The Federal Reserve previously said that there will be two more interest rate hikes by the end of the year. Well the Fed has kept their promise so far by raising interest rates in the July meeting, taking rates to 5.25%-5.50%, the highest level since 2001. A 25 basis point hike which was expected by the market after a Fed one month brief pause.

The question is what comes next?

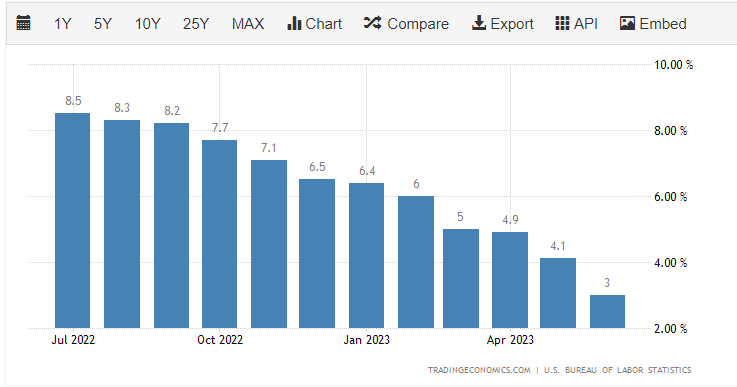

In the latest projections, Fed officials are estimating one more rate hike this year. Inflation is showing signs of slowing down:

Encouraging but the Fed officials still reiterated that “inflation remains elevated” and the Fed remains “highly attentive to inflation risks“. This language hints at one more rate hike this year versus the idea the Fed is done hiking in this rate cycle.

And Powell did indeed state that more rate hikes remains an option if the economy were to continue to strengthen and put upwards pressure on prices.

“At the margins, stronger growth could lead over time to higher inflation and that would require an appropriate response for monetary policy,” Powell said. He also said that core inflation remains “pretty elevated.”

“I would say it’s certainly possible that we will raise funds again at the September meeting if the data warranted,” said Powell. “And I would also say it’s possible that we would choose to hold steady and we’re going to be making careful assessments, as I said, meeting by meeting.”

The word financial media is highlighting after Powell’s conference is “data dependence”. The Fed is taking a pragmatic approach and therefore keeping CPI, labor market and GDP data as major market moving events.

And speaking about the economy, here is the headline on July 27th on the advance estimate of Q2 US GDP:

GDP: US economy grows at a faster pace than expected in Q2

The Bureau of Economic Analysis’s advance estimate of second quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 2.4% during the period, faster than consensus forecasts. Economists surveyed by Bloomberg had the US economy growing at an annualized pace of 1.8% during the period.

Strong economy? Well that would mean the Fed would still keep the foot on the accelerator pedal.

How about the labor market?

This is where things get exciting for those calling for peak interest rates. Powell has said in many meetings that the economy is not showing any signs of a slowdown because the jobs data keeps coming out stronger than expected. However, the June NFP data which came out in the first week of July showed a cooling in jobs. 209,000 jobs were created in the US for the month of June which was below the estimate of 225,000. Once again, this comes after US NFP data was blowing out the estimates for almost 9 months straight.

This data print really got the markets excited because they put two and two together. A slowing labor market AND inflation coming down. The Fed is therefore almost done raising interest rates.

But now, economic growth remains resilient… and as many of you know regarding inflation, money velocity is key which means central banks dealing with inflation need the economy to slow down.

This begs the question: if the Fed continues to raise interest rates surprising markets, will the ‘recession’ trade kick in?

Currently, US stock markets remain in a strong uptrend even taking out major resistance levels. You do not want to bet against an uptrend. However, in recent days post Fed meeting, the markets have been a bit choppy. But this should be expected as it does take a few days for markets to digest the info from the Fed. US Q2 GDP data may have sparked something as it means the Fed can realistically remain hawkish on interest rates.

How did other markets react?

The US dollar broke down below the 102 resistance zone and bounced around the major 100 psychological zone. Today’s price action is surprisingly bullish as the dollar reacts to Q2 GDP data. However, as long as we remain below 102, the US dollar can still print a lower high taking the dollar lower. If the dollar were to close above 102, then I would see it as a sign the markets are seeing this as a hawkish Fed given recent data.

What I am keeping a close eye on is bond yields. Yields remain strong. If the market was to call the top of this interest rate cycle you would expect to see yields drop. Why? Remember, there is an inverse relation between bond prices and bond yields. If the price of bonds rise, ie: investors are buying bonds, then rates would decline. This is what you would expect to see if the market believes the Fed is done hiking because these yields would be the highest you can get from bonds.

Currently, yields still remain below their recent highs but if they were to breakout, it would be a major sign when it comes to where the market thinks interest rates are going.