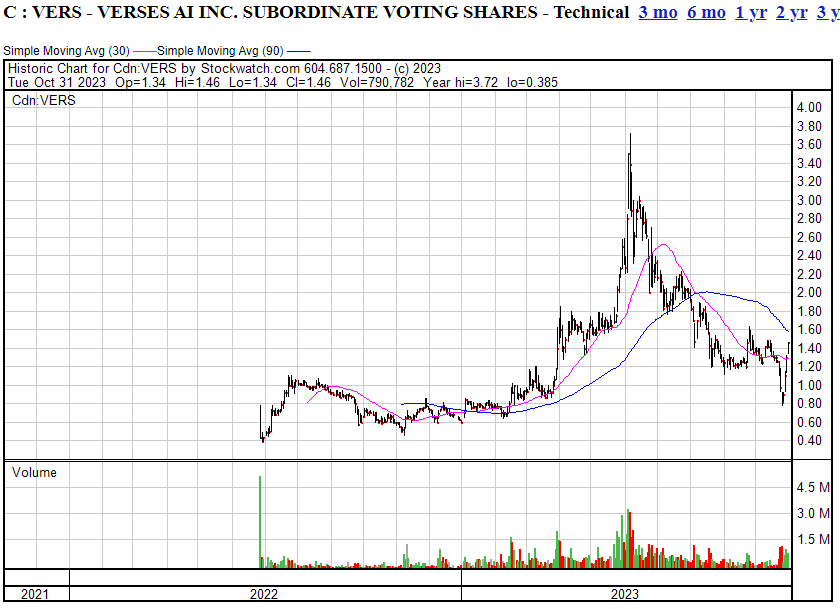

Verses AI (VERS.N) (another former client) is a textbook exampe of this. Massive spike to start, big drop when a short-seller Youtuber climbed all over it, big return when that d-bag got slapped down with ongoing great news and the company announced exposure to AI, but another fall-off recently as a lack of gamechanging level ups saw people get bored with the story.

In Verses’ case, they kicked together a new product that is being rolled out currently, and folks have rediscovered the story in the last few weeks.

You can see each of these steps playing out in the chart below.

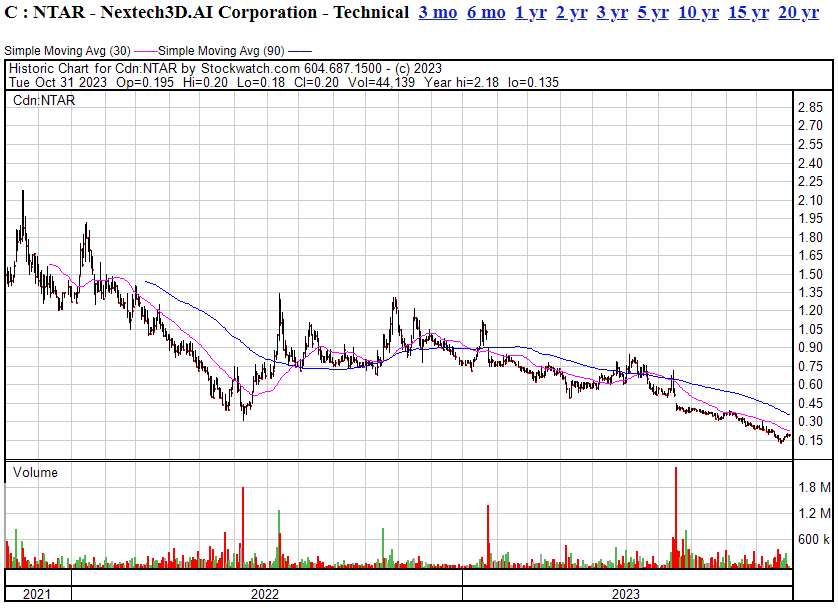

By contrast, NTAR had an early boom, a few spikes here and there, but a lot of that early interest was down to straight promotional hype and early stage expectation.

The actual work of building a profitable business was, for a long time, not exactly the point, as much as spinning off entities and sidling up alongside Amazon was.

At some point though, the investor wants to see a product transition from ‘this is what we’ll be’ to ‘this is what we are’. NTAR is trying to get there, but there are a lot of non-believers at the moment that are weighing on the stock, and a constant news barrage isn’t shaking them.

NTAR needs something transformational.

Now, this isn’t me saying there’s no business to be had in NTAR – far from it. I think it’s a scalable tech biz with great B2B potential that spans out in several directions. We’ve talked a lot about how big the potential market for them is, how much business they do with Amazon, and how easy the tools are to use.

But many companies in history have been weighed down by having multiple opportunities rather than one big focus. Should NTAR focus on ecommerce or video game assets or real estate developers or AR or wayfinding..?

Spinning off assets will often help that ‘where do we focus’ situation, and the spinouts here did allow the company to gift investors, essentially, free money. But to get that free money, they had to sell their spinout stock. And that puts pressure on the core stock, the three of which will forever be related not just because of how those spinouts came to be, but because a lot of business they do relies on their association with NTAR.

If the markets are good, no problem, plenty of love to go around and the success of each company feeds off the other.

But when the markets are bad, keeping three stocks afloat is hard work.

That work is made harder when you have short-sellers beating you up on the messageboards. It’s harder still when everyone else out there is sliding, and hiding their cash.

At the end of every trading day you’re alloted a score to show how you did as a company. That’s the share price. And watchihng that score fall can be hell on a man with any pride about him.

So you get to the stage where you have to do SOMETHING, ANYTHING, EVERYTHING, to get folks buying today.

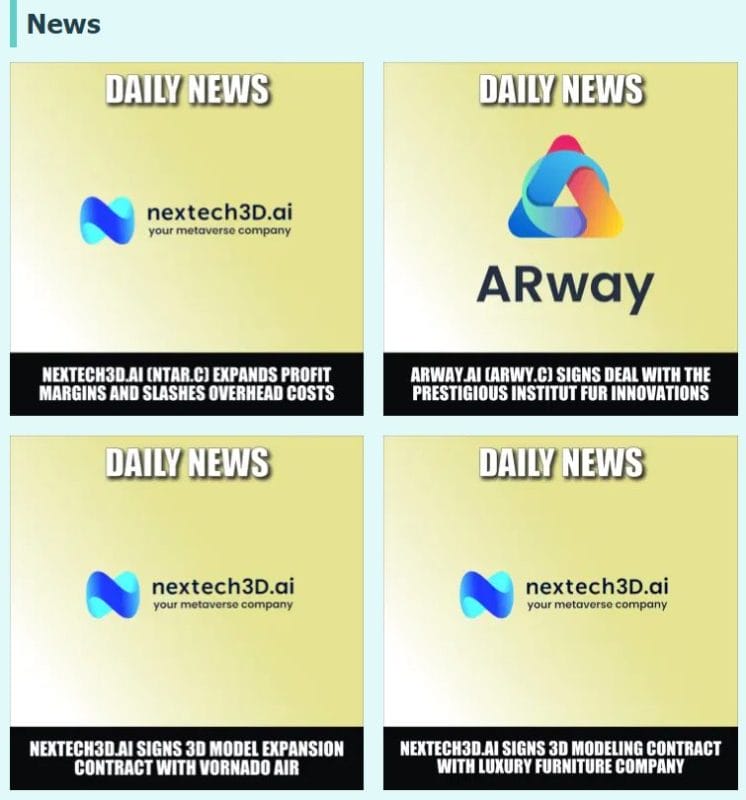

Below is a screengrab from the front of our website, at the time of writing. Four of the six most recent news releases that our client companies have put out are from NTAR and co.

That’s a lot. And that’s from just the last few days.

