Brascan Resources Inc. (BRAS.C), a Canadian-based junior explorer, recently unveiled its financials for Q1 2023. With a firm commitment to exploration and development, the company’s diverse mineral asset portfolio has been a central focus for potential investors and industry analysts.

The company’s portfolio includes several promising mineral property interests in the Baie Verte region of Newfoundland and the diverse regions of Brazil. However, it’s worth noting the termination of certain option agreements as part of their strategy in focusing on properties with the highest potential.

Brascan entered into several option agreements throughout 2021 and 2022, primarily with third-party vendors, to acquire 100% interest in multiple properties. These included Middle Arm Fault, Black Cat, Miguels Lake, Mountain Pond, and Birchy Lake properties in Newfoundland, and the Alegre, Parana Cu, Brasil-Li 1, and Brasil-Li 2 properties in Brazil.

“We’re into critical minerals. Vanadium, titanium, magnatites, scandium, phosphorus in Quebec. We’re into lithium in a big way in Quebec… We’re also in Brazil in Minas Gerais in lithium as well… we have a fantastic gold project called the Alegre Gold Project.” – Brascan CEO, Balbir Johal

Each agreement generally required Brascan to make cash payments, issue common shares of the company, and incur specified exploration expenditures over a given period. Furthermore, these agreements were subject to Net Smelter Royalties (NSRs), with Brascan having the right to purchase a portion of these NSRs.

However, in Q1 2023, Brascan elected to discontinue future exploration work on some of these properties, including Middle Arm Fault, Black Cat, and Birchy Lake properties in Newfoundland, recognizing impairment losses for each.

The focus now shifts to the remaining mineral property interests, including Miguels Lake, Mountain Pond in Newfoundland, and the expanding interests in Brazil: Alegre, Parana Cu, and Brasil-Li. With exploration expenditures committed for these properties, Brascan is gearing up for intense development activities in the coming years.

Despite the discontinuation of certain projects, Brascan’s commitment to exploring and developing their portfolio has not waned. On the contrary, the remaining properties offer promising prospects. The cash payments, share issuances, and exploration commitments to these properties demonstrate the company’s faith in the potential of their mineral assets.

Investors will be keenly watching the progress of these projects, particularly the ongoing exploration commitments. For example, for the Mountain Pond Property in Newfoundland and Brasil-Li 1 Property in Brazil, Brascan has already completed the first round of exploration expenditures.

“Now, all these things are not going to work out, but each one, I believe, is a billion dollar opportunity. So if one works out just like how venture capitalists do it, that’s my style.” – Balbir Johal

The termination of some option agreements might have raised eyebrows, but this strategic move allows Brascan Resources to direct its attention and resources towards the properties with the greatest potential. As the company dives deeper into 2023, stakeholders eagerly anticipate updates on the exploration progress of the mineral properties still in play.

Johal’s maverick nature and unconventional thinking may be unsettling to some, but his unique approach could very well add significant value as many innovative thinkers find success where others fail to see it.

Brascan’s recent financial release shows a forward-thinking company willing to make bold decisions for the betterment of its future. The strategic refocusing of their diverse mineral asset portfolio is a move that is expected to pave the way for Brascan’s growth in the coming years, offering potential rewards for the company and its investors.

This isn’t Balbir’s trip down the river, he’s been involved in mining in one way or another since 1984 and his track record is nothing to sneeze at because he understands the most important aspect of successfully developing a mineral project.

“I’ve had two where the valuation is less than a million, and they’ve gone to 5 billion. Now, I didn’t do that alone, but I brought in the right people, made the right connections.” – Balbir Johal

As an emerging player in the mineral exploration industry, Brascan’s activities highlight the importance of adaptive strategy while staying true to the ultimate goal: achieving sustainable exploration and development in the most promising mineral properties. The company’s determination in maneuvering the challenging landscape of mineral exploration is an exciting journey that investors and industry watchers should closely follow.

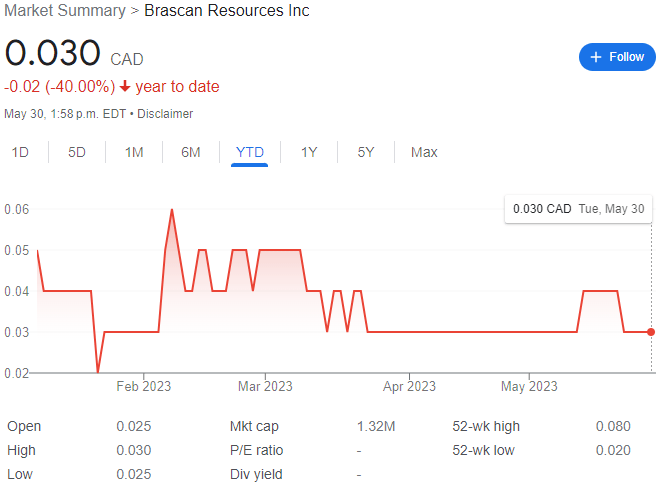

Brascan Resources currently trades at $0.03 CAD per share for a market cap of $1.32 million.