Coinbase shares were up 14% at one point today as investors were buoyed by a court ruling in a Bitcoin spot ETF case that could benefit the crypto exchange as well. The stock has given up some of those gains and this is very important for the chart which we will discuss below.

With this optimism, this could be a turning point for Coinbase as well which has been battling with the Securities and Exchange Commission. Coinbase is one of the largest crypto custodians and has been tapped by a host of prospective ETFs, including BlackRock’s proposed Bitcoin ETF, in that capacity.

The big catalyst is the Grayscale Bitcoin Trust victory. Grayscale saw a victory formalized in federal appeals court Monday, when a judge’s mandate that the SEC review the company’s Bitcoin ETF proposal took effect.

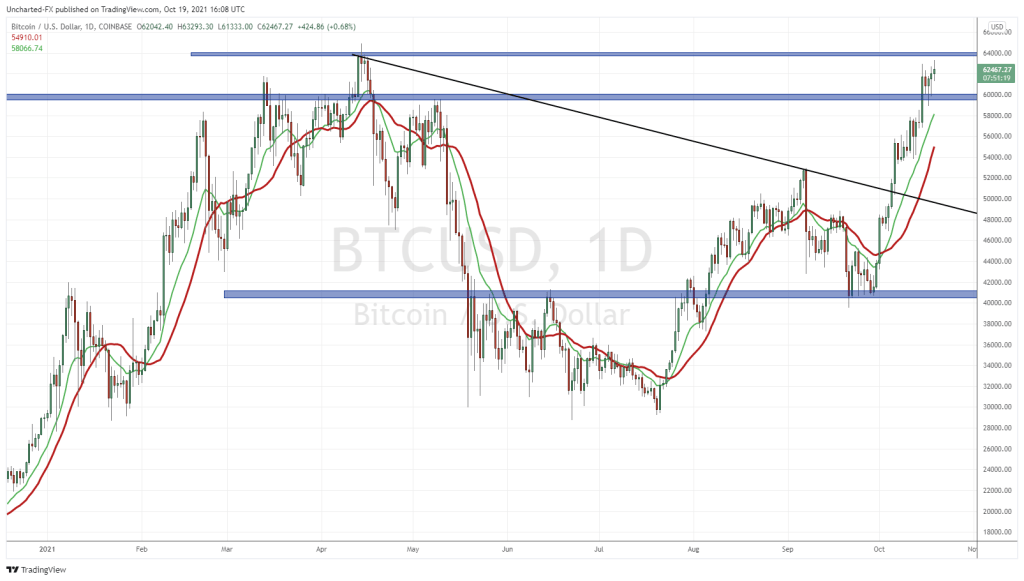

So let’s take a look at the chart of Coinbase:

After a strong uptrend and breakout in July, the stock has pulled back and closed back under the $84 zone. This was once resistance then turned support and is now acting as resistance once again. We call this type of area a flip zone. They are very important in technical analysis.

The stock has just been ranging between $70 to the downside and $84 to the upside.

Today’s price surge saw the stock take out $84 but this is why candle CLOSES are very important. Those who have chased the breakout are hurting… and could potentially be faked out if the daily candle closes like it is right now. A close back below the $84 zone. If so, the range will continue and traders and investors will have to wait for another catalyst for the breakout.

There could be some overall strength in the crypto market and crypto stocks given the recent breakout on Bitcoin. The largest cryptocurrency has finally closed above the 31,000 zone and hit 35,000. Profit is being taken but Bitcoin can continue the upwards momentum as long as the price remains above 31,000.

When it comes to the next resistance zone, then there is some upcoming at $38,000.

Meanwhile Ethereum is attempting to breakout but is still finding quite the resistance around the $1900 zone.