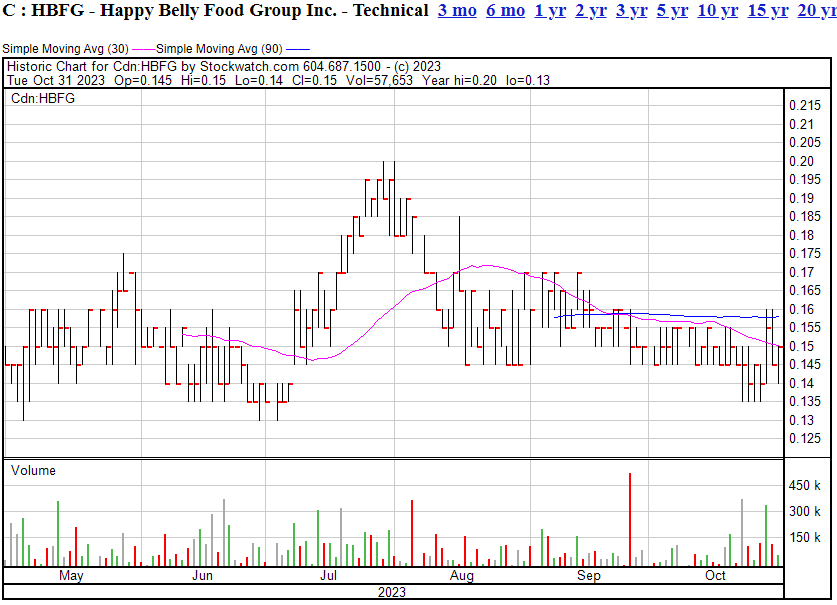

Doing the opposite of this isn’t the answer. We’ve talked to Happy Belly Food group (HBFG.C) before, liked their story, got on well with management, but they decided ‘the market will note us based on our successes’ and decided not to promote themselves despite having decent newsflow.

They’re not down. They’re not up. They just are.

One company flew close to the sun and fell off, another has never seen much sunlight.

End result: Same.

NTAR’s downward trajectory is hard to turn around, but HBFG’s long term lack of movement at all is a similar cross to bear.

Contract news is a hard sell, generally. Investors often struggle to get excited about services businesses, because they require constant new business to stay in business and, usually, don’t come with a public facing price tag. There’s a good reason not to publicly mention dollar figures in news releases; Competitive advantage. The moment you tell the world what you charged one client, the next client wants that deal or better, and before too long you’re headed to zero.

NTAR is trying hard. They’re doing deals, signing contracts, and of course a company wants to mention when they expand a contract or nail a new one down, but without the dollar figures involved in those deals being public, the news doesn’t kick up much dust. Without the context to know if your new 3D model vendor deal is worth four figures or eight figures, it’s hard for an investor to get excited, and harder still when they read the same story yesterday, and the day before.

NTAR needs to ask:

- What is the ‘level up’ that will get investors off their seats?

- Is it even worth talking about new contracts if everyone just expects them now?

- Can news-flow get so thick that it becomes news-sludge?

Technically speaking, NTAR and co. aren’t clients of ours anymore. We still mention them because, when we begin a relationship with people, and when our readers buy into a stock, we care enough about both to not leave them hanging the day the contract ends, but the NTAR story is starting to get lumpy.

They haven’t asked for my advice here, but if they did, I’d suggest they lay low for a bit and see what silence brings to the stock price. If it doesn’t freak out, continue on – give it some time to breath.

And when they do speak up again after that pause, bring so much fucking glory to that one next news release that it genuinely means something, and maybe kicks off new interest.

Those four news pieces above, all wrapped up in one story… that’s interesting. That’s important.

Investors who are interested in the story today will still be interested tomorrow. But what they don’t want is so much volatility that you can’t time an entry, or so much noise that you can’t be understood.

How about it, NTAR? You got something big and hairy and transformational under that kilt?

When you do, let us know, we’ll tell the world.

UPDATE: NTAR just announced a $3.6 millin private placement at $0.12. This is notable because they did so with the stock sitting at $0.17.

This is a good move in my opinion; chances are the stock may have run down to that point anyway considering recent trading, but by voluntarily dropping straight to that price, they take control of the share price for a spell, and maybe fill that placement easier with an entire warrant offered at just $0.17 per share. It’s the equivalent of bidding $150 when the auctioneer is asking for $110; you shake the room up, establish a new base, show confidence going forward and maybe shake off a few weak hands.

Whether they get that placement filled is the big question, but the warrant offering is sexy, and if NTAR can get it’s way back over $0.20 in the weeks and months ahead, the warrants will bring in new cash. The downside? Dilution. With 118 million shares outstanding now, another 30 million into that totalwon’t be a small thing.

But fortune favours the brave and Evan Gappelberg has shown nothing if not that he’s got balls so big they require a separate seat when he travels.

— Chris Parry