Riding the wave of exceptional growth and profitability, Plurilock Security Inc. (PLUR.V), a trailblazer in identity-centric cybersecurity solutions, has reported an impressive surge in its Q1 2023 revenues, as well as a considerable reduction in net losses year over year.

The data released for the first quarter of 2023 illustrates a booming business model that saw the company’s total revenue more than double to $15,767,328, compared to the $6,953,052 recorded in the same period last year. This skyrocketing performance resulted from strategic acquisitions, a boost in organic sales, and effective cross-selling within the Solutions and Technology Division.

Prominent among these acquisitions were INC, Atrion (ATR), and CloudCodes (CC), contributing to a significant part of this fiscal upswing. The varied revenue streams from hardware and system sales, software licenses and maintenance sales, along with professional services, all demonstrated robust growth, contributing to the company’s impressive financial results.

“They’ve (Plurilock) got other deals with other large companies and government groups that come to 40 plus million dollars a year, which is four times their current market cap.” – Equity Guru founder, Chris Parry

Hardware and systems sales witnessed an upward swing to $12,444,129 in Q1 2023 from $6,495,896 in the corresponding quarter of 2022. Meanwhile, software, license, and maintenance sales ramped up to $2,713,578 from $429,456 year over year. The revenue from professional services also marked an upsurge to $609,621, a stark contrast from $27,700 in the same period the previous year.

In a significant development, the company almost halved its quarterly net loss, reducing it from $(1,886,015) in Q1 2022 to $(975,305) in Q1 2023. This accomplishment is reflective of Plurilock’s strategic actions towards streamlining operations and focusing on profitable avenues.

Plurilock’s customer-obsessed approach, combined with their cutting-edge behavioral biometric technologies and top-tier cybersecurity tools, has ensured the security of many enterprises. This unique approach is recognized across industries, helping them secure larger enterprise and government customers.

The company’s deep understanding of regional and global cybersecurity challenges, coupled with their innovative solutions, has ensured an unshakeable competitive advantage. Plurilock’s experienced staff and cutting-edge solutions have made it a go-to provider for businesses looking for strong cybersecurity measures.

Beyond the robust financial performance, Q1 2023 has seen Plurilock make key strategic moves. From attracting seasoned veterans like Blake Corbet to their Board of Directors to securing a $3.4 million purchase order for Plurilock’s IT solutions from the Department of National Defence, the company has made significant strides.

“Once you’re in with the Department of Defense, you never out with those guys, right? They don’t change suppliers every other day. If you’re getting in with the Department of Defense, you’ve gone through it already security wise, and they trust you.” – Equity Guru founder, Chris Parry

Looking ahead, the Vancouver-based cybersecurity solutions provider shows no signs of slowing down. With its strong financial position, a suite of leading-edge cybersecurity solutions, and an expanding customer base, Plurilock is poised to continue on its upward trajectory.

Plurilock’s Q1 2023 performance is a testament to the robustness of its business model and the effectiveness of its solutions. As the company continues to navigate the cybersecurity landscape, it is set to redefine the industry standards while delivering value to its stakeholders.

“They’re actively using AI and making money out of it. Why would you not be invested in this?” – Equity Guru founder, Chris Parry

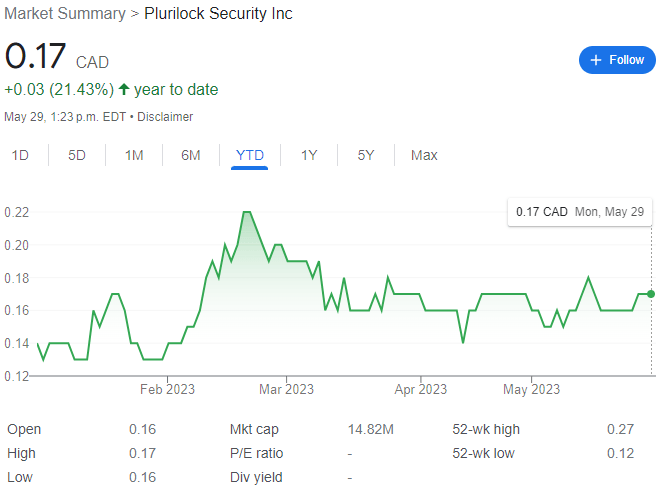

The company currently trades at $0.17 per share for a market cap of $14.82 million